Implementing instant payments: 7 high-impact areas for PSPs

In our previous blog about instant payments, we introduced the recent legislative proposal by the European Commission (EC) on mandating instant payments for all payment service providers (PSPs) across the SEPA area, and outlined its implications for PSPs.

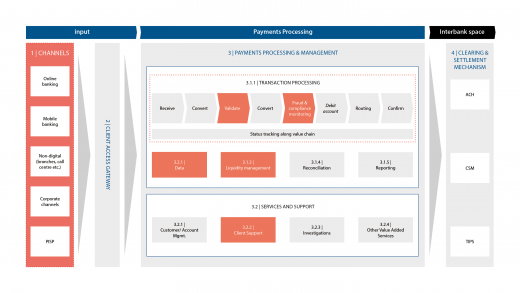

In this blog, we aim to provide key insights into the impact of implementing SEPA instant payments (SCT Inst) for PSPs by focusing on specific areas of transaction processing. Although some areas are impacted less than others, we will specifically focus on those areas where we have observed high impact in the project engagements for our clients. To highlight and describe the impact, we use our Payment Reference Model as shown in Figure 1. The high-impact areas are highlighted in red.

The Payment Reference Model covers the entire payment processing chain, from the moment of input via PSP channels (1), to passing through the payment processing system of the PSP (3) and, finally, to the moment of transmitting the payment to the clearing and settlement mechanism (CSM) of choice (4). The model also covers various PSP supporting activities, e.g. from managing data (3.1.2) to customer account management (3.2.2).

Key insights into the high-impact areas of SCT Inst implementation

We have identified the following seven high-impact areas for PSPs that are working on the implementation of SCT Inst:

- (Phase 1) All channels currently supporting regular SEPA credit transfers (SCTs) must be prepared for initiating instant payments This requires significant changes in PSP channels (e.g. support of instant payment messaging format).

- (Phase 3.1.1) A new transaction processing system must be put in place to support single transaction processing with 24x7x365 availability. This requires significant operational resources and monetary investment from the PSP side.

- (Phase 3.1.1) To validate transactions instantly, PSPs must ensure that they are always reachable. Additionally, an IBAN/Name check functionality must be included in the transaction validation stage, meaning that a suitable vendor must be chosen to deliver this functionality.

- (Phase 3.1.1) Fraud scoring and AML checks must be conducted in real time on a per-transaction basis, without impacting the customer experience. This requires modifications to the current systems and operational processes.

- (Phase 3.1.2) Data access must be in real time for processes using payment account information (e.g. ancillary processes need to be updated to access internal data sources in real time, particularly payment account statuses).

- (Phase 3.1.3) Regular SCTs have cut-off times in place to balance cash positions, whereas instant payments require sufficient funds for instant settlement of accounts. This means that PSP accounts may heavily fluctuate, and liquidity must be monitored and forecasted more precisely. Ideally, PSPs should put fallback mechanisms in place to mitigate the risk of insufficient balances.

- (Phase 3.2.2) Client support is highly impacted as extended support may be required, e.g. to educate customers and familiarise them with the benefits and features of instant payments or to handle the increased number of support requests related to potentially rejected instant payments due to their real-time nature.

These seven impact areas illustrate why implementing SCT Inst has a severe impact on a PSP’s transaction processing chain.

Stay tuned!

Contact us