Navigating the data economy: key considerations for decision-makers in banking

In an article written by INNOPAY and recently published in Journal Payments Strategy and Systems (JPSS), the opportunities arising from FiDA, eIDAS2 and Data Acts are analysed, providing strategic considerations and key next steps for banks navigating the data economy. Here, we highlight six key points from the article to help banks prepare for tomorrow.

The PSD2 and Open Banking movement has enabled innovative consumer use cases and sparked technological upgrades of the financial sector through the introduction of API technology. This enabled third parties to develop innovative services on top of existing banking infrastructure, intensifying competition within the banking and payment sectors for specific financial products and client segments. While banks have primarily approached PSD2 as a compliance-driven project, investing significantly in opening their infrastructure, it is these third parties that are generating new value and enhancing customer relevance. Through new regulatory reforms such as PSR, FiDA, and eIDAS access to banking data infrastructure will be significantly expanded, compelling banks to enhance their digital capabilities while navigating increased regulatory requirements. Banks need to start preparing today to be better able to serve their customers and their ever-evolving data needs tomorrow. So which considerations should they bear in mind?

6 key points from the JPSS article

1.Providing data access by banks (under PSD2) has largely been a compliance first strategy

Open Banking, initiated by PSD2, has introduced API technology that allows third-party providers to build services on existing banking infrastructures. This has intensified competition in the banking and payments space, with third parties generating new value and customer relevance on top of banking infrastructure while banks face further disintermediation and bearing the costs.

2. Regulatory reforms will further drive investments for banks to develop new capabilities

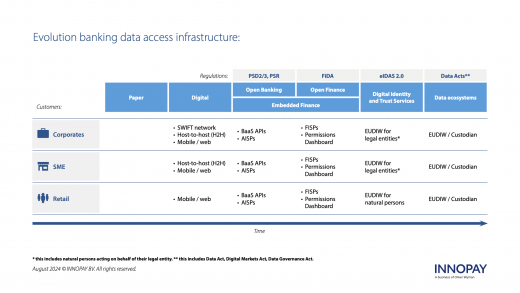

FiDA, eIDAS 2.0 and PSR will require banks to invest in upgrading their data infrastructure to ensure compliance. However, these regulations will also offer a robust set of tools, such as APIs, the EUDI Wallet, and permission dashboards, that banks can leverage to create new data-driven, customer-centric solutions. In Figure 1 below the evolution of banking data access infrastructure is illustrated:

3. FiDA will lead to innovative use cases and new avenues for banks to capitalize on assets

The upcoming FiDA regulation builds upon PSD2 but will extend data access to a broader range of financial data (e.g. savings, investments, lending, mortgages, insurance) to support advanced financial use cases (e.g., better and more holistic personal finance advice, better product comparison and switching). Customers will be provided greater control over their data through tools like permission dashboards. For banks pursuing a more offensive strategy ‘beyond compliance’, it will open new avenues for partnerships and business models (e.g., by monetization of premium APIs).

4. The EUDI wallet lowers costs and leverages bank’s customer data

The revised eIDAS framework, which introduces the European Digital Identity Wallet (EUDIW) ecosystem, mandates that banks must accept the digital wallet for identification and authentication purposes. The wallet will be offered with a high level of assurance, making it suitable for banks' onboarding and KYC procedures, potentially reducing associated costs. Additionally, banks can establish themselves in the ecosystem as issuers of credentials within digital wallets. This allows their customers to utilize these credentials to access digital services in third-party contexts, such as using a bank-issued income statement to demonstrate creditworthiness to a tennant.

5. Banks should consider strategic opportunities beyond compliance to maximize return on investments

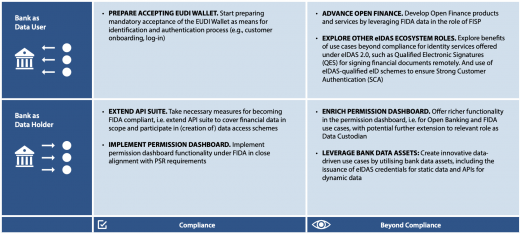

Instead of merely complying with forthcoming regulations like PSD3/PSR, FiDA, and eIDAS2.0 banks should focus on securing their future relevance by looking beyond short-term regulatory compliance and ROI. The key to this is exploring new use cases that leverage customer data and tools - such as permission dashboards - across various new emerging data sharing ecosystems. An overview of strategic directions and key actions for banks to navigate the data economy are presented below:

6. Banks should acknowledge their position as trust anchor in data economy in the role of ‘data custodians’

The European vision of data sovereignty, supported by regulatory reforms, aims to enhance data sharing across sectors. To bring this vision to life, a permission dashboard is essential, enabling customers to control who has access to their data. Banks are uniquely positioned to serve as Data Custodians in customer’s everyday life by providing them secure tools to handle data access requests and manage their permissions.

In conclusion, bank executives at any bank wishing to participate successfully in the data economy will need to critically review their digital strategy, approach to partnerships and industry collaboration as well as their capabilities. They should recognize that putting customers in control of their money and data is imperative for future strategic and commercial relevance. Ultimately this approach will unlock new value and help banks to secure their future in the data economy. Reach out if you want to learn more about this to Mounaim Cortet or Pepijn Groen.