INNOPAY OBM SNEAK PEAK: Embedded Payments on the rise

With financial institutions (FIs) playing a key role within the Embedded Finance value chain, assessing their Open Banking offerings is imperative to develop a comprehensive understanding of the breadth and depth of their services. These offerings serve as key enablers for emerging embedded business models in close collaboration with their strategic partners.

Open Banking & Embedded Finance – two sides of the same coin

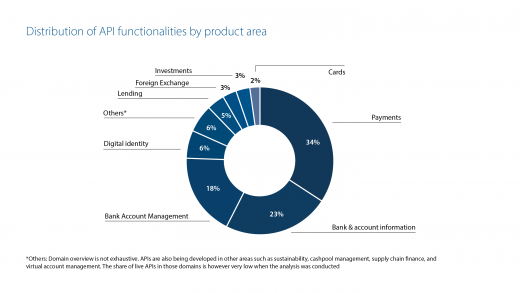

Open Banking, or the concept of FIs enabling third parties to access financial data, services, products and infrastructure through APIs, has served a key role in promoting competition and innovation in the financial industry. The breadth of APIs offered differs significantly between FIs, with payment and account information APIs still representing a significant share of available APIs. However, a range of other data, services and products, within the space of accounts, cards, lending, insurance, trade and wealth management, are becoming increasingly API enabled. With this development, FIs further pave the way for Embedded Finance, providing the financial building blocks which are made available via technical service providers and/or directly at the point of need in an external, client-facing non-financial platform. FIs typically act as balance sheet providers within this emerging Embedded Finance value chain, whereas the client-facing platform acts as a distributor of the embedded financial service.

Introduction to the OBM

Since 2017, the INNOPAY Open Banking Monitor (OBM) has been the leading publication assessing Open Banking developments of financial institutions worldwide. Over the past six years, hundreds of developer portals have been assessed to develop a comprehensive understanding of Open Banking API offerings from FIs across the globe. FIs are assessed on the functional scope of their API products and the overall developer experience features provided to the ‘API consumers’ (i.e. any third party that is integrating with the FI’s APIs). The developer experience is made up of various features spanning API Documentation, Developer Usability and Community Development. INNOPAY’s developer portal capability model is summarised in Figure 1.

The latest edition of the OBM represents INNOPAY’s largest undertaking yet, evaluating 530 FIs, over 3,202 API functionalities and over 80 developer experience features. The OBM’s 2023 update has unveiled numerous new insights. One main insight from the OBM update related to the field of Embedded Finance is highlighted below. A first sneak peek at the other findings can be found here, and the final report is expected to be published soon.

Key finding: rise of payment APIs

Since the initial OBM publication in 2017, both the number and scope of payment APIs have continued to increase. Payment APIs now account for 34% of all observed API functionalities as shown in Figure 2. This rise can be explained by the growth of specific payment functionalities that have been added over time. The types of payment APIs include cross-border payments, instant payments (via various schemes), Buy Now, Pay Later (BNPL), standing orders for recurring payments, scheduled payments, request-to-pay and batch payments. In view of the current regulatory developments surrounding instant payments in Europe and the related use cases, INNOPAY expects the number of payment APIs to continue to soar.

In particular, regulators in the EU are driving instant payment adoption throughout Europe as part of the payment sovereignty agenda. A similar development is ongoing in the USA, where the U.S. Federal Reserve (Fed) is launching its own instant payment service, ‘FedNow’, in July 2023. The work on this has already started, since the Fed began to formally certify FIs to implement instant payments in April 2023. Moreover, countries such as Brazil and India have already adopted instant payment schemes in the form of PIX and UPI respectively. As trends like these continue to spread around the globe, new use cases will continue to appear with payment innovations built on top of these real-time rails.

Outlook

This rise in payment-related API functionalities follows the overall trend of increasing demand for alternative payment methods, especially within the e-commerce space. Embedding additional payment options within the checkout process can thereby foster increased cost-effective reach and conversion for distributors while offering flexibility for end-customers at the point of sale.

Case Study: Deutsche Bank’s Embedded Instant Payment API

One example of these advances in payment-related functionalities is Deutsche Bank’s instant payment API. It enables merchants to initiate SEPA instant payments (SCT Inst) via the merchant’s web or app environment. Deutsche Bank in this case acts as the regulated entity and technical service provider, while the merchant – in the role as distributor – can offer an additional (instant) payment method, seamlessly embedded at the point of sale to boost conversion. End-consumers do not need to onboard for the service and can use it with any German bank account that can send and receive SEPA Instant Payments. Furthermore, the API consists of a built-in ‘confirmation of payee’ service, which validates the IBAN & name of the receiving party, thereby reducing the risk of payment errors and fraud.