PSPs in Europe: How to stay afloat in choppy waters

For many years, PSPs have had relatively easy pickings, charging significant markups to online merchants for handling their payment traffic. A large variety of players entered the market. In Germany, ±60 PSPs are active, and in the Netherlands 120 players either hold a license or are specifically exempted from license duty to act as PSP.

This highly diversified market is not likely to persist. The easy days for PSPs are over. Although volumes of online transactions are growing steadily, retail prices for online transactions are dropping, for some payment methods even at 10-15% p.a. The open ecosystem that will develop as a result of PSD2 is both an opportunity and a threat to PSPs (see Box 1). Simultaneously, merchants expect ever-increasing service levels as they go through their digital transformation. As a result, players aim to gain scale through strategic acquisitions and therefore the industry is consolidating.

|

Box 1: PSD2 game changer in the payments market PSD2, the European Commission’s new Payment Service Directive drives fundamental change in the payments market, and creates new opportunities and threats for PSPs. Where the first Payment Service Directive opened up access to the merchant, allowing for the role of Payment Service Providers, PSD2 opens up access to the payment account (‘XS2A’). PSD2 allows for two new regulated roles (Payment Initiation Service Provider –‘PISP’, and Account Information Service Provider – ‘AISP’) that can offer services on top of the consumer’s payment account. The account holder remains in control over his data: his explicit consent is required to provide payment initiation or account information services. As banks are required to provide XS2A to these third-party providers (‘TPPs’), PSPs have the opportunity to develop new services on top of this new open infrastructure, but face the risk of new entrants offering innovative services on top of the PSD2 infrastructure. |

Strategic options for PSPs

These developments challenge PSPs to define a clear view on how to remain relevant to their customers. The options differ significantly between large, global players, and smaller, local players. The former (e.g. Ingenico, ePayments, and Adyen) primarily serves large, international customers and deals with multi-currency payment settlement, currency risks, and cross-border data protection regulation. The latter (e.g. Computop and Heidelpay in Germany, Mollie and Buckaroo in The Netherlands) largely acts as payments facilitator for merchants in local markets, catering to a long tail of merchants with easy integration options.

We see these two segments persisting in the medium term, as each of them provides a unique value to its customers. To remain relevant in each segment, PSPs can pursue (a combination of) four strategies:

- Strive for cost-leadership through scale, flexibility, and backward integration;

- Explore options before, during, and after payment to provide the merchant full-service offering;

- Provide merchant omni-channel offering;

- Diversify the service offerings to new market niches: the PSD2 and Digital Identity ecosystems.

1. Pursue cost-leadership through scale, flexibility, and backward integration

In a maturing market with increasing price pressure, cost-leadership is a key driver of competitive advantage. A first way to create cost-leadership is by pursuing scale.

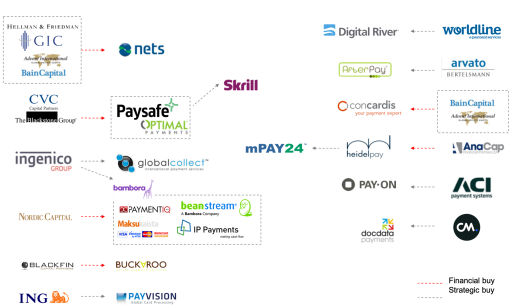

Examples of recent scale-driven acquisitions in Europe are Worldline’s acquisition of Digital River World Payments and Ingenico’s acquisition of Bambora. The latter was the result of a successful buy-and-build strategy by Nordic Capital, who combined several smaller PSPs into one group, Bambora, which it sold within a timeline of three years. We currently see various financial sponsors as well as banks entering the market, acting to enforce the consolidation process.

A second path to cost-leadership is to build a flexible platform with low-cost, automated onboarding processes through APIs. Though relevant for both global and local players, fast and easy integration is becoming an especially relevant USP (Unique Selling Proposition) in local markets. Automated, low-cost operations with limited payment methods allow for flexible business models, where the merchant gets a no-cure-no-pay solution on its payment operations without a required minimum transaction volume. By putting the responsibility of onboarding mainly on the merchant, these players can make a targeted offering to local merchants looking for low-cost, flexible payments integration.

A final cost-saving measure can be to integrate acquiring activities into the payment method offering, capturing value both from integrating and facilitating the payment for the merchant, as well as from acquiring the transaction. This initiative mainly makes sense for players with a high share of transactions in one payment method, as complexity can stack up when offering multiple payment methods.

2. Explore options before, during, and after payments to provide merchant full-service offerings

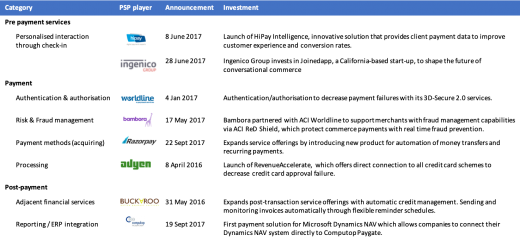

To counter dropping transaction fees, and to remain relevant in an ever more complex digital world, PSPs can do much to unburden the merchant. We see several options for PSPs to offer additional services on top of payments processing and integration. These services can take place throughout the customer journey, either before, after or during the payment

During pre-payment, the PSP can offer tools to help the merchant drive personalised interaction by checking in the customer early on in the process. Targeted interactions can help improve conversion. During payment, better identification of the customer allows for personalised interaction and the improvement of risk & fraud management. During post-payment, additional services for PSPs can be found in financial support (such as credit management and pay-out), reporting, and integration with the ERP and other services.

We see recent initiatives of global and local PSPs across the complete spectrum of services. These initiatives are being taken by large players and smaller players alike.

3. Provide merchant an omni-channel offering

Another way for PSPs to unburden merchants is to become a one-stop shop for omnichannel retailers. Most offline retailers have built online propositions, and online retailers are increasingly moving offline. Global PSPs and offline payments players are acting on this trend by building a full omnichannel offering, mostly through acquisitions. Ingenico’s acquisition of Globalcollect, the Payone – B+S card system merger, and Concardis’ acquisition of Cardtech are cases in point. Integrated omnichannel offerings help these players drive cross-sell across their customers’ business segments and to provide integrated service offerings for their customers on the path towards a seamless customer experience.

4. Diversify PSP service offerings to new market niches; the PSD2 and Digital identity ecosystems

Finally, two new ecosystems are coming up where PSPs have a natural role to play, and offer natural targets for expansion of services offered.

The first of these two ecosystems is based on new regulated services that are opened up with Payment Service Directive 2 (‘PSD2’). Though the actual impact of PSD2 on payments remains to be seen, this is a significant opportunity area for PSPs. Given PSPs’ role as intermediary in the relationship between merchant and acquirer, becoming an intermediary between the issuer and consumer may be a natural role for PSPs to play.

We see similar roles coming up in a second ecosystem: Digital Identity. An opportunity for PSPs is to move towards digital identity schemes and extend the PSP business towards digital identity service offerings. Digital identity schemes, for example in the Nordics (Bank-ID) as well as in the Netherlands (iDIN), allow business opportunities for Digital Identity Service Providers (DISPs). PSPs may be technically well positioned to offer DISP services as the technical infrastructure capabilities can be leveraged. Other opportunities for DISP players to unburden merchants are providing digital onboarding as well as signing services for financial obligation purposes (think of loan agreements and credit management).

Strategic opportunities for PSPs

The current market environment is a challenging one for PSPs. Many players will likely not be able to survive and will be acquired or stop business. For those players that are able to invest smartly, however, significant opportunities exist to remain relevant, either by pursuing cost-leadership tactics, or by diversifying the service offering and unburdening the merchant. Exciting times are ahead for those who weather the storm.

This editorial was first published in The Paypers’ Online Payments and Ecommerce Market Guide 2017 which features thought leadership editorials from ecommerce and payments industry professionals.