PSD2 and Open Banking Use Cases for Insurers in an Open Data Economy

Legal drivers such as GDPR and PSD2 in Europe and CDR in Australia are enabling the customer with more ownership and control over its own data. As a result, the customer is increasingly empowered to more easily provide consent-based access to his/her data by a service provider of choice. This trend is accelerating across countries, industries, and market actors and as such we are moving towards an Open Data economy. In this emerging landscape, data is shared between organisations under control of the rightful owner(s) and used by third parties to improve or develop new business models and service concepts. This increased availability of data in new ways brings insurers new opportunities to build or improve risk models and develop new products and services. As an initial step, insurers can already start capitalising on the Open Data economy by exploring useful use cases that will become available under PSD2 (XS2A) and Open Banking.

Access to account (XS2A) under PSD2 provides opportunities to insurers

One major development contributing to concrete customer ownership and control over data is visible in the European financial sector, where PSD2 enables customers to allow a third-party access to their payment account (XS2A). Based on a customer’s consent, the third party can retrieve account information from a customers’ payment account (covering balances and transaction history) or initiate payments from a customer’s payment account.

Open Banking enables additional possibilities for insurers

A visible trend in the emerging PSD2 ecosystem is banks opening up data and functionality beyond XS2A, such as information on other account types, customer’s identity data and aggregated and anonymised information on their customer base. The INNOPAY Open Banking Monitor provides a comprehensive overview of the masters in openness that move beyond mere regulatory compliance. Again, here, all access to these data and resources is based on a customer’s consent.

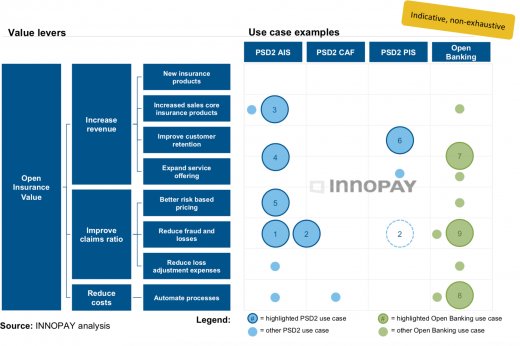

The data and functionality that become available - as a result of the trend towards openness in banking - enable beneficial use cases for insurers, across their traditional value chain and beyond. Potential use cases are summarised in figure 1.

In the section below a selected set of nine use cases are explained in further detail.

Examples of use cases for insurers based on data and functionality in the scope of PSD2 XS2A

Some selected use cases based on functionality available under PSD2 XS2A are:

- IBAN-name check: an IBAN-name check helps to reduce fraud with improved potential of checking accountholder authenticity, and reduces the number of corrective money transfers needed due to incorrectly registered IBAN;

- Improved debit collection process: Account balance checks before initiating payment (direct debit) requests, reduce bounced requests. Furthermore, through payment initiation, the insurer has the opportunity to provide personalised reminders to pay, decreasing the costs of debtor management;

- Improved acceptance process: As account data enables next-level risk-profiling, it can prove to be of assistance in a faster and improved, or even automated, acceptance of customers;

- Personalised financial advice: Account data enables in-depth insights in spending patterns and a customer’s financial position that can be used to provide personalised financial advice;

- Personalised or dynamic premium quotes: Risk-profiling based on account data enables strategies and tools for personalised premium quotes;

- Additional payment methods: Offering an alternative to traditional direct debits for premium payments and (ad-hoc) payments for services, as some insurers are transitioning from being a mere insurer towards a service provider that foresees in the customer’s needs at the point of relevance.

Examples of use cases for insurers based on Open Banking data and functionality

More functionalities and customer data become available as banks venture into the Open Banking play. Three highlighted use cases (based on data and functionality that are currently opened up by a subset of banks) that can bring specific value to insurers are described below:

- Improved personal financial management services: Insurance companies offering personal financial management applications can include a function to retrieve all accounts (e.g. accounts related to savings, credit cards, mortgage, pension, investments) at once;

- Retrieve up-to-date user address: Since customers are usually more inclined to update their address in a timely fashion at their bank, insurers can facilitate the customer by checking the last known address at the bank;

- Verify customer ID: Insurers can raise barriers to cases of identity fraud by including banks’ API identification functionalities in the insurance onboarding process.

Key success factors in exploring new business models for PSD2 and Open Banking

The data and functionality that will become available provide a wide array of opportunities for insurers. While insurers are well-positioned to act on these opportunities, there are some key success factors to consider.

First, insurers need to enable secure and cost-effective API connectivity with banks. It is key to select the right service provider that can offer this connectivity ‘as a service’ in order to contribute to your requirements and strategic objective.

Second, insurers should think about a clear and transparent consent strategy. Customers must be fully aware of the data they are sharing and the purpose for which it is being used. Safeguarding the data benefit balance is of utmost importance to persuade customers to share their data.

Third, once the necessary data is retrieved with the consent of the customer, it needs to be ‘crunched’. There is a need for solid data analytics capabilities to mould the data into customised and personalised (financial) advice for customers.

Sharing data is a new phenomenon and the opportunities present new fuel to establish relevance and possibilities for differentiation. Insurers that put in place a solid strategy for an Open Data economy will be in a good position to seize the opportunities brought forward by PSD2, Open Banking and the Open Data economy at large.