Instant Payments makes data the new game for Corporate Treasury

The role of the corporate treasurer will change significantly with the transition towards an open, digital and data driven economy. Partially motivated by regulatory push (eg PSD2, GDPR), organisations are increasingly adopting new business models in which data is shared 24/7 to better respond to instant customer demand. This requires treasury to become data centric.

Data transactions entail (digital) data interactions between departments within an organisation, but also within supply chains and cross sector. In this context, the value of data transactions increases considerably as business processes become more transparent. It enables corporate treasury to better predict cash flows, mitigate transactional risks and forecast liquidity needs. Supported by the roll out of Instant Payment (IP) infrastructures across Europe and other regions, they can now also act immediately.

With the availability of data increasing rapidly and the capability to respond instantly, it makes sense for treasury to pursue a data centric approach. This is a prerequisite for any organisation that wants to successfully operate and participate in an open data economy and society.

Instant payments increase the need for transparency in transactional flows

The IP infrastructure heralds the end of fixed cut-off times as payments are sent and received real-time at any time of the day, any day of the year. The absence of cut-off times challenges treasurers to manage the company’s cash position, as payment flows are processed outside current working hours. Treasurers may need to increase reserves to provide for unexpected mismatches in transactional flows. A measure any treasurer would like to avoid.

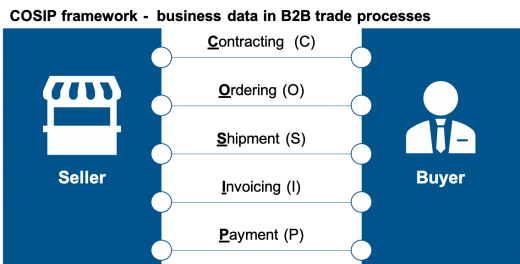

Insights in data interactions that ultimately result in a payment (ref. figure 1), is essential to accurately predict and control payment flows in an instant around-the-clock environment. Sharing relevant data within and across organisations, creates transparency in business processes and provides treasury with the necessary insights to improve working capital. Enhanced predictability in combination with IP enables the treasurer for instance to reduce mismatches in settling outgoing with incoming funds. As a result, cost related to cash pools and intra-day and overnight facilities can be optimised.

Data sharing enables transparency in transactional flows

The availability of data has increased significantly due to the digitisation of business processes. However, accessibility to data is still lagging. A lot of data still resides in silo-ed and or closed systems (eg TMS, ERP or banking applications), making it difficult for treasurers and other stakeholders (e.g. invoicing, procurement, logistics) to share and apply data effectively. A data centric approach to treasury is therefore pivotal to optimally benefit from instantly available (payment) data.

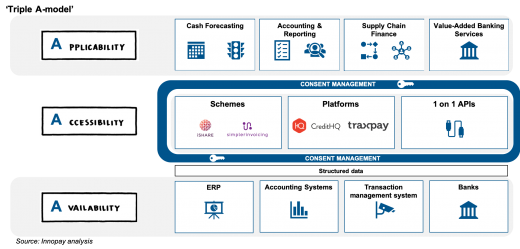

However, this is easier said than done. Similar to payments, data sharing also comes with high responsibilities. It needs to be secure, comply with regulation (eg consent based), and safeguard the value for all parties involved. To successfully share data, organisations need to develop the following three capabilities: data Availability, data Accessibility and data Applicability. The picture below illustrates how data sharing could work for corporate treasury when implementing and mastering this ‘triple-A framework’. For detailed description of the Triple-A framework, please have a look at the EBA report supported by INNOPAY: Data Exploration Opportunities In Corporate Banking.

In short, the data availability layer represents the source where data is generated and or stored. The accessibility layer is the way data is disclosed from the source to an application. This can be achieved using 1-on-1 APIs, a platform or a collaborative scheme defining a common set of agreements across organisations. In the applicability layer, data is converted to information delivering the insights treasury is seeking to create value in managing intraday liquidity, cash forecasting and FX risks, for instance.

However, relevant payment data originates in multiple business processes and resides mostly unstructured in even more systems. Systems that do not yet provide for a transparent recording of data to accommodate relevant insights.

When sharing data intercompany or across organisations, managing access and consent crucial. As with payments, treasurers should be in control and thus able to determine specifically what data is shared with whom, at what time and for what purpose.

Finally, by using automated business logic and AI, treasury can further enhance their capability to act 24/7 to instant changes in transactional flows. Already, we see Fintech companies (Highradius and Asterian, for instance) stepping into this space by offering services that deliver data-based treasury insights.

Future corporate treasury is data centric

As the world is increasingly being disrupted by open business models and around the clock availability of products and services, the roll out of IP infrastructure can be considered as a simple hygiene factor. It is only a matter of time until the corporate treasurer will experience a similar disruption. Data is the new game and a data-centric treasury is pivotal to successfully navigate organisations into open, secure, and profitable data driven business models.

---

[1] Digital consent management is key for data opportunities