European Commission publishes impact assessment study on PSD2

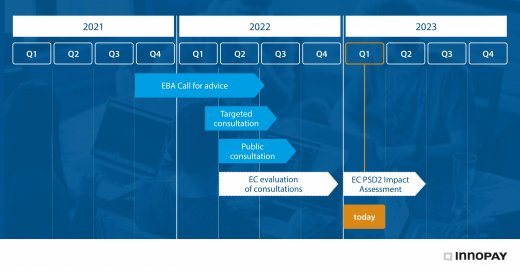

The European Commission (EC) published its study on the impact of the Payments Service Directive 2 (PSD2) on 2 February 2023. This is the most recent development in the EC’s mandatory review process aimed at reflecting on the achievements, shortcomings and impact since PSD2 entered into force in 2016. Various organisations were asked for input as a part of the review, and the European Banking Authority (EBA) published its response to the call for advice on 30 June 2022. In the meantime, the EC has conducted and evaluated a targeted consultation and a public consultation. The study forms part of the EC’s Work Programme 2023 within the section ‘Economy that Works for People’.

This study was aimed at holistically assessing the application as well as the economic and market impact of PSD2, EU-wide. It covered the following:

- Cost-benefit analysis regarding the performance of the directive on the EU level in terms of its relevance, effectiveness, efficiency and coherence.

- Identification of market trends that have been able to flourish thanks to the implementation of PSD2, including improvements in point-of-sales, e-commerce, remote and cross-border payments, licensing for third-party providers, and changes in the market regarding entry and exit of players, emergence of services and value chains.

- Recommendations for improvements to the regulation, based on the following three pillars:

- Scope and exclusions of PSD2: Improvements to address alignment and consistency of application across the EU, reduction of legal uncertainty by clarifying terminologies, increasing scope in line with new developments in the market and potentially unifying PSD2 with the Second Electronic Money Directive (EMD2) and establishing consolidation with the Regulation of Markets in Crypto-assets (MiCA).

- Open banking: Improvements to address standardisation and interoperability issues, focus on ensuring that the regulation covers emerging payments service providers and addresses FinTech industry development concerns.

- Data and consumer protection: Improvements focused on enhancing the system for customer identity control, data authorisation and protection of payments service users. The recommendations address adherence regarding data access and data sharing in the payments landscape in line with General Data Protection Regulation (GDPR) and European Data Protection Board (EDPB) guidelines.

Overall, the study reveals that the EC’s considerations about future legislative changes are strongly influenced by the evolution of both the financial landscape and the payments market. It can be concluded that the legislative changes on the horizon have the potential to impact the financial sector in a positive way, such as by enhancing the customer experience, reducing fraud, safeguarding data, fostering innovation and driving Open Finance initiatives.