Der Zahlungsverkehr in einer digitalen Welt: ein Spagat zwischen den immensen potenziellen Vorteilen und den neu entstehenden Risiken

Vor dem Hintergrund sich rasch entwickelnder Landschaften der digitalen Welt bildet der Zahlungsverkehr ein entscheidendes Element im Rückgrat unserer modernen Wirtschaft. Obwohl sich Banken und Kartennetze angesichts der digitalen Konkurrenz als bemerkenswert widerstandsfähig erwiesen haben, verändert sich die Welt. Heute sind Sofortzahlungen über Telefon, Apps, QR-Codes, schnelle Zahlungsnetzwerke und Hochgeschwindigkeitsinternetverbindungen für viele zum Gateway geworden.

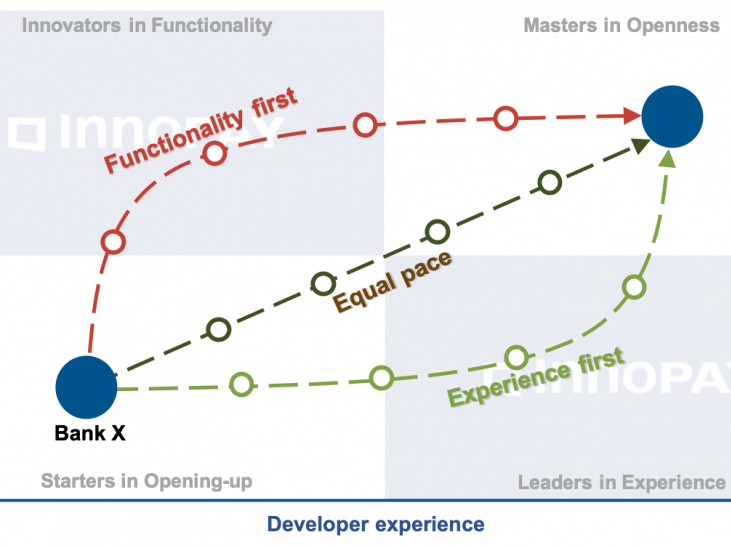

Organisationen stehen vor einer Reihe von Herausforderungen, wenn sie das Potenzial des Zahlungsverkehrs nutzen wollen: Dazu gehören robuste Cybersicherheitsmaßnahmen zum Schutz vor Datenlecks und Betrug, die Navigation durch komplexe rechtliche Rahmenbedingungen, die von Land zu Land unterschiedlich sind, die Bewältigung von Interoperabilitätsproblemen zwischen verschiedenen Zahlungsplattformen und -systemen sowie die kontinuierliche Anpassung an sich schnell entwickelnde Technologien und Kundenpräferenzen, um auf dem Markt wettbewerbsfähig zu bleiben.

Bei INNOPAY verstehen wir die Komplexität und die Herausforderungen, denen sich Unternehmen in dieser sich schnell weiterentwickelnden Zahlungslandschaft stellen müssen. Zahlungsverkehr ist fest in der DNA von INNOPAY verankert. Dank unserer tiefgreifenden Branchenkenntnis und unserem innovativen Ansatz unterstützen wir Sie mit maßgeschneiderten Lösungen für Ihre spezifischen Bedürfnisse.

Verwandter Inhalt