Helping insurers to reap the benefits of Open Insurance

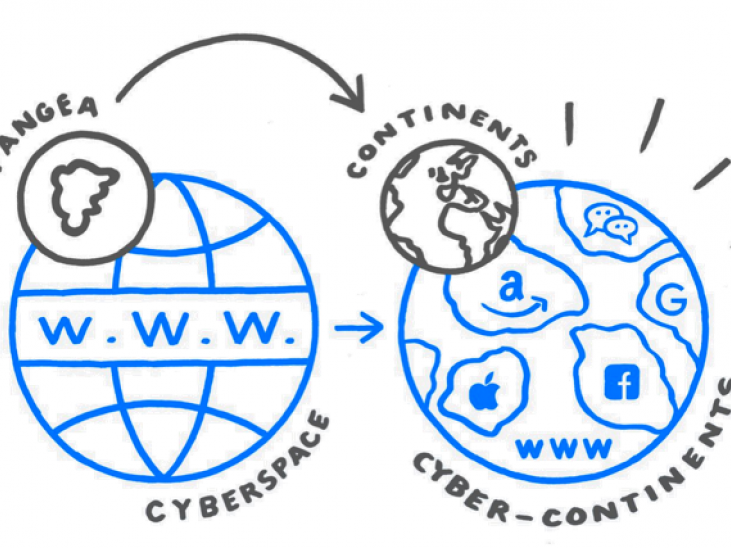

Open Insurance is part of the financial sector’s Open Finance journey. The concept of Open Insurance revolves around using API technology and data sharing to promote transparency, collaboration and innovation within the insurance industry. It is inspired by PSD2 and Open Banking, and in particular by their principles of secure access, embedded services, standardisation and collaboration. Open Insurance has the power to create a more dynamic and customer-centric insurance ecosystem. To ensure its success, however, challenges related to data security, privacy and regulatory compliance must be carefully addressed.

Drawing on a decade of experience – from the implementation of PSD2 to the ongoing Open Finance journey – INNOPAY is helping insurance industry players to reap the benefits of Open Insurance.

Related content