Innopay's TPP RADAR: Europe gearing up to use access to accounts under PSD2

PSD2 is the revised European directive for payment services, with the supporting Regulatory Technical Standards entering into force on 14 September 2019. PSD2 Access to Accounts (XS2A) introduces two new regulated payment services providers: Payment Initiation Services Providers (PISP) and Account Information Services Providers (AISP). Together these are referred to as Third Party Providers (TPPs). The new roles create possibilities for innovation in the European market by enabling market players, with or without a payments background, to create innovative products and services based on the access to a customer’s payment account.

All EU Member States have finalised the transposition of PSD2 into national law and are ready to issue TPP licences, and most Member States have already done so. With the TPP Radar, INNOPAY provides insights into the current state of play, by providing an overview of licenced TPPs per country, detailing their background, customer focus, and service offering enabled by their licence.

Key findings of INNOPAY’s TPP Radar:

- mainland EU is catching up with frontrunner UK on the number of issued licences: the UK alone now makes up for a total of 51% of issued licences, but EU member states are catching up;

- limited number of licences issued to non-financial services players: activity from parties with a non-financial services background that obtain a TPP licence is visible, but limited to roughly 10% of the total number of licenced TPPs;

- market corrects lack of standardisation in PSD2 XS2A through efficient connectivity services: 28% of B2B focused TPPs offer white label PIS/AIS services, reducing impact, complexity, and costs of connecting to different bank APIs;

- B2C services enabled by PSD2 evolve in line with market expectations: 40% of B2C services focus on enabling increased control over personal finances.

Number and type of TPP licence issued per EU member state

The UK is currently the frontrunner in the TPP landscape. Although mainland Europe is catching up, there is still considerable ground to gain. The UK alone has issued a total of 88 licences, versus 83 in mainland Europe. Sweden and Germany follow the UK at a distance, with 16 and 14 licences issued. Figure 1 provides an overview of the number and type of TPP licence per EU member state.

Background of TPPs

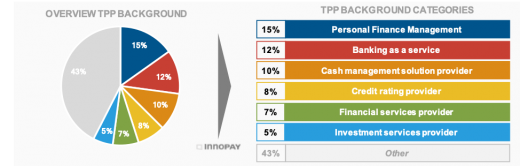

The majority of current licenced TPPs has a background related to financial services. These backgrounds include Personal Finance Management solutions, PSPs, card issuers, credit (rating) providers, and cash management solutions.

Several non-traditional payment players have obtained a TPP licence. Such parties include a telco, loyalty program providers, a grocery store chain, a (retail-) product marketplace, and others. Their numbers, however, are limited to roughly 9% of the total number of TPPs.

There has been market-wide speculation regarding the threat of bigtechs entering the payments market as a result of PSD2 XS2A. Currently, Google is the only bigtech that has obtained a TPP licence (i.e. AIS and PIS licence in Lithuania).

Figure 2 provides an overview of the top-6 categories of TPP backgrounds.

TPP customer segment focus and related service offerings

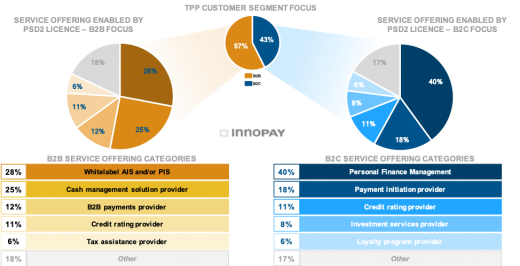

Only few TPPs have used their PSD2 licence to enable a service offering that lies outside the scope of financial services, yet. With EU-wide issuing of licences in its infancy, and parties outside the financial sector being educated more and more on the opportunities PSD2 XS2A could bring to them, this is expected to change. The customer segment focus of TPPs is currently skewed towards the B2B sector (57% B2B versus 43% B2C).

The largest category of B2B TPP service offerings shows the TPP market addressing the absence of API standardisation, with 28% of TPPs offering bank API connectivity as a service with their white label PIS/AIS services. The offerings of these parties differ, as some focus on mere technical connectivity, while others on value added services such as transaction categorisation, peer benchmarking, or credit scoring.

The largest B2C service offering (Personal Finance Management, 40%) and second largest B2B service offering (cash management solution provider, 25%) lie at the heart of the market’s expectations regarding PSD2 use cases, as they revolve around (real-time) insights and actionable applications based on transaction data. Again, here, the service offerings differ in the scope of value added.

The overview of top-5 TPP service offerings enabled by PSD2 licences per customer segment focus is visualised in figure 3.

Reap the full potential of PSD2 XS2A in your sector

More and more, the opportunities of PSD2 are being recognised outside the financial sector.

INNOPAY has extensive cross-sectoral experience in enabling organisations to reap the full potential of PSD2 XS2A, with its consulting services ranging from defining your strategic PSD2 XS2A-positioning, to identifying actionable PSD2 XS2A opportunities, and obtaining a TPP licence.

Reach out to us for insights into the full range of TPP backgrounds, TPP service offerings, or if you are interested to find out what opportunities PSD2 XS2A can bring to your organisation.