The Instant Payments Regulation: Key initiatives and changes

The Instant Payments Regulation (IPR), which entered into force on 8 April 2024, will have consequences for all payment service providers offering SEPA payments, both inside and outside of the Eurozone. In this blog, INNOPAY’s Linda Geux, Martine Nau and Tim Gillieron highlight six key areas affected by the IPR. The authors explore the broader implications of IPR to help market participants navigate the new requirements.

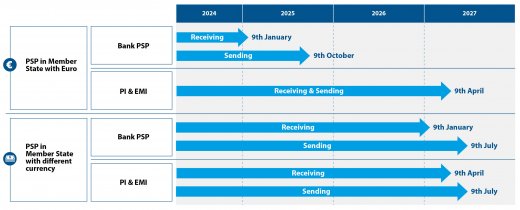

Now that the IPR has officially entered into force (on 8 April 2024), instant payments – sending and receiving payments around the clock (24/7/365), with funds available for use on the payee’s bank account within maximum 10 seconds – will officially become a regulatory requirement for all payment service providers (PSPs) offering SEPA credit transfer payments. PSPs located in the Eurozone will be required to offer the receiving of instant payments (IPs) as of 9 January 2025, and the sending of IPs as of 9 October 2025. PSPs in Member States outside the Eurozone will need to offer the sending and receiving of IPs by 9 July 2027 at the latest.

6 key areas

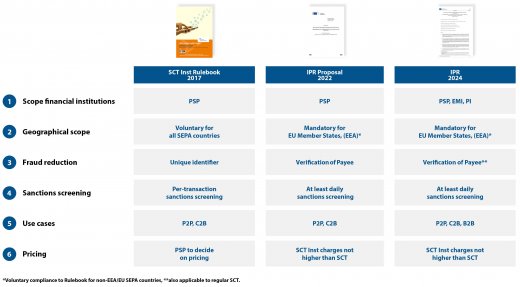

So what have been the key areas affected by the IPR since the publication of the voluntary Instant SEPA Credit Transfer (SCT Inst) rulebook in 2017? And what will be the implications of the IPR for market participants? Figure 1 summarises the six key areas affected by IPR:

1. Expanded scope of financial institutions regulated by IPR

In the 2022 draft regulation, receiving and sending SCT Inst only applied to bank PSPs (credit institutions). With the final IPR, this scope has been broadened to include non-bank PSPs like payment institutions (PIs), including issuers and acquirers, and electronic money institutions (EMIs)*.

To establish a level playing field, PIs and EMIs will have the option to gain direct access to payment systems for clearing and settlement and to safeguard funds directly at the central bank.

This will enable PIs and EMIs to leverage IP infrastructures, compete with traditional banks and participate in accelerating the uptake of instant payments through their own innovative offerings. As these institutions have only recently been added to the IPR, they are granted an extended timeline (see Figure 2).

2. Availability of instant payments becomes mandatory across the EU

With the IPR, the European Commission (EC) moves availability of instant payments from voluntary to mandatory for all domestic and cross-border euro transactions across the EU. Moreover, it introduces the same approach, whether the Member State has the euro as currency or not. The rules as set out in the IPR are expected to be adopted in all European Economic Area (EEA) countries as part of the EEA agreement, in line with the objective to create a single European internal market with free movement of capital. Inclusion in the SEPA equivalence requirements for other SEPA countries seems likely in the future. PSPs in a non-euro-zone Member State are granted more time to comply (see Figure 2).

This will make cross-border transactions involving the euro more seamless, more efficient and a more attractive payment option to customers by reducing transaction times and costs across borders.

3. Fraud reduction requirements including Verification of Payee

The initial IPR proposal defined the mandated Verification of Payee (VoP), to match the beneficiary’s IBAN and name before initiating a transaction (also known as IBAN-name check). This not only stays intact, but the IPR also requires the VoP requirement to apply to regular SEPA credit transfers (SCTs) as well. Additionally, VoP opt-out options for payment service users (PSUs) are significantly reduced to one use case: a PSU that is not a consumer submitting multiple payment orders as a package. The draft PSR will also require implementation of VoP for non-euro transactions in Member States. On top of that, the IPR enables PSUs to define maximum amount thresholds – both per transaction and per day – for SCT Inst transactions.

All the above measures are aimed at reducing fraud in authorised push payments (i.e. APP fraud). To elaborate, Surepay, provider of an IBAN-name check solution and market leader in the Netherlands, has seen a decrease in fraudulent transactions of 81% since the introduction of the service in 2017. The above measures also aim to increase consumer trust

In a previous blog we discussed possible future scenarios in which the VoP market can evolve. The European Payment Council (EPC) is currently developing a VoP rulebook demanding certain standards to ensure interoperability among various VoP solutions.

4. Sanctions screening procedures are adjusted to match the nature of IP

EU figures show that up to 10% of all transactions get rejected, of which 99.8% are because of false hits. The <10 seconds processing time stipulated in the IPR will not allow PSPs to conduct decent sanctions screening. Therefore, to prevent an increase in rejected transactions due to false hits in sanctions screening, the EC has moved away from the ‘per transaction’ screening requirement for SCT Inst transactions. Instead, the IPR imposes a periodical (at least daily) screening, and an obliged screening when new targeted financial restrictive measures come into place. This reduces the implementation burden and reduces operational costs for PSPs. By preventing an increase in rejected transactions due to false hits, the IPR also mitigates the negative impact on customer experience.

To ensure that the periodical screening results in effective sanctions screening, PSPs will need to submit an annual report. Based on this, the European Banking Authority (EBA) and Commission will review the impact, leading to a report on the effectiveness and, if relevant, a legislative proposal.

5. Focus on business-to-business use cases

The IPR demands the implementation of SCT Inst capabilities across all channels that currently also facilitate regular SCTs, including bulk payments. This means that the IPR is expanding its focus beyond obvious peer-to-peer (P2P) and customer-to-business (C2B) use cases, like sending a payment request to a friend or paying a bill as a customer. PSPs will only need to provide SCT Inst services if they offer a similar service for regular SCTs.

Bulk payments, often sent by corporates via file-based transfers, can now be settled instantly without additional costs. PSPs must accept these batches, unpack them and convert them into a single IP. While this offers a chance to increase volume on IP rails, it may also require PSPs to modify corporate customer interfaces and increase their processing capabilities, impacting today’s pricing structures for bulk payments.

6. Pricing

The IPR requires financial institutions to ensure that the fees they apply for SCT Inst transactions do not exceed any fees for corresponding regular SCT transactions. This has an impact on current business models of PSPs. On the one hand, PSPs are no longer allowed to offer IP as a premium service to their customers, making it challenging for PSPs to earn back investments regarding IP. In some markets, such as Germany, surcharges for IP are currently a common practice. On the other hand, the IPR enables PSPs to realise new additional services for which extra fees set by PSPs are allowed.

Conclusion

The IPR will have profound impact on the payments landscape due to its increased scope along the geographical, institutional and use case axes. The rules set out in this regulation around fees, fraud prevention and sanctions screening present compliance obligations and implementation and business-related challenges for PSPs. Moreover, the upside of some requirements – such as the necessity of having bulk payments converted into a single IP – may not always be clear. On the other hand, the IPR creates opportunities for PSPs, including in the shape of new services to be developed and potential new revenue streams to be opened up.

*From this point in the blog, EMIs and PIs are included when referring to a PSP unless explicitly referred to as EMIs and/or PIs