EPI: Paving the way for future bank relevance, and not just through payments

Sixteen major Eurozone banks have come together in the European Payments Initiative (EPI) to launch a new payment system aimed at taking on rival card schemes and the threat posed by Chinese and US big-tech firms. Although previous pan-European collaboration projects (e.g. Monnet, Eaps, Payfair) have not been perceived as a great success, the mounting competitive pressure and challenging market dynamics are now driving banks back together.

EPI is seeking to develop a unified payment solution for consumers and merchants across Europe, including a payment card and digital wallet, covering in-store, online and person-to-person payments as well as cash withdrawals. INNOPAY shares the view that EPI is a worthy step towards strengthening Europe’s payments landscape, providing that it leverages existing best practices where possible and receives the full and continued support of all relevant banks.

However, the initiative seems to have emerged as a result of political pressure from the European Central Bank’s call for more collaboration, rather than out of a desire to pursue true customer value. That is, compared to the solutions available today, it is not likely to fundamentally improve the way people actually pay at the point of interaction, nor will the initiative in its current form be an answer to banks’ quest for future relevance.

In essence, the EPI collaboration is a good start, but the battlefield for banks’ future relevance is much broader than payments alone. If anything, the banks involved should leverage this collaboration platform and momentum to shape their future relevance. That is why we urge the banks involved in EPI to take a broader view of digital transactions. In other words, in addition to payments, banks need to actively address the topic of digital identity and seamless data sharing. This will not only drive the creation of truly value-added services, but will also strengthen their competitive position. While we understand the EPI’s current scope and focus on protecting the business case for payments (which is also supported by the European Commission’s decision not to impose further legislative measures on interchange fees for now), the new battle revolves around identity and data – and even more value is at stake.

Need for new type of trust infrastructure in Europe

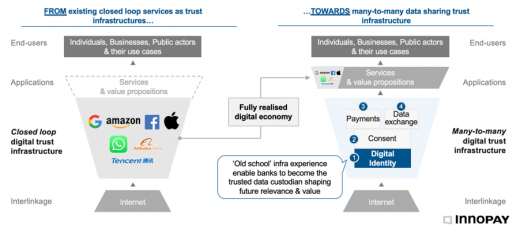

For banks to reap the full benefits of the data economy, Europe needs a new type of trust infrastructure based on digital trust. This will allow us to move away from the closed, institutional trust-driven approach that is ‘forced’ upon users by the big-tech firms. The key components of such an infrastructure are depicted in Figure 1.

In the digital trust infrastructure, common standards for data rights and obligations are embedded in the very fabric of the internet (‘transactional internet’). A federated and trusted digital identity is fundamental in such an infrastructure. Connected to this digital identity is a consent and authorisation mechanism that enables end users to control their money and data. An electronic interoperable payments network and data exchange layer can then be built on top of consent. This approach enables data availability and accessibility at scale to power new applications in payments and the broader data economy. Ultimately, this leads to better protection of user data and privacy, greater innovation at scale and creation of new business models and value exchange, thus safeguarding banks’ future relevance.

Banks are well placed to create the digital trust infrastructure

“What makes banks so well placed to create the digital trust infrastructure?” I hear you ask. This is due to three key reasons: positioning, experience and assets.

Firstly, banks have always been positioned as a ‘money custodian’. Becoming a ‘data custodian’ (in a much broader sense than they already are) in the digital economy would be a natural extension of this role. More importantly, while players from other industries are still winning trust – especially among the younger generation – banks have a head start that they should be able to leverage. The broader public are more likely to accept banks than other players in this role.

The second factor is experience. As data is becoming increasingly valuable in the digital economy, there is a strong rationale to apply ‘digital payment-like’ governance and mechanisms to ensure trust in the envisioned digital trust infrastructure. Banks have the necessary experience with schemes to turn the digital trust infrastructure into reality.

Thirdly, banks have the required assets. Besides having an exemplary role, banks are also very proficient at determining consumers’ digital identities due to their Know Your Customer (KYC) obligations. Thanks to these digital identities and strong customer authentication (SCA) mechanisms, banks can already play a key role in giving consumers control of personal data in other sectors. After all, consumers must be identified with sufficient reliability if they are to irrefutably authorise other parties to use particular data (which is why digital identity is positioned as the core building block in Figure 1). Furthermore, the mandatory opening up of banks under PSD2 has enabled them to gain experience in obtaining and managing authorisations from consumers. Each authorisation must be recorded securely and reliably so that the consumer always has an up-to-date overview of the parties which have been given access and, if desired, can also withdraw their consent for that access. This experience, combined with digital identity, is an important asset that can be deployed beyond the confines of payments and banking. By turning this experience into services, banks can take a significant step towards facilitating the data economy in other sectors.

Over to you

We all know that developing a scheme for a digital trust infrastructure requires collaboration – initially with banks in the pioneering role as outlined above, followed by the subsequent involvement of other private-sector operators. In addition to shaping the collaborative domain of the digital trust infrastructure, banks will also need to develop a clear view of their individual competitive position, strategy and value proposition within such a network.

The banks involved in EPI have already cleared the first hurdle by agreeing to collaborate on payments. They now need to shift up a gear to truly strengthen European banks’ position in payments and the data economy by developing innovative services that add true customer value. It is time for banks to work together to create a digital trust infrastructure and reinforce their position as trusted data custodians.