Embedded financial services: unlocking value through strategic partnerships

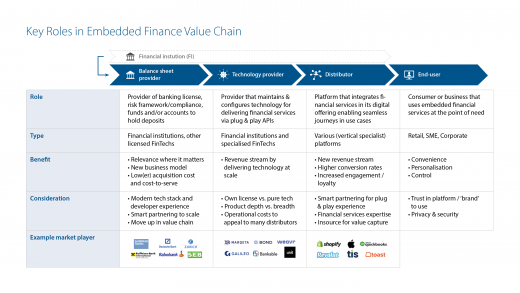

Embedding financial services enables financial institutions to deliver value at the point of need. Through seamless integration, financial services and products can be made available in a broader customer journey, typically facilitated on non-financial, digital platforms. Such platforms serve sizeable client segments (retail, SMEs, corporates) via their often vertically specialised value propositions, and enable high-frequency digital interactions. This paves the way for all participants within the Embedded Finance value chain (i.e. balance sheet providers, technology providers, distributors and end-users) to reap the benefits.

The Embedded Finance value chain

The emerging ecosystems powered by Open Finance facilitate API-enabled access to financial data, products and infrastructure. In turn, this provides third parties – also referred to as ‘distributors’ – with the required capabilities to seamlessly embed financial products at the point of need to better serve customers. These third parties can offer financial services without bearing the costs of becoming a regulated financial institution themselves.

One might argue that such integration of financial services is nothing new. Indeed, non-financial players have been offering financial services via co-branded credit cards together with major retailers and airlines for decades. Other common forms of such integrations include sales financing through electronics retailers and car loans at dealerships, for example. However, there are two reasons why the current emerging Embedded Finance solutions are so powerful. First, the financial products are integrated into vertically specialised, digital platforms that serve sizable customer bases and where daily interaction takes place. Second, the financial products are surrounded by a seamless sales and service delivery model: state-of-the-art financial APIs, seamless user experience with plug & play onboarding, and a self-service model.

Figure 1 visualises how the traditional role of a financial institution is decoupled. Note that certain market players combine multiple roles in the value chain. For instance, a balance sheet provider can build its own technology layer on top of its own balance sheet to provide Embedded Finance to distributors. In fact, this is what leading financial institutions are seeking to develop under their ‘Banking as a Service’ strategies and where concrete API propositions are offered through their API marketplaces.

Embedded Finance products and revenue drivers

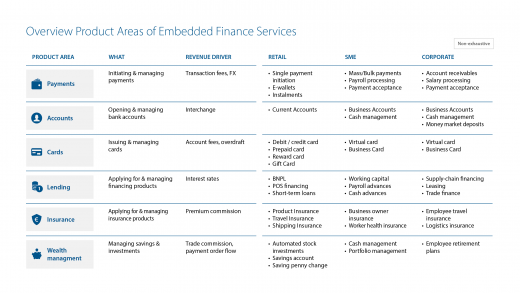

Embedded Finance does not necessarily involve the offering of new products. It can also entail the provision of existing products through new channels. In this case, the revenue drivers of these products are typically the same within an embedded context. The value created by this ‘embedding’ is explained based on a use case below.

Figure 2 shows six product domains for which the demand for an embedded solution is gradually increasing. Many distributors initially began by offering deposit accounts and payment products, before extending their embedded product range to also include credit cards and lending products such as merchant financing and cash advances.

Deposit and payment products are interesting for distributors because they represent sizable revenue pools, they promote ‘stickiness’, and they offer a powerful way to build customer relationships. In addition, these products generate many digital interactions with customers. In turn, these enable the capture of customer data that can be used to inform risk management processes and to underwrite decisions for higher-margin lending products.

In terms of the outlook, the Embedded Finance product portfolio is likely to expand further as customer onboarding, product onboarding and product servicing processes are all gradually digitised and made accessible via an embedded model. The advancements of real-time risk assessment capabilities will further accelerate the expansion of the Embedded Finance portfolio.

Use Case #1: AppleCare+

Probably one of the most mature embedded insurance cases is the extended warranty for Apple hardware products. As a balance sheet provider, AIG underwrites the insurance but remains almost invisible in this case. This is because Apple enables the technical integration as well as the client-facing app or platform to offer the insurance product as an additional service for the hardware devices sold. In this case, AIG benefits from Apple’s leading user experience as well as large customer base, without having to invest directly in client acquisition. This also results in significant additional revenue for AIG, as on average only 20% of earnings on extended warranty products need to be paid back to the policyholders, according to most estimations by industry experts. Meanwhile, Embedded Finance enables Apple to further grow its customer base by not only enhancing its product portfolio but also adding another revenue stream. Warranty Week estimates Apple’s annual revenue from AppleCare in 2021 at US$8.5 billion, which makes Apple by far the world’s largest extended warranty provider. The advantage for Apple users is that they no longer need to look for a suitable insurance or warranty extension, as they can directly opt in for a tailored offering.

Use Case #2: Shopify Balance

Shopify has ramped-up its merchant solution platform over the years. The company now enables merchants to handle not only the setup of their online stores, but also payments, billing and lending – all facilitated through its Commerce Components suite. The main feature is the Shopify Balance solution, which provides a business account for Shopify merchants. In this case, Evolve Bank & Trust acts as the balance sheet provider, while Stripe facilitates the integration of the financial service within Shopify’s merchant ecosystem. Evolve Bank & Trust benefits from tapping into Shopify’s merchant portfolio, growing its net income by over 150%. This indicates the immense growth potential of embedding bank offerings within established digital platforms. Meanwhile, Shopify itself reports significant growth within its merchant solution revenue (47% from 2020 to 2021), which shows the commercial value of extended services beyond the core business. Today, Shopify earns more than 73% of its revenue from merchant solutions, the vast majority of which are embedded financial products.

Use Case #3: Wethos’ one-stop shop for freelancers

Freelancers and small business owners that are using Wethos’ platform are now able to open bank accounts and request card services and other payment features, all within the platform’s experience. As the technical service provider, Unit partners with multiple financial institutions that act as balance sheet providers in the background. This enables Unit to offer even more licensed products and select the most suitable solutions for each client (in this case, Wethos). Since the launch of embedded financial products, Wethos has experienced 40% month-over-month user growth plus a six times higher retention rate among users who utilise the embedded products. This demonstrates that, besides additional revenue, an embedded proposition can also lead to increased customer numbers and stronger brand loyalty.

Given the many opportunities that Embedded Finance presents, the various value chain actors should start organising for success. First, they should identify which products they deem relevant for embedding, for which client segments, and across which geographies. Second, they need to identify which parties to partner up with to offer embedded services at scale. Lastly, they should determine how to organise themselves internally to execute successfully.