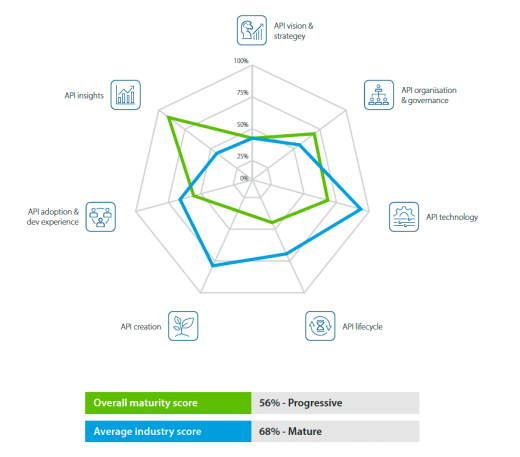

INNOPAY’s 7 key dimensions of mastering Open Finance maturity

Open Finance is growing rapidly as financial institutions continuously launch new APIs and improved developer portals to extend third-party access to financial products, services and customer data. However, there is more to Open Finance than that. INNOPAY has developed a comprehensive model covering seven key dimensions to help financial institutions assess their Open Finance maturity, and therefore their readiness to unlock new business opportunities, maximise revenue streams and lay the foundations for meeting upcoming compliance obligations.

Over the past few years, leading financial institutions (FIs) have continuously extended their Open Finance offering by providing third parties access to financial products, services and customer data using application programming interfaces (APIs). This started in the form of Open Banking and focused mainly on compliance with the EU’s revised payment services directive (PSD2) for payment initiation and account information services. While some FIs chose to merely comply with PSD2, others recognised the opportunity to unlock additional value for their customers and create new revenue streams for themselves by providing access to financial products/services other than payments, i.e. Open Finance. These FIs are now publishing rich APIs that support a superior developer experience for Open Finance applications. We expect this development to further accelerate in the future, given the European Commission’s proposal for a regulation on a framework for financial data access (FIDA)

Although developer portals and APIs are the result of months of complex planning, testing and technological upgrades, there is more to Open Finance than just API functionality and the developer experience. INNOPAY has developed a comprehensive model to help FIs assess their Open Finance maturity in seven key dimensions (Figure 1). The model can be used to develop a baseline understanding of the strengths and weaknesses in the FI’s capabilities. Additionally, it gives insight into the FI’s preparedness to unlock new revenue streams with Open Finance-related APIs and to meet forthcoming compliance obligations such as FIDA.

Dimension 1 – vision & strategy: First and foremost, FIs need to get their strategy right. This entails not only developing a clear vision on Open Finance and its role in meeting strategic objectives and compliance obligations, but also identifying how to move beyond compliance to drive new product development, customer experience enablement, process efficiency and revenue generation. The role of APIs in sharing and consuming financial data should also be clearly defined. Ultimately, these aspects need to be aligned with the organisation’s overall strategy and contribute to achieving the overarching objectives.

Dimension 2 – organisation & governance: The vision subsequently needs to be embedded throughout the organisation by defining policies, processes and procedures that govern the Open Finance propositions. This entails the creation of dedicated roles, leadership structures, decision-making processes and resource allocation to ensure objectives are met effectively and risks are managed accordingly. The governance model should undergo frequent review to maintain continued alignment.

Dimension 3 – API technology: Strong underlying technological and administrative capabilities are crucial for adopting and executing the defined Open Finance strategy, in terms of both guaranteeing the essential adherence to security standards and exposing APIs in a standardised manner to remove potential friction for developers. For large enterprises, this dimension also includes adherence to the MACH paradigm (Microservices-based, API-first, Cloud-native and Headless). MACH architecture aims to increase organisational agility and flexibility by removing complexity when adding, replacing or removing structural components, tools and/or functionalities. This is often a pain point for many FIs.

Dimension 4 –API lifecycle: Open Finance propositions require structured and recurring processes to manage their lifecycle at scale. This means clearly differentiating between propositions focused on sharing financial data and those consuming financial data. Moreover, APIs supporting said propositions should be treated as digital building blocks rather than technical by-products. While there is no one-size-fits-all approach, most organisations should outline appropriate inception, validation, creation, operation and retirement processes. Progress through the processes should be monitored and documented, with relevant stakeholders being given access to the documentation.

Dimension 5 – API creation: Well-designed APIs consider both technical and functional qualities. This means both the overall API catalogue and individual APIs need to portray certain qualitative characteristics to be successful enablers for Open Finance propositions. An API-first approach ensures that APIs are viewed as distinct products. Consequently, APIs form the starting point in the development of new propositions focused on meeting the identified needs of the customers in question. FIs should use common design practices as well as relevant non-functional requirements (NFRs) to shield developers from underlying complexities. For example, the REST architecture style is used by 99% of the banks assessed in INNOPAY’s Open Banking Monitor, while less than 1% support GraphQL and/or SOAP.

Dimension 6 – API adoption & developer experience: APIs mostly target developers and innovators outside the FI. The resulting communities and partnership ecosystems need to be catered for and actively engaged with. Moreover, adoption often hinges on smooth onboarding processes and developer usability. Many FIs still underestimate the importance of high-quality documentation (e.g. getting-started guides, specs for each API) and a sandbox. [LR3]

Dimension 7 – API insights: The effective operation of an API-driven organisation requires insights into API usage. This means creating a feedback loop of KPIs which measure the success of the overall API portfolio based on metrics around uptake, performance, security, UX and/or monetisation. Besides monitoring and updating the metrics, the FI should use the insights to predict future performance and guide future API decision-making about improvements and innovations.

Based on these seven dimensions, FIs can assess their Open Finance maturity, and therefore their readiness to unlock new business opportunities, maximise revenue streams and lay the foundations for meeting upcoming compliance obligations.

This article was originally published in The Paypers.