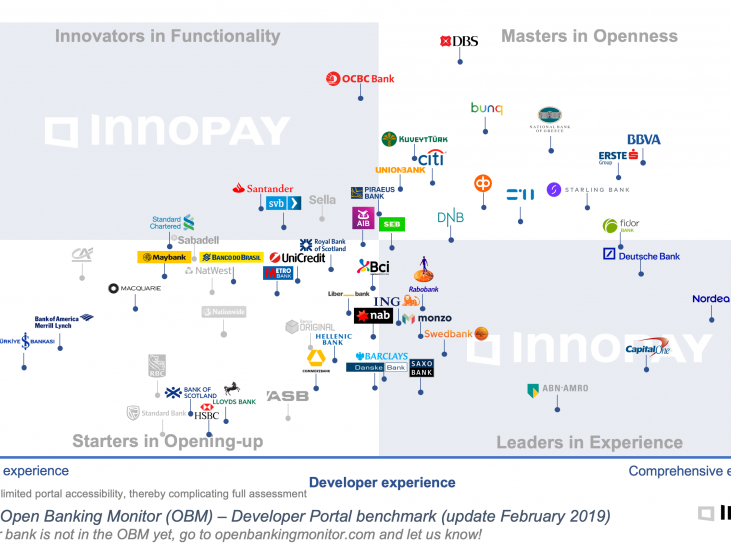

At INNOPAY we experience that Financial Services executives are embracing Open Finance. Open Finance is an emerging paradigm in the financial services industry in which value creation results from sharing, providing, and leveraging access to data, products, and services through application programming interfaces (APIs). It is designed to develop more compelling, 'embedded' value propositions and experiences for customers and partners as they interact and transact in digital ecosystems.

Learning from European developments (most notably the implementation of PSD2, i.e., the revised Payment Services Directive), various Open Finance frameworks have emerged in the rest of the world. Despite nuances in scope, timing and driving forces, they all seem to have an aligned objective: opening up financial institutions to leverage data and functionalities through APIs in order to drive value creation in digital ecosystems.

It is now time to act

Besides the compliance challenges of Open Finance, financial service providers and other players must cope with an ever-evolving competitive landscape. Emerging actors are disrupting traditional value propositions and business models while simultaneously offering new opportunities for collaboration.

Open Finance is the most important building block for financial service providers to compete and collaborate in digital ecosystems. It is therefore now time to act. INNOPAY has an extensive track record in supporting financial institutions (e.g., banks, insurance companies, asset managers, pension funds, etc.) and service providers operating in digital ecosystems in developing strategies, designing new products and services, and implementing them.

This media is blocked due to your cookie settings.

To access our media edit your consent and accept 'Functional' cookies.

Open Finance Expert Team

Related content