Balancing the big potential benefits and novel risks of payments in a digital world

In the rapidly evolving landscape of the digital world, one crucial element forms the backbone of our modern economy – payments. Although banks and card networks have proved remarkably resilient in the face of digital competition, the world is changing. Now, instant payments through your phone, apps, QR codes, fast payment networks and high-speed internet connections have become the gateway for many.

Organisations face several challenges when harnessing the potential of payments, including ensuring robust cybersecurity measures to protect against data breaches and fraud, navigating complex regulatory frameworks that vary across different jurisdictions, addressing interoperability issues among various payment platforms and systems, and continuously adapting to rapidly evolving technologies and customer preferences to stay competitive in the market.

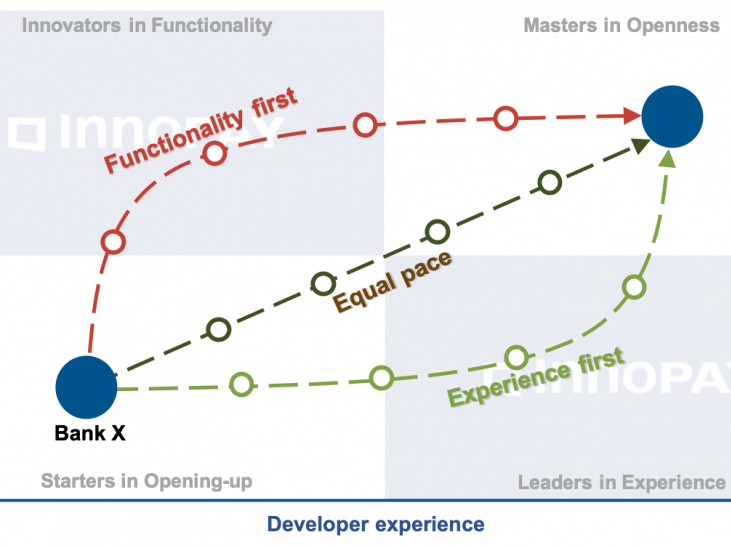

At INNOPAY, we understand the intricacies and challenges that organisations face in this rapidly evolving payments landscape. Payments is in the core of INNOPAY’s DNA and our deep industry expertise and innovative approach, empower you with tailored solutions for your specific needs.

Related content