DNB Event: Digital euro meets Dutch payment professionals

Last week’s seminar called ‘Digital euro meets the Dutch experts’, organised by the Dutch Central Bank (DNB), was all about how a Digital Euro can ensure trust, continuity and autonomy in digital payments. This article summarises the main takeaways from the seminar.

Against the backdrop of a rise in digital payments and the resulting decline in the use of cash, the European Central Bank (ECB) is keen to ensure continued access to central bank money in a digitising world. Therefore, in July 2021, the ECB launched a study to explore ways of offering a digital euro, a digital form of public money as a digital alternative to cash. It will be issued and backed by the ECB.

The Dutch Central Bank (DNB) is one of the central banks that is actively participating in the research and development of the digital euro. DNB recently organised a seminar called ‘Digital euro meets the Dutch experts’ aimed at stimulating the discussion about the development of the digital euro in the Dutch payment sector.

Main takeaways from the seminar

- Guiding principles of digital euro are clear as the basis for the design phase

According to the ECB, the digital euro aims to provide a monetary anchor and improve financial inclusion, while also preserving privacy and providing a public alternative to cash. During the seminar, participants discussed how this ambition translates into concrete goals on the positioning of a digital euro compared to current payment solutions, and what the resulting added value for consumers would be. Answering these questions, and discussing them with all involved, is an important part of the current digital euro investigation phase of the ECB.

- Societal distribution of costs and benefits is unclear

In the current design of the digital euro, the distribution of the digital euro to users (citizens/companies) will be done by supervised intermediaries. These supervised intermediaries will be responsible for the user interaction (e.g., Know-Your-Customer (KYC), Anti-Money Laundering (AML), customer support). How the costs for facilitating this user interaction and other related costs will be distributed over the users (citizens/merchants), supervised intermediaries (banks) and the ECB is another part of the investigation phase. One of the possible scenarios is that the ECB will offer compensation to supervised intermediaries. This is currently being investigated by the ECB, whereby a decision is expected to reached by the end of Q1/23.

- Privacy is a top priority

Privacy is a top priority for the design of a digital euro, as was stressed by Evelien Witlox, Digital Euro Programme Manager at the ECB. The privacy features could also differ between the online and offline versions of the digital euro, with the offline digital euro being designed with more privacy features. The offline digital euro is a peer-to-peer validated solution, whereas the online digital euro involves a third party for validation.

- As public money is a public cause, involvement of governments and society is key

The ECB stressed the importance of realising that the digital euro is part of keeping reliable payment solutions available for society. Therefore, the decision about the direction in which to develop it should not be rushed. In fact, a key next step will be to decide whether the digital euro should be implemented at all. Furthermore, the development procedure should be seen as a learning process. It involves a novel approach, especially as the ECB is experimenting with public consultation in the creation of a rule book for the digital euro scheme. The process of analysing and incorporating input means that this project must be rolled out one step at a time. On the upside, this creates the opportunity for third parties that may be impacted by the possible implementation of the digital euro to have some influence over the decision-making process in the preliminary stage. As Olaf Sleijpen, Executive Board Member of Monetary Affairs at DNB, said in his opening speech: “There is still much to think about, much to solve and much to talk about.”

Next steps

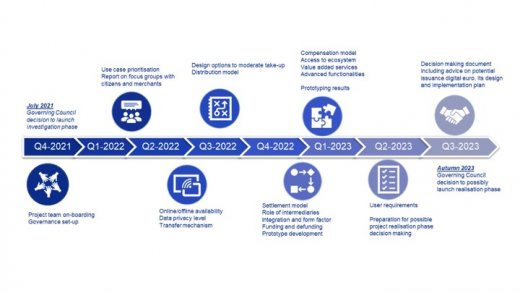

In the ongoing digital euro investigation phase, the next milestone is the prototyping results by the end of Q1 this year. These results are expected to further clarify how supervised intermediaries will be compensated and how they will be able to access the digital euro ecosystem. Furthermore, these findings should elaborate on the advanced functionalities and value-added services of this digital euro. Looking ahead, the ECB aims to present the user requirements in Q2/23. Figure 1 provides a current overview of the roadmap for the digital euro.

In summary, the ECB and DNB both acknowledge that the development of the digital euro is a learning process. Moreover, such a fundamental decision should be considered from multiple sides, which is why they are keen to involve a variety of stakeholders in the process. While some uncertainty remains, the timeline of goals published by the ECB indicates that many aspects are likely to become increasingly clear over the course of this year.

See the ECB website for more information about the digital euro project.