Is “Open Insurance” the next Uber of the industry?

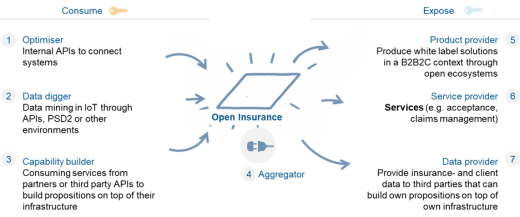

As every interaction becomes a transaction, Open Insurance or API (B2B2C) insurance is being labelled to bank in on this trend. Although that sounds amazing, the term still lacks a good definition to provide meaningful guidance for insurance companies. To get more clarity INNOPAY has defined 7 Open Insurance roles for the industry. Insurers should take notice and make a clear positioning choice to enable new revenue and business models whilst ensuring continued relevance and growth.

Uber model for insurance? Not so fast

Insurers know how Florida residents are feeling. The pressure the industry is facing seems to keep coming like an unending stream of hurricanes: continuous digitalisation of processes, the rise of online aggregators, rising customer expectations (millennials & Gen Z), a continuous focus on new regulation and compliance, low interest environments, modest to low economic growth and disruption of the value chain by InsurTechs.

In this environment change is hard, and the statement is often made that it is only a matter of time before a new Uber like player will disrupt the industry. Of course, this comparison does not hold. Not in the least because of the low consumer interest in these products but also because in a networked model there is not an increasing need to transfer risk and thus grow the core insurance market. Whereas an increasing use of for example AirBnB by both hosts and customers leads to network effects of new hosts and new customers.

But then what? 7 Open Insurance roles to structure the world

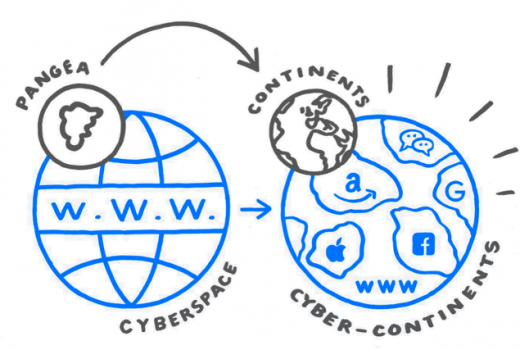

That said, platforms are rising and eating the world. And InsurTechs are developing new propositions which are replacing parts of the traditional value chains of insurance companies. To stay relevant and bank in on the position of networked platform players insurers need to open up. Openness is about getting access to increasing and vast amounts of structured data in many-to-many situations to enable new open ecosystem propositions. Basically, this is nothing new as there are numerous examples of industry or commercial initiatives which are driving this trend. Think about sharing fraud detection signals via shared databases or commercial parties. But the trend towards openness is becoming more and more important as digital transactions are growing exponentially [1].

This trend towards openness by the industry is often labelled as “Open Insurance” which is a term rising because of the Open Banking trend. But whereas Open Banking seems to be a (somewhat) settled definition this is still not the case with Open Insurance. Initiatives like the Open Cologne [2] or the Open Insurance Initiative Network (OPIN) [3] work towards API standardisation for (consumer) data sharing in combination with consent. To get more clarity INNOPAY has defined 7 Open Insurance roles for insurance companies.

- Optimizer: Insurers are often very siloed organizations. To enable cross-product and cross-channel offerings, insurers are working on data standardisation, governance and stewardship in combination with internal APIs to facilitate meaningful data sharing.

Example: an internal optimisation we have seen at one Dutch insurance company using an API interface to couple their policy administration systems, client request database, and payment software in order to increase the operational excellence, decrease throughput times and handling time per request, driving down operational costs while increasing customer satisfaction.

- Data digger: One of the most promising trends for insurance companies is the exponential growth of structured data which can be consumed and used with customer consent. This data can be used to enrich product or service offerings, more targeted customer propositions or better risk management.

Example: PSD2 is of course a huge opportunity for insurers [4] but also social, IoT [5] or other platform sources can be very relevant. Using external and personal customer data enables insurers to increase the accuracy of actuary risk models. One step further, using real-time customer data (e.g. connected car) input enables insurers to provide insurance with dynamic risk models – and pricing. This enables insurers to attract target groups with a more diversified or personalised product portfolio.

- Capability builder: Building upon available services through API’s increases insurance capabilities, enriching the services for customers. Insurers can, for instance, improve their selling process by using one or more third party services for customer plans.

Example: Access the customer Gmail API to get email information about planned trips based on airline or hotel booking confirmations. Based on this information the experience around travel insurance can be enhanced.

- Aggregators or schemes: Develop a platform where many-to-many API connections are facilitated by offering standardized connections. In a landscape with many different API developers, providers, platforms and insurers -each dependent on an until now non-standardised API landscape- the party that is able to aggregate API’s and becomes the standard go-to marketplace for data and services, is in the leading position to learn from data capabilities and monetise the aggregator model once it has become the industry standard.

Example: Price aggregators have already become very common but other aggregators or schemes could take off when new structured data sources become accessible.

- Product provider Insurers that can develop relevant and user-friendly API’s can decrease their dependence on brand value. Using API’s, insurers can provide white label products in a B2B2C model in an open ecosystem. This, just like insurers that can provide (partial) services, means increased revenue when other insurers or commercial parties offer their network of customers your insurance products, be it white-label or not. Insurers mastering this process can increase conversion without marketing, sales because of integration into processes previously hardly accessible, and increase scale of their insurance portfolio.

Example: Lemonade and Simplesurance are offering API’s to 3rd parties to integrate their products in their customer journeys.

- Service provider Insurers able to leverage on their core capabilities by providing services or partial services through API’s, (e.g. claim handling, fraud reduction, policy acceptance), can increase the revenue by exposing core capabilities, or by ways of becoming a shared service centre. This is especially attractive for insurers where operational scale is of utmost importance to remain profitable.

Example: insurers can monetize on their fraud detection algorithms and expose them to 3rd parties.

- Data provider Insurers that leverage their existing customer relations and build on the trust that customers have in the company can increase customer relevance or increase monetisation models through exposing insurance and client data– with consent - to third parties so these third parties can build or improve services upon this data.

Example: insurers have insight in customers, with which they can expose and monetise their accurate customer persona, policy details, claims data to other commercial parties where customers have (potential) business.

So, how to bank in on openness?

There are several questions coming into play for insurers when considering becoming a trusted player in open ecosystems.

- How can openness increase relevance to our customers?

- How does openness impact our strategy and business model?

- Which open insurance roles are suitable to execute on?

- Which data and capabilities do we need to leverage internally?

- How do we structure and monetize our API’s to new and often unknown ecosystem players?

- How can we partner with the InsurTech scene?

- What can we learn from banks and other parties connecting to their ecosystems and building new open business models?

- How can we attract the right talent to deliver on these new opportunities?

Before insurance companies move forward and invest in programs to become the next Uber, they have to ask these questions. Providing clear answers will help them navigating the challenges ahead and make sure their investments are worthwhile. Want to discuss, please reach out to Maarten Bakker (maarten.bakker@innopay.com) or Vincent de Rijke (Vincent.de.rijke@innopay.com).

---

[1] https://www.everythingtransaction.com/

[2] http://deliverythinking.com/open-cologne-the-first-open-insurance-initiative/

[4] https://www.innopay.com/en/publications/insurance-and-open-banking-wave-seven-use-cases

[5] https://www.innopay.com/blog/how-openness-will-change-insurers-pricing-strategies/