What is happening in Open Banking?

INNOPAY monitors the developments of the Open Banking landscape with great interest. What is happening in the Open Banking landscape? Which banks have exposed APIs and what are their offerings? Through our Open Banking Monitor we share our insights and analysis with the community.

Our publications

A list of publications of the INNOPAY Open Banking Monitor can be found below:

- 06/2022 - "The current status of Open Banking – and a glimpse into the future"

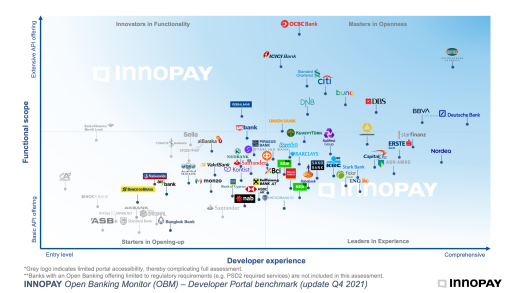

- 12/2021 - "Open Banking Monitor update Q4’21: Banks are stepping up their game"

- 07/2020 - "Increasing API focus on business and community context"

- 10/2019 - "Banks moving beyond the PSD2 requirements"

- 01/2019 - "Let’s take a moment to make up the rankings and identify potential new “Masters in Openness”

- 07/2018 - "Mastering Open Banking: How the 'Masters in openness' create value"

- 02/2018 - "Who are the Masters in Openness?"

Want to know more?

Innopay's Open Banking Monitor assesses publicly available developer portals of banks with an Open Banking offering (beyond the mandatory scope of PSD2). If your bank is not included or if you're interested in our approach, send an email to info@innopay.com and let us know!

Related content

Event

|

|

from

till

EintrachtLab, Deutsche Bank Park, Frankfurt am Main, Germany

What if regulation wasn’t a brake on innovation, but your biggest opportunity?On...

read more

Publication

|

Blog

Given recent developments around the introduction of Section 1033 in the US, this blog takes a closer look at the current state of Open Banking in the country.To do so, we will apply INNOPAY’s Open Banking Monitor (OBM). Since 2017, the OBM has provided global insights into the industry by analyzing various developer experience features -...

read more

Publication

|

Blog

Embedding financial services at the point of need is one of the most exciting developments within the digital finance space right now. With new use cases and partnerships being announced almost daily and projected revenues generated through Embedded Finance (EmFi) north of a €100 billion in Europe, many banks feel the urge to explore...

read more

Publication

|

Blog

As of 9 February 2025, the Trump administration has introduced significant uncertainty surrounding the future of the Consumer Financial Protection Bureau (CFPB). This uncertainty is marked by the closure of CFPB offices and a suspension of funding, reflecting a continued hostility towards the bureau that was evident during the first Trump...

read more

Publication

|

Article

In an article written by INNOPAY and recently published in Journal Payments Strategy and Systems (JPSS), the opportunities arising from FiDA, eIDAS2 and Data Acts are analysed, providing strategic considerations and key next steps for banks navigating the data economy. Here, we highlight six key points from the article to help banks ...

read more

Event

|

|

from

till

Amsterdam, the Netherlands

Mounaim Cortet, Vice-President of INNOPAY, will be speaking at Mobey Forum’s Ams...

read more

Publication

|

Blog

As part of INNOPAY’s continued focus on monitoring the Embedded Finance (EmFi) l...

read more

Publication

|

News

INNOPAY has promoted Mounaim Cortet to the firm’s partnership, effective as of&n...

read more

Event

|

|

TechQuartier, platz der Einheit 2, Frankfurt

Get ready for an exclusive journey into the world of transaction data at the upc...

read more

Publication

|

Article

The latest edition of the INNOPAY Open Banking Monitor report is now available, containing a round-up of Open Banking API offerings and developer experience features available from financial institutions across the globe plus a selection of articles summarising the major trends over the past year. Benefit from these insights into the key ...

read more

Publication

|

Blog

Open Finance is growing rapidly as financial institutions continuously launch new APIs and improved developer portals to extend third-party access to financial products, services and customer data. However, there is more to Open Finance than that. INNOPAY has developed a comprehensive model covering seven key dime...

read more

Event

|

|

online

Mounaim Cortet, Managing Director at INNOPAY, will be a featured speaker at...

read more

Publication

|

Blog

Market leaders further strengthen their competitive edgeDigital value propositions in financial services have seen a surge, accelerated by many factors, including regulatory pressure (e.g. PSD2), changing customer behaviour in part driven by the COVID-19 pandemic, as well as the latest buzz around ‘embedded finance’ enabling access to fin...

read more

Publication

|

Blog

Embedding financial services enables financial institutions to deliver value at the point of need. Through seamless integration, financial services and products can be made available in a broader customer journey, typically facilitated on non-financial, digital platforms. Such platforms serve sizeable client segments (retail, SMEs, corpor...

read more

Publication

|

Blog

With financial institutions (FIs) playing a key role within the Embedded Finance value chain, assessing their Open Banking offerings is imperative to develop a comprehensive understanding of the breadth and depth of their services. These offerings serve as key enablers for emerging embedded business models in close collaboration with thei...

read more

Publication

|

News

INNOPAY is pleased to announce its participation in The Paypers' highly anticipa...

read more

Publication

|

Blog

On 6 and June, the ‘API The Docs’ conference took place at the headquarters of m...

read more

Publication

|

News

The Paypers has announced the upcoming release of its ‘Enablers of Embedded Fina...

read more

Publication

|

Article

A whole year has passed since our previous update of the INNOPAY Open Banking Monitor, which means it is high time to take a new look at where the industry stands. This year’s update will cover the status quo of Open Banking globally, highlighting what steps banks have taken, which general trends can be identified, and whether these have ...

read more

Publication

|

News

How is the revised Payment Services Directive (PSD2) helping financial instituti...

read more

Publication

|

Blog

The COVID-19 pandemic has accelerated the ongoing digital transformation process globally. This has also caused corporate treasurers to explore opportunities to digitise their business operations and look for possibilities to accelerate and optimise their decision-making. However, traditional digital channels are not equipped for real-tim...

read more

Event

|

|

TechQuartier, Platz der Einheit 2, Frankfurt am Main

On Thursday 23 February we will organise INNOPAY's Night of Insight from 18:00-2...

read more

Publication

|

News

While the market for embedded finance is still nascent, things are moving fast. ...

read more

Publication

|

News

Last week, INNOPAY’s Maarten Bakker presented highlights from the Open Banking M...

read more

Publication

|

News

Supported by INNOPAY, the EBA Open Banking Working Group (OBWG) has published&nb...

read more

Publication

|

Blog

The latest edition of the INNOPAY Open Banking Monitor shows that existing players in the financial industry are stepping up their game and providing interesting Open Banking product propositions. Meanwhile, new banks are entering the arena.

In response to the rising demand for open, embedded finance, financial institutions are increasin...

read more

Publication

|

Blog

In this guest blog that Mounaim Cortet has written for Nordea - a leading Nordic universal bank -, Mounaim shares the key findings from INNOPAY’s most recent Open Banking Monitor, with a special focus on Nordea as well as the future of Open Finance.INNOPAY’s Open Banking Monitor shows the efforts banks are making in expanding their A...

read more

Publication

|

News

INNOPAY has named Mounaim Cortet as the new country manager for the DACH region. As of 1 May 2022, he is responsible for the operations and further market development in this region.

Mounaim has been working at INNOPAY since 2012 in positions including strategy director and global lead for strategy and open finance consulting services.&n...

read more

Publication

|

Blog

We are thrilled to publish a new update of the INNOPAY Open Banking Monitor (OBM)! Since our previous publication many things have changed, so the time has come to update the rankings and to take a closer look at some of the key developments. This sneak preview provides a snapshot of the efforts banks have made in expanding their API prod...

read more

Topic

Open Finance is an emerging paradigm in the financial services industry in which value creation results from sharing, providing, and leveraging access to data, products, and services through application programming interfaces (APIs).

read more

Publication

|

News

The Open Banking Report 2021, which has just been published by The Paypers, foll...

read more

Event

|

|

Online

Why and how are APIs currently remodeling the finance services industry? How can...

read more

Event

|

|

from

till

Online

Webinar for EBA members: Gearing the bank operating model towards digital and Open Banking readiness

On 27 Sep and 1 Oct 2021, Karl Illing, Country Lead Germany at INNOPAY ...

read more

Event

|

|

from

till

Online

Webinar for EBA members: Gearing the bank operating model towards digital and Open Banking readiness

On 27 Sep and 1 Oct 2021, Karl Illing, Country Lead Germany at INNOPAY ...

read more

Event

|

|

Online

The world is moving towards an open data economy. Businesses are partnering up b...

read more

Publication

|

Blog

To receive exclusive access to an extended Paper which expands on the ideas deve...

read more

Topic

The rising importance of digital identity, consent management and data sharing has created a ‘Blue Ocean’ market for banks. We believe that they now have a unique opportunity to strengthen and truly safeguard their relevance in the data economy. But they need to start taking decisive action right now in order to demonstrate that they can ...

read more

Publication

|

Blog

In today’s data economy in which everything has become a transaction, future relevance for banks is no longer based on payments alone. To help senior executives of banks to start leveraging their Open Banking capabilities in this context, we recommend three must-do actions to holistically address the components of a digital trust in...

read more

Publication

|

News

Today we celebrate the first ‘birthday’ of the Regulatory Technical Standards (RTS) on Strong Customer Authentication (SCA). 14 September 2019 was the date that marked the go-live of key security requirements for third party access to payment accounts (XS2A). Since then, banks have been required to open up certain payment functionalities ...

read more

Publication

|

Video

The rising importance of Open Banking, digital identity, consent management and data sharing has created a ‘Blue Ocean’ market for banks. We believe that they now have a unique opportunity to strengthen and truly safeguard their relevance in the data economy. But they need to start taking decisive action right now in order to demonstrate ...

read more

Publication

|

Blog

Banks need to get their Open Banking strategy right. Our research indicates that...

read more

Event

|

|

from

till

Online

On Thursday 28th May, we are organising a webinar on Mastering Open Banking. Wha...

read more

Publication

|

News

Keep an eye out for our upcoming blog on the latest INNOPAY Open Banking Monitor. We reflect on the status quo of the Open Banking landscape, discuss the new ‘Masters of Openness’ and explore what it takes to build, maintain and grow your Open Banking community.

The updated version of our Open Banking Monitor will cover:

...

read more

Publication

|

News

On Thursday 28 May, we are organising a webinar on Mastering Open Banking. What are the latest developments? What are examples of best practices? And what can we learn from the experiences of banks themselves?

In this webinar, Karl Illing (director & country lead, INNOPAY Germany) and Mounaim Cortet (senior manager at INNOPAY) will p...

read more

Topic

Adding customer value through Open Banking by sharing, providing and leveraging access to bank resources through application programming interfaces (APIs). We support banks in their PSD2 and Open Banking transformation. Find out how.

read more

Publication

|

News

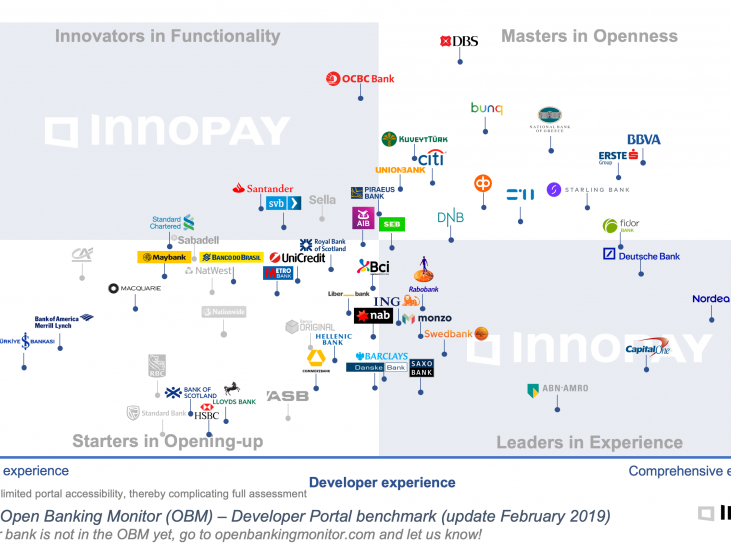

Open Banking has seen considerable activity in the last few months. Indeed, with the EU’s compliance deadline for PSD2 looming, Open Banking developer portals have emerged in great numbers, with 300-plus banks now in our monitor.

In the recent release of the INNOPAY Open Banking Monitor (OBM), updated in August 2019, we described the cur...

read more

Publication

|

Blog

PSD2 is the revised European directive for payment services, with the supporting...

read more

Publication

|

Blog

As the number of digital transactions is growing exponentially, companies who have relevant and frequent digital interactions with their customers compete to become future ecosystem orchestrators. This is also true for the banking sector, where customers are increasingly banking through their smartphone, making that the primary digit...

read more

Publication

|

Blog

Looking back on a much eventful year in Open Banking; various banks have updated their Developer Portal in the last quarter of 2018, either by expanding the Functional Scope, by offering more APIs, or by introducing tools and features improving the Developer Experience. Predominantly with the shared goal of attracting more end-customers, ...

read more

Publication

|

Blog

Towards the first pan-European Open Banking based scheme

Imagine you’re taking an Uber at the airport, get to your destination and while you’re getting out of the Prius … ping… you receive a push notification from your bank that says € 32,78 was debited from your payment account. The full Uber experience, but no cards or wallets needed.&...

read more

Publication

|

Blog

This article was first published by the Paypers in the Open Banking Report 2018.

read more

Publication

|

Blog

PSD2 has been an important catalyst for banks to open up. While many banks in Europe are still focused on making the PSD2 deadline of September 2019, we see some leading banks move beyond compliance and shift towards Open API Banking. In this emerging Open Banking play, banks start to understand that enabling secure access to custome...

read more

Publication

|

Blog

Senior bank executives are starting to understand that Open Banking will have ke...

read more

Publication

|

Blog

This article was first published in The Paypers which features thought leadership editorials from ecommerce and payments industry professionals.

The concept of Open Banking and its potential grows steadily on corporate banks. PSD2 has been an important catalyst for banks in opening up, however, it forced them to focus on complying first,...

read more

Publication

|

Blog

We all know by now that “XS2A” - access to payment accounts by third party providers (TPPs) - is going to happen in some shape or form under PSD2, but there is still considerable uncertainty. The transposition of PSD2 into national law is being delayed in twenty member states[1] and while the Regulatory Technical Standards on Strong Custo...

read more

Publication

|

Blog

The European Banking Authority’s (EBA) has published its long-anticipated draft Regulatory Technical Standards (RTS) on ‘strong customer authentication and secure communication’ on 12 August. The RTS are considered key to achieve the PSD2 objectives of enhancing consumer protection, promoting innovation through competition and improving t...

read more