Three scenarios for open banking-based request-to-pay

There are a growing number of request-to-pay (RTP) use cases, beyond the popular P2P transactions. This article looks at the differences between the two most prominent models: SEPA RTP (SRTP) and Open RTP (ORTP). With the future for RTP propositions being somewhat unclear now that both models are co-existing, we examine three possible high-level scenarios for how these RTP models might evolve.

Request-to-pay (RTP) is sometimes wrongly thought of as merely a payment means or a payment instrument. In fact, RTP is a payment solution consisting of both a ‘communication layer’ that allows the payee to request a payment from the payer, and a ‘payment layer’, i.e. the payment instrument.

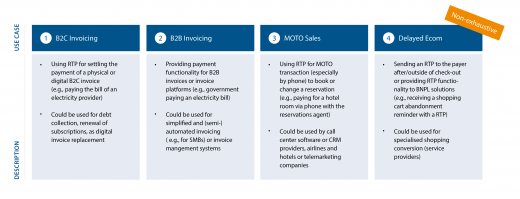

RTP is frequently used in person-to-person (P2P) transactions, such as when splitting a restaurant bill with a friend. Other RTP use cases including B2C invoicing, B2B invoicing, delayed e-commerce and mail order/telephone order (MOTO) sales seem to be gaining traction, as evidenced by solutions such as Deutsche Bank’s RTP solution offered by MultiSafePay, Libeo, LUXHUB, Serrala. Figure 1 summarises a selection of use cases relevant for RTP, beyond the commonly known P2P use case.

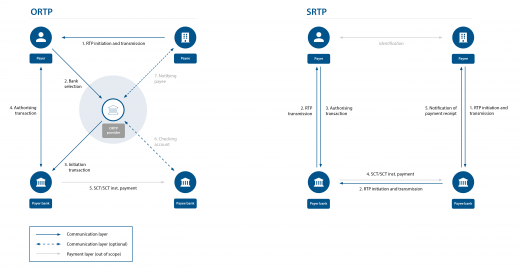

Various models for RTP solutions exist to address such use cases. The two most prominent models are SEPA RTP (SRTP) and what we refer to as ‘open RTP’ (ORTP). Notably, as illustrated in Figure 2, the key difference between SRTP and ORTP is that ORTP involves a payment initiation service provider (PISP) that is licensed under PSD2. The licensed PISP initiates an account-to-account (A2A) payment on the payer’s behalf. The above-mentioned examples of use cases primarily leverage the ORTP model, but there are also other methods to enable settlement of payment requests besides A2A payments (e.g. cards, wallets).

Designed as a scheme between participating banks and payment institutions, SRTP is based on EU initiatives aimed at harmonising RTP solutions in Europe. In contrast, ORTP can be leveraged by any PSD2-licensed market player offering a payment initiation service (PIS). While in the case of SRTP the communication and payment initiation take place directly between the scheme participants, in the case of ORTP the PSD2-licensed PISP facilitates the RTP communication between payee and payer and acts as an intermediary for the initiation of the payment. Both models can leverage SEPA credit transfer (SCT) and instant SEPA credit transfer (SCT inst.) as underlying payment instruments to initiate the payment. The payment can be concluded directly (Pay Now), but RTP can also support use cases in which the acts of purchase and payment are decoupled, whether for better alignment with the use case or to give more flexibility to the consumer (Buy Now, Pay Later).

Note that some versions of ORTP have been in existence since before PSD2. However, these do not involve a licensed PISP. These non-PSD2 ORTP solutions include proprietary merchant RTP solutions, mono-bank solutions (e.g. Tikkie based on iDEAL in the Netherlands), multi-bank solutions (e.g. Bizum in Spain, BLIK in Poland, TWINT in Switzerland, Vipps in Norway and Swish in Sweden) and non-bank solutions (e.g. Stripe request payment and Adyen pay by link). This article focuses only on ORTP based on PSD2-licensed PISPs and SRTP.

OPEN RTP IS ABLE TO RESPOND QUICKLY TO MARKET DEVELOPMENTS & CUSTOMER NEEDS

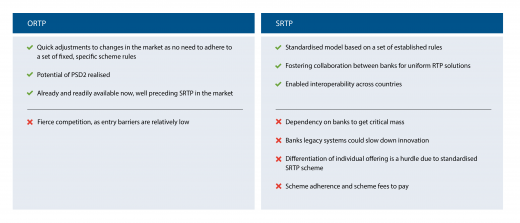

SRTP was initiated with the goal of increasing business adoption of RTP and enabling interoperability among countries by offering a standardised European messaging framework (RTP scheme). However, it seems that this goal has not yet been reached. Meanwhile, several PSD2-based ORTP solutions already exist throughout Europe, such as from Deutsche Bank, Gocardless, Mastercard Pay by Link and Token. Even though neither of the models are currently widely implemented, one of the key advantages of ORTP is that PISPs can differentiate and respond quickly to market developments and changing customer needs, since they do not have to adhere to defined scheme rules and a collaboration framework. This also makes it easier to tailor products to specific use cases and add new features, supporting a faster go-to-market. Moreover, ORTP does not involve any scheme fees. Figure 3 shows an extended list of the advantages and disadvantages of these two RTP models.

THREE POSSIBLE SCENARIOS FOR RTP SOLUTIONS

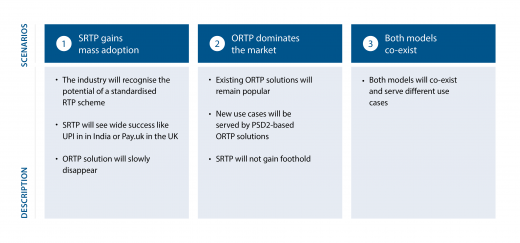

Currently, we foresee three possible, high-level scenarios for how RTP propositions might develop in the future. These are summarised in Figure 4.

Scenario 1: SRTP gains mass adoption

In this scenario, SRTP wins against ORTP and conquers the RTP market. SRTP’s standardised messaging infrastructure eliminates dependency on open banking developments and enables broad fraud mitigation, which helps to build trust in SRTP. Another USP of SRTP is that it is more regulated. Thanks to providing a set of standardised and interoperable operating rules, it is attractive for specific use cases, for instance for debt collectors (e.g. speeding penalties). It also offers benefits for B2B invoicing in more tightly regulated situations, such as for energy providers who bill governments, which tend to have multiple payment authorisation layers for approving such payment requests.

For this scenario to happen, banks will need to recognise the value of a standardised messaging scheme and implement SRTP. It is likely that the existing interfaces and connectivity of banks can be leveraged to deploy SRTP, maximising reach and ability to provide guaranteed service levels. Banks will need to move away from, or modify, currently implemented solutions and recognise the added value of interoperability for the payments ecosystem at large. Additionally, they will need to take note of the countless potential use cases which can enable SRTP success.

A number of successful examples of scheme-based RTP, such as UPI in India and Pay.UK in the UK, have already created high expectations for SRTP in the European Union.

Scenario 2: ORTP will dominate the market

In this scenario, ORTP will conquer the RTP market, especially by moving beyond currently popular P2P use cases. User appreciation for ORTP solutions seems to be growing, mostly linked to their ease of use and the convenience they provide. ORTP solutions can easily be customised in line with changing customer needs and market developments, without having to adhere to any specific additional scheme rules. On top of that, ORTP has the potential to add value in the various use cases mentioned. Current RTP players (e.g. fintecture or Payconiq) and new entrants, leveraging PSD2 licenses, have the ability to capture that value and evolve into one-stop-shop solutions faster, offering related services such as credit management tools and other SaaS software in which RTP messaging functionality is pre-integrated (e.g. Serrala).

Many banks have already invested in some kind of proprietary RTP solution (e.g. ABN Amro, Deutsche Bank, ING, KBC, Rabobank) or have legacy systems that hinder fast exploitation of SRTP. In this scenario, the banks will remain reluctant to join the SRTP scheme due to the lack of a compelling business case and cumbersome changes in infrastructural layers that might be needed. Current ORTP players and new entrants will exploit this momentum to extend their current solutions and will use this window of opportunity to rapidly enter the market. Additionally, current ORTP providers are buoyed by the necessary experience, the necessary flexibility in shaping solutions and the necessary trust of consumers which originated in the P2P context.

As a final note, regional scheme-based initiatives like Nordic Bill Payment form an additional challenge for European standardisation. This and the numerous other current incumbrances to harmonisation of SRTP make this scenario likely to occur.

Scenario 3: ORTP and SRTP will co-exist

This third scenario highlights the complexity of both models co-existing and interacting as they serve different use cases. In many countries, the market for RTP solutions is neither established nor harmonised. This might be related to national payment methods having a strong position in the payment mix (e.g. iDEAL in the Netherlands), low PIS adoption, or both. Especially in such countries, it is more likely that SRTP and ORTP will co-exist. In these markets, we expect that SRTP will be favoured for more complex use cases (e.g. B2B invoicing, debt collection) for which trust is a prerequisite. Trust also matters in ORTP solutions, of course, but these will tend to be used for cases involving lower value and risk, in which convenience and user friendliness are deemed most essential (e.g. MOTO or delayed e-commerce).

For this scenario to become reality, banks will need to recognise the value of joining the SRTP scheme and take the necessary steps to reach critical mass on both the consumer and the provider side. Banks and ORTP providers alike will need to adapt in this scenario, whether in terms of their underlying communication infrastructure or the use cases they address. This change will be particularly important in countries in which open banking is less widespread or bank-to-bank communication networks are weak (e.g. Czech Republic).

The odds seem in favour of Open RTP

RTP has the potential to add value by supporting the uptake of instant payments and addressing numerous use cases. The advantages include simplifying the customer journey, making the payment process more transparent and enhancing reconciliation. Although it is still too early to officially declare the winner between SRTP and ORTP, the odds seem to be in favour of ORTP. The latter’s first-mover advantage and the ability to quickly adapt to new market dynamics and customer needs may well prove critical in this battle. Regulatory initiatives in the form of PSD3 and the recent legislative proposal on mandating instant payments might further strengthen the position of ORTP providers. This development could put further pressure on the EU’s desire for sovereignty in European payments, as non-banks continue to actively pursue the opportunities provided by ORTP.