Corporate customers are pivotal in creating value on top of Instant Payments infrastructure

As Instant Payments is expected to become the new normal in payments in many countries, it is imperative for financial service providers to offer Instant Payments capabilities to remain relevant in the future. The significant investments required to update current payment infrastructures motivates financial service providers to look for relevant use cases and create value-added services for their customers.

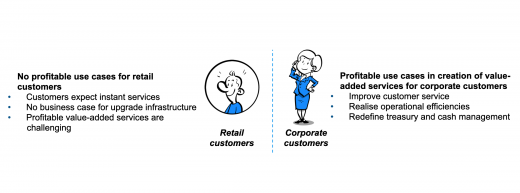

In this blog, we explain why financial service providers should aim Instant Payments value-added services towards corporate customers rather than retail customers.

No profitable use cases for retail customers

Instant Payments (IP) use cases may be found for both retail and corporate customers. However, offering relevant IP use cases for retail customers, appears to be quite challenging, mainly for three reasons.

1. Keep up, customers already expect instant services

Today’s retail customers expect digital services that are always online, instantly available and on-demand. We live in an online society, where we can communicate with each other through a variety of social media possibilities instantly. Examples that have shaped consumer expectations are media streaming services such as Netflix, online shopping platforms like Amazon and (challenger) banks enabling customers to open an account in a matter of minutes at any time.

Retail customers simply expect financial service providers to deliver a similar level of service for payments. Offering anything less than IP is a dissatisfier for them and opens the door to competitors that do offer an instant experience.

2. No profitable business case for upgrade existing infrastructure

To meet customer expectations, financial service providers are investing in the SCT Inst scheme. In the EU, it is anticipated that this new scheme will take over the current SCT scheme. However, rather than a payments revolution, IP is more an upgrade of the current payments infrastructure. Current SCT payments are in most cases free of charge or available for a small fee (e.g. urgent payments). Since customers already expect this upgrade, it is not likely they are willing to pay (extra) for payments services that are instantly processed through SCT Inst.

3. Creation of profitable value-added services is challenging

Offering an upgraded infrastructure to keep up with expectations, is often no basis for a profitable business case. Value-added services on top of IP might be the answer. Instant mobile peer-to-peer (P2P) is a relevant use case and is becoming the go-to service. However, these P2P value-added services have already been claimed by players like PayPal and Tikkie. They already offer these IP services to customers free of charge and on top of the existing payments infrastructure (SCT).

Other services for retail customers are limited, as evidenced by the small number of use cases that circulate across webinars, forums and blogs. This leaves little room for financial service providers to create profitable value-added services on top of the new Instant Payments infrastructure for retail customers.

So, if value-added services aimed at retail customers will not deliver a profitable business case for IP, what will?

Potential profitable use cases in value-added services for corporate customers

Many SME’s and larger corporates (corporate customers) are still lagging in operating instantly. However, also in the corporate space (B2C, C2B and B2B), IP will become the new normal. The potential value of instant payments for these corporate customers is bigger, as they can benefit in multiple ways by instant incoming and outgoing payments. As such, financial service providers have a window of opportunity to unlock this value by creating new services on top of the IP infrastructure in for instance the following three areas.

1. Improve customer service

The ability to send and receive payments instantly allows corporates to interact with their customers in a different way. For example, insurance- and reimbursement claims to customers can be settled in real-time, providing corporates with an instant service level to improve customer experience. On the other side, corporates can offer their customers ‘just-in-time’ payments. Customers can pay at the latest moment with instant confirmation of successful payment. This new way of interactions with customers can improve customer service.

2. Realise operational efficiencies

IP also enables corporate customers in different segments to realise operational efficiencies. Drop shipping business models (e.g. direct delivery from the supplier) are further supported by IP, as merchants can directly forward the customer payment to the supplier along with the order and have goods directly delivered to the customer. The need for holding inventory is therefore reduced.

For merchants, different over-the-counter (OTC) payment methods can be enabled by value-added services on top of the IP. Facilitating Instant credit transfers between merchants and their customers can potentially eliminate the need for third parties (e.g. card schemes). This leads to operational and cost efficiencies [1].

3. Redefine treasury and cash management

As the SCT Inst scheme defines 24x7x365 availability of clearing and settlement, there is no naturally defined cut-off time for making end of day statements. Corporate customers therefore need to redefine their internal procedures for managing cash positions. Also, as incoming payments may take place beyond office hours, corporate customers will need to update their operating capabilities to predict future cash flows in order to optimally manage financial positions overnight and during weekends and holidays.

With adequate tools and services, treasury departments will benefit from the reduced need for operating loans or lines of credit, as payments are not only received faster, but 24/7/365. Efficiency of working capital is increased, as money is faster and at less costs available for reinvestment.

As discussed above, profitable IP use cases are hard to identify for retail customers. Retail customers already expect instant payment processing and are not likely willing to pay (extra) for value-added services. Financial service providers face the risk of losing their customers if they do not meet these expectations.

Value-added IP services for corporate customers, however, are far more promising. IP will also for SME’s and corporates become the new normal. In contrast to retail customers, financial services providers still have plenty of opportunities to sustain their relevancy and show their corporate customers how to unlock the IP potential and create value. The time to act is now!

Stay tuned for our next blogs, where we will deep dive on value-added corporate services, like new merchant payment methods, treasury management support and data enriched Instant Payments.

INNOPAY consultants are innovation experts in digital transactions and active in, amongst other, the banking industry and payments business. To discuss how we can support your organisation in creating customer value with Instant Payments, please contact Wouter van den Hengel (wouter.vandenhengel@innopay.com).

Written in collaboration with Leon Koesoemowidjojo

---

[1] We will discuss on the IP opportunities and risks for financial service providers in OTC-payments in our following blog.