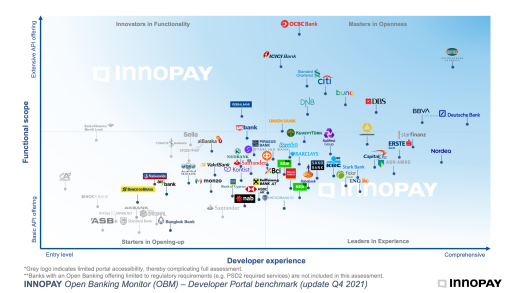

Sneak preview Open Banking Monitor update Q4’21: Banks are stepping up their game

We are thrilled to publish a new update of the INNOPAY Open Banking Monitor (OBM)! Since our previous publication many things have changed, so the time has come to update the rankings and to take a closer look at some of the key developments. This sneak preview provides a snapshot of the efforts banks have made in expanding their API product offering and in developing a more comprehensive Developer Experience. Besides various incremental improvements we see more players stepping up and providing interesting open banking product propositions. In addition, we would like to welcome the following newcomers to the OBM: BCI, Kontist Bank, MediciBank, Stark Bank, Swedbank and VakifBank!

3 key findings from the 2021 update of the Open Banking Monitor

1. APIs per bank have shown a 17% increase, showing an expansion of API product propositions.

Compared to last year’s results of the OBM, on average, banks are offering more APIs, as shown by a 17% increase in APIs offered per bank. This increase implies that the APIs offered by banks now cover a broader variety of common banking functionalities. Top of the list are still account information (for various account types) and payment initiation (for various payment instruments) & payment management (for various user-initiated actions around the payment). These are followed by Customer information APIs (enabling the controlled sharing of selected data attributes), which have increased considerably. Similarly, a variety of Corporate APIs have hit the market further driving efficiencies and improved customer experience in transaction banking operations (e.g. Trade Finance guarantees, electronic bank account management (eBAM) and realtime cash pooling capabilities).

2. Average Developer Experience increased with 11%, raising the bar to remain on par with peers

Overall Developer Experience performance score increased by 11%, mainly driven by:

-

Community Development: 22% increase of banks actively investing in community development efforts through news articles, blogs, events, or partnership programs. This indicates that banks are picking up on the importance of establishing an Open Banking Community to drive innovation, as also highlighted in our previous publication.

-

Developer Usability: 21% increase through additional, or optimised, development tools such as dynamic sandbox functionalities, detailed ‘getting started’-guides, or more comprehensive application & credential management features - providing for a better development experience by easing the life of API consumers.

-

API Documentation: 3% increase in features such as information on API business context, API versioning & changelogs, and conciseness of the API specifications -improving overall readability of the API documentation and related content.

3. Banks in the Middle East are stepping up their game

Over the past two years, multiple banks located in the Middle East have managed to secure a position in our Open Banking Monitor. AKBank, Arab Bank, IsBank, KuveytTürk, Albaraka, and now VakifBank have rapidly launched and evolved their Open Banking propositions. Especially in Turkey Open Banking is becoming an increasingly popular topic with now also an Open Banking Turkey Monitor being available with some interesting insights!

We will further explore these findings in a report scheduled for early 2022. If you want immediate access once the publication will be available, sign up via the button below.

INNOPAY’s experience and service portfolio can help financial institutions to design, launch and scale their Open Banking initiatives. If you want to know more, reach out to discuss the opportunities for your organisation.