Quo Vadis Open Banking in DACH?

Market leaders further strengthen their competitive edge

Digital value propositions in financial services have seen a surge, accelerated by many factors, including regulatory pressure (e.g. PSD2), changing customer behaviour in part driven by the COVID-19 pandemic, as well as the latest buzz around ‘embedded finance’ enabling access to financial services at your fingertips. Therefore, it has never been more crucial for financial institutions to understand the emerging financial ecosystem in which they operate.

As Europe’s largest area, the DACH region (Germany, Austria, Switzerland) represents a significant part of the financial ecosystem. This blog takes a deep-dive into the DACH landscape, examining the progress made by financial institutions in the region in embracing open banking by assessing both the offered functionalities as well as developer experience. By analysing market dynamics and adoption trends, valuable insights are provided into the unique opportunities and challenges faced by banks in this region. The impact of key players, industry collaborations and consumer attitudes towards open banking are discussed. Additionally, light is shed on the innovative solutions emerging from the DACH region and how they are poised to shape the future of banking, locally and globally.

INNOPAY Open Banking Monitor

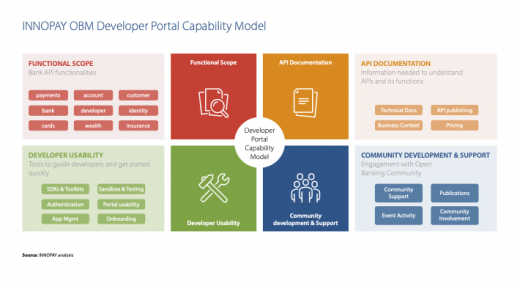

Since 2017, the INNOPAY Open Banking Monitor (OBM) has been the go-to benchmark for assessing open banking offerings of financial institutions across the globe. Over the past six years, hundreds of bank developer portals have been assessed to develop a comprehensive view on the state of play of open banking offerings around the globe. Financial institutions are assessed on the functional scope of their API products as well as the overall developer experience provided to the API consumers, consisting of API documentation, developer usability and community development (see figure 1). For more information on the global open banking activities and historical development, please see previous publications.

Summary

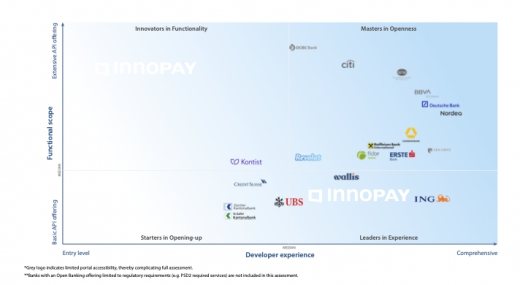

The overall development of open banking in the DACH region can be summarised in that a very select group of financial institutions lead the way and make up the lion’s share of premium API functionalities offered. ‘Premium’ in this context refers to functionalities beyond the regulatory scope of PSD2. In essence, only Deutsche Bank can compete with the global masters in openness, which are displayed in grey in the visual below (figure 2).

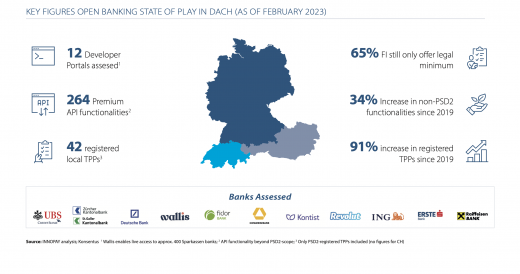

The leading banks Deutsche Bank and Commerzbank alone make up more than 30% of all premium API functionalities available in the DACH region. Looking at the market overall, still two out of three financial institutions do not have an offering which goes beyond the mandatory scope of PSD2, with the result that the total number of financial institutions included in the monitor is still very limited (see figure 3).

Reasons for the slow uptake of open banking initiatives at financial institutions in the DACH region are twofold:

1. “PSD2 Backlog”

As most European financial institutions’ API platforms were launched in the context of realising PSD2 compliance, September 2019 can be seen as the birth date of open banking across Europe for the majority of financial institutions. From this date, financial institutions had to enable licensed third parties to access payment initiation as well as account information services with the customer’s consent. However, many developer portals and APIs were not yet fully operable at the time, which led to many financial institutions working on technical, performance and availability issues, expanding access to required data and improving basic usability well into 2020. These shortcomings in meeting regulatory requirements even led to BaFin not granting any exemptions on the Fallback mechanism for German financial institutions.

2. Global External Drivers

Due to the pandemic at the start of 2020, many organisations, including financial institutions, needed to shift their focus to core business activities and cost savings. Studies indicate that budgets for technology-related innovation have dropped, therefore slowing down the development of new open banking propositions. As soon as the pandemic loosened its grip on the financial industry and society, the war in Ukraine had a similar effect on many institutions, again shifting the focus to other areas within their operations. Another possible contributing factor is the large increase in funding for cybersecurity in financial institutions. According to reports, many financial institutions aimed to raise their IT security budget by up to 20-30%.

Main Findings

1. Developer experience improved across the board

One positive finding of the update was the overall improvement in the developer experience capabilities across the DACH financial institutions included in the assessment. The experience of developers utilising the API services of financial institutions plays a key role in the ultimate adoption and usage of their APIs. The advances in developer experience are best typified by Deutsche Bank and Commerzbank, both of which scored within the top 10 globally for developer experience. As the OBM’s scoring model is continuously improved, comparing absolute scores with previous versions is difficult; the progress is therefore best evidenced by highlighting some market practices that have emerged.

Case Study: Wallis’ API Matchmaker

One positive DevEx example is the API matchmaker function from Wallis. This functionality allows developers to find the API that best matches the needs and wants of their customers, by focusing on the actual use case itself. This feature tackles the stated lack of education within the financial institutions’ clients by explaining the actual benefit they can deliver with the use of APIs. It also serves to highlight the advanced functionality of their bank and multibank APIs.

Case Study: Advanced Portal Guidance

Secondly, another exceptional developer functionality is the very advanced ‘Getting started guide’ by Erste Bank. Instead of a generic guide, Erste provides step-by-step instructions based on a live API, from initial registration all the way to going live with user data. This speeds up API consumer onboarding and enables third parties to start developing applications with Erste’s APIs as soon as possible.

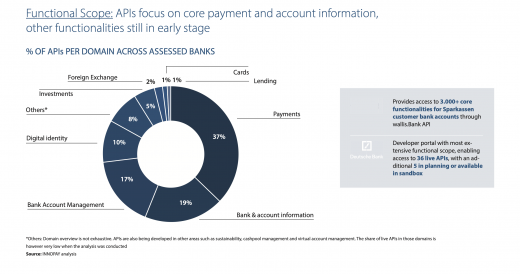

2. Functional API scope very limited overall

While we found significant improvements in the developer experience of DACH financial institutions, progress on the overall scope of API functionality has been lacking. In fact, since our previous assessment in 2019, we have observed a 34% increase in premium API functionalities (adjusted for number of banks included), but, as already mentioned, this is mainly driven by the two leading financial institutions in Germany (Deutsche Bank and Commerzbank). When looking at all the included financial institutions, still over 55% of offered API functionalities are within the space of PSD2 offerings. With the inclusion of all PSD2-regulated financial institutions in the DACH region, this percentage is even significantly higher.

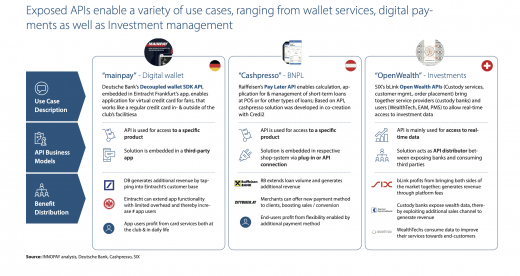

This low adoption rate of premium APIs indicates that there is still much to be done with regard to education on open banking and the benefits for financial institutions, key partners and end-customers. Despite this, we have observed several financial institutions enabling interesting use cases powered by premium APIs, some of which are highlighted below.

3. Swiss open banking needs to catch up

Overall, the level of open banking activities is still lagging compared to Germany and Austria, especially on developer experience. The reasons for this are threefold and are linked to the fact that, in contrast to the other two DACH countries, the Swiss regulator decided not to follow the European Union in adopting legislation to force banks to open up to third parties.

A) This industry-driven approach results in a very fragmented landscape, with some institutions not participating in any initiatives, others following the PSD2 implementation and some even already publishing premium APIs either via the open banking platform bLink or directly via their own API marketplaces. However, many API developer portals lack full access and guidance, which made a full assessment difficult. It also creates confusion, as some financial institutions, for example, publish information on multiple portals, leaving API consumers guessing which information they should follow.

B) One potential downside of industry-driven open banking approaches is the difficulty in establishing standardisation, which is something that we have observed in the Swiss OB market. While incumbent financial institutions follow newly developed “SFTI common API specs” focusing mainly on corporate APIs, another initiative, the ”Swiss NextGen API” is promoted especially by (Fin)tech providers and is oriented towards the most common European standard developed by the Berlin Group and including retail and small business APIs.

C) Another effect is the concentration of OB activities on the topic of Open Wealth, mainly driving the adoption of very specific user groups by connecting the chain of custody banks, portfolio management systems, external asset managers and wealthtechs. A negative side effect of this is that the development of use cases for retail or SME clients has not been prioritised until now, with the result that the regulator has announced its intention to intervene with regulatory measures in the event that OB adoption does not also increase in those areas significantly in 2023. As a result, a consortium within the financial sector has recently announced the delivery of a Multibanking proposition for retail clients by mid-2025.

Outlook for the DACH Region

Looking ahead based on the findings in the monitor as well as the overall market developments, INNOPAY sees two main trends that will drive API product developments in the coming year(s) in the DACH region.

(Instant) Payment APIs in the Spotlight

One item of note from our analysis is that of the 12 DACH developer portals that were included in the 2023 OBM, only 50% had APIs for initiating instant payments (SCT Inst). Given that only financial institutions with APIs beyond PSD2 functionality are included in the OBM, it can be reasonably assumed that the overall provisioning of instant payment APIs is even lower across DACH financial institutions as a whole. With the forthcoming EU regulation on instant payments requiring all financial institutions that offer regular credit transfers to also offer instant payments, greater reach will be enforced going forward. New and existing ‘account-to-account’ (A2A) payments use cases are expected to be powered by this instant payment infrastructure.

Embedded Finance on the Rise

Embedding financial services enables financial institutions to deliver value at the point of need. Through seamless integration, financial services and products can be made available in a broader customer journey, typically facilitated on non-financial, digital platforms. Such platforms serve sizable client segments (retail, SME, corporate) via their often vertically specialised value propositions and enable high-frequency digital interactions. This paves the way for all participants within the embedded finance value chain (i.e. balance sheet providers, technology providers, distributors and end-users) to reap the benefits.

Embedded payments and embedded lending are only the beginning of embedded services. More embedded finance propositions are emerging across financial products (accounts, cards, insurance, wealth management) at pace, leveraging API technology. Embedded finance business models will continue to challenge the status quo in financial services and become the key building block for financial service providers that wish to compete and collaborate in digital ecosystems.

To track the latest developments around use cases, the technology provider landscape and business models, INNOPAY is currently developing an Embedded Finance Radar, so stay tuned for the upcoming insights and get in touch to learn more about how INNOPAY supports financial institutions globally.