Banking executives are gradually starting to understand that Open Banking will have key implications for their future competitive positioning and related digital transformation activities. Open Banking can be defined as a business approach in which value creation results from sharing, providing and leveraging access to bank resources through application programming interfaces (APIs).

Open Banking is set to transform digital experiences through embedded value propositions across customer journeys co-created with third parties that leverage access to bank resources. This ultimately will add customer value and put the customer more in control of its data. Banks that are able to put the required capabilities in place to effectively and seamlessly engage with third parties will benefit from an early mover advantage and opportunity to future-proof their competitive position.

Open Banking in Europe

In Europe, in addition to the general drivers prompting Open Banking and API development – i.e. extending business reach, improving time to market, developing new partnerships, nurturing new business models and fostering agility and innovation – APIs have become particularly relevant by reason of the second payment services directive, PSD2. Indeed, many banks are responding to the PSD2 compliance challenge by offering APIs enabling the mandatory services for third party access to account (XS2A). In addition to compliance, we already see some leading banks extending their API offering to serve third parties and corporate customers directly.

Learning from European developments, different API and Open Banking regimes emerged in the rest of the world. Key objective is to open up banks to leverage their functionality and data through APIs to create an Open Banking ecosystem driving value creation.

Next to the compliance challenges, banks need to cope with an ever changing competitive landscape with new players disrupting traditional value propositions and business models, while simultaneously also presenting new opportunities for collaboration. The time to react is now.

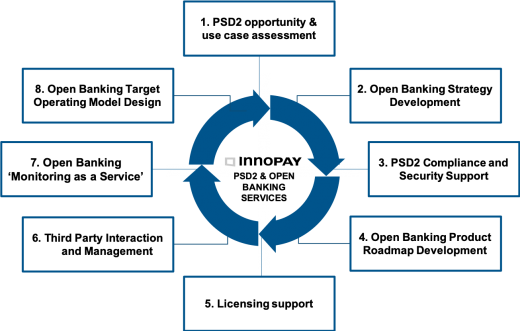

Our services

To support banks in their PSD2 and Open Banking transformation we offer the following propositions.

1. Open Banking Strategy Development

PSD2 and the broader development of Open Banking APIs create major shifts in products, channels and platform opportunities thereby changing the ways banks need to compete and collaborate. We can support with:

-

Opportunity and strategic risk assessment

- Business vision and strategy definition

- Open banking positioning and strategic objectives

- Open banking business models and propositions

- Insight in Global Open Banking state of play across regulators, industry initiatives and strategic responses of market actors

2. PSD2 Compliance & Security support

As the compliance deadline is nearing banks need to ensure a solid plan of approach and execution process in a regulatory environment that is still in flux. We can help with:

- Regulatory interpretation and requirements traceability

- Compliance design and “health check” on existing decisions and hypotheses

- Expert support on e.g. interaction models, Strong Customer Authentication, consent management, API design and standards, vendor scan & selection

- Security and risk assessment

- Insight in and implications of key regulatory developments and industry initiatives

3. Open Banking Product Roadmap

Moving beyond PSD2 compliance APIs requires solid understanding and decision making on the strategic attractiveness of APIs and organisational and technical readiness to execute. We can provide guidance on:

- API portfolio development for Retail and Corporate client segments

- Actionable Business, legal, operational, functional and technical framework for transactional and data services

- Development of functional and capability driven Open Banking roadmap

- Creation of Proof of Concepts to understand business impact of (design choices for) Open Banking products

- Value-based design of Open Banking propositions

4. Third-Party Interaction and Management

Banks that are able to put the required capabilities in place to effectively and seamlessly engage with third parties will be able to future-proof their competitive position in an Open Banking era. We can help with:

- Identification of Third Party interaction requirements

- Set-up effective consent management framework for different third-party engagements

- Creation of risk-based onboarding framework for third parties

- Framework for growing and maintaining Third Party community

5. Open Banking ‘Monitoring as a Service’

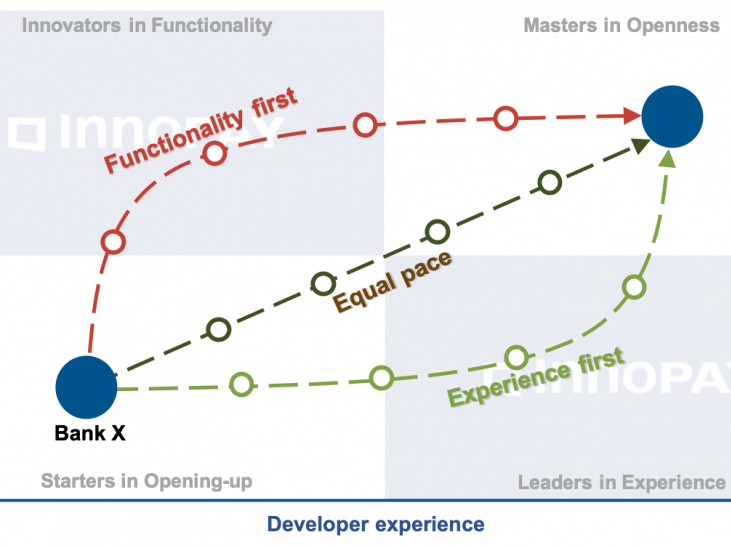

With many banks across the globe establishing the basics of their API Developer Portal, there is a strong incentive towards differentiation in the emerging Open Banking landscape. We can support in:

- Performance assessment of current developer portal capabilities, incl. functional API scope and developer experience tools

- Tailor-made peer benchmark to identify key gaps in Developer Portal

- Capability Roadmap to close gaps and further enrich functional API scope and improve comprehensiveness of developer experience

6. Open Banking Target Operating Model Design

- Quick scan of operating model capabilities across 8 key imperatives

- Holistic view of target operating model supporting execution of Open Banking strategy (e.g. using Crosslinx Framework©), spanning customer, management, capability and product cycle

- Embedding of strategy execution capabilities for Open Banking

7. Licensing Support

The financial services sector is highly regulated. Typically, you will need a licence to operate for launching new products as a financial institution, such as when becoming an account information or payment initiation service provider under PSD2. We are experienced with various licence applications through embedding the regulatory requirements in the daily operations in a pragmatic manner, following an activity-based approach. We can support your organisation with:

- Quick scan of licensing capabilities tailored to client needs such as strategy validation (product, competition, market), regulatory assessment (gap analysis) and operational readiness (operating model heat map)

- Licence application activities such as preparation of documentation (policies and procedures) and workshop facilitation (performing risk assessments, identifying need for operational adjustments, etc.)

- Operating model implementation support to continuously ensure your organisation operates in a compliant manner with optimised cost of compliance

8. PSD2 opportunity & use case assessment

PSD2 opportunities are being recognized more and more outside the financial services sector. INNOPAY has extensive cross-sectoral experience in supporting businesses to define new value creation opportunities from PSD2 use cases. We can support in:

- Identification of actionable PSD2 opportunities and use cases

- Creation of Proof of Concepts to understand business, technical and operational impact of (design choices for) PSD2 use cases

- Identification and selection of suitable vendors for realising PSD2 opportunities

- Supporting go-to-market of new PSD2 enabled products and services

Do you want to learn more about our thinking regarding PSD2? Contact us!

Related content