A sneak preview of the INNOPAY Open Banking Monitor Q1 2023: The old guard are embracing new opportunities

A whole year has passed since our previous update of the INNOPAY Open Banking Monitor, which means it is high time to take a new look at where the industry stands. This year’s update will cover the status quo of Open Banking globally, highlighting what steps banks have taken, which general trends can be identified, and whether these have resulted in new and innovative features and best practices. In turn, this will provide insight into the current frontrunners, the newcomers and the very latest API capabilities in a continuously evolving landscape.

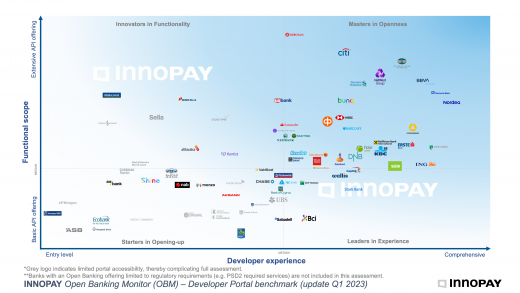

In the following section, we highlight three key findings that have been observed since the last Open Banking Monitor (OBM) update. A visual representation of the latest Open Banking Monitor can be seen in Figure 1.

1. Community Development is driving differentiation in DevEx as Open Banking continues to evolve

European banks continue to dominate in Developer Experience (DevEx). In the latest Open Banking Monitor (see Figure 1), the upper right quadrant contains two major Dutch banks (ABN AMRO and ING Group), two large German players (Deutsche Bank and Commerzbank) and numerous other European banks (including Nordea, BBVA, the National Bank of Greece, Raiffeisen Bank International, Erste Bank and SEB). A common driver behind this differentiation can be found in the extensive Community Development efforts across these banks.

Community Development is defined as a way for banks to inform and actively engage their communities of users. Besides strengthening the bank’s position within the landscape, setting up, maintaining and growing a community around a bank’s developer portal also incentivises users to drive innovation, leading to a greater variety of functionalities in a reduced timespan. This can be achieved by actively collaborating with the community by, for example, creating direct interaction channels with a respective bank, enabling users to suggest new API features or functionalities, or organising events and hackathons. The importance of Community Development is discussed in one of our previous publications.

Consequently, to a large extent, Community Development is a way to differentiate and drive adoption in an increasingly competitive European market. Similarly, there is significant room for improvement in the Developer Usability of most non-European banks’ developer portals. In contrast to the developer portals provided by EU banks, the vast majority of them remain unintuitive to navigate and difficult to use, requiring developers to spend significant time browsing through the portals. The latest ranking on DevEx capabilities is visualised in Figure 2.

2. Payment APIs on the rise, while Account APIs remain stable but significant

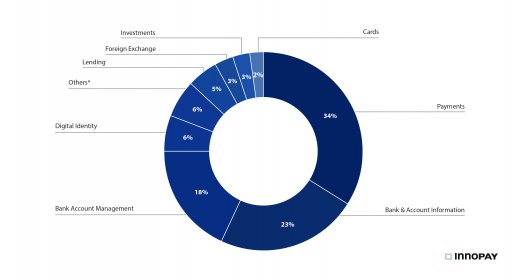

Payment APIs continue to increase in number as well as in scope, now accounting for 34% of all observed API functionalities. This can be explained by the rise of more localised as well as specialised Payment APIs, such as Cross-border Payments, Instant Payments, BNPL, Recurring Payments/Standing Orders, Scheduled Payments, Request-to-pay, and Batch/Bulk Payments. In particular, the number of Instant Payment APIs is expected to continue to increase due to the current instant payment regulatory developments in Europe, which are being driven by regulators in the EU as part of their payment sovereignty agenda. Similarly, the US Federal Reserve will be launching its ‘FedNow’ instant payment service in July 2023, having begun the process of formally certifying banks to implement instant payments in April 2023. Moreover, countries such as Brazil and India have already adopted instant payments, in the shape of PIX and UPI respectively. As trends like these continue to spread around the globe, new use cases will continue to appear, with payment innovations built on top of these real-time rails.

There continues to be a significant number of APIs related to Bank & Account Information. They account for 23% of all observed API functionalities and remain stable in terms of scope. APIs in this category are still focused on Transaction History, Account Balance, List of User Accounts and Branch/ATM locations. Unsurprisingly, functionalities once introduced by regulation (i.e. PSD2), such as Account Information APIs, make up the lion’s share of functionalities offered by banks. These functionalities are now increasingly being offered by banks outside of Europe. Unlike in Europe, however, the adoption of these APIs is not driven by regulation but rather by the industry itself in some markets, due to the value they can create for end-users, security enhancements and banks’ revenue streams. Figure 3 provides a breakdown of the most relevant API functionalities.

3. EU Open Banking is still leading but US Open Banking is catching up

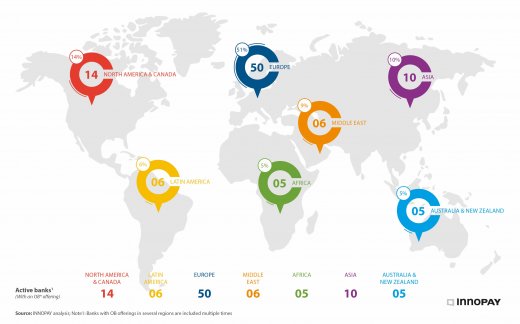

Whereas US banks were previously lagging behind, there have been significant developments in the US Open Banking space over the past year. While Europe still represents the lion’s share of available APIs, with 14% North American banks now make up the second-biggest geographic share in the OBM (as depicted in Figure 4). Moreover, as can be concluded from Figure 1, the quality of US developer portals has improved significantly, with Citi Bank positioning itself among the Masters in Openness. Additionally, US Bank and Wells Fargo can be highlighted due to their improved performance in this year’s update. Both banks significantly expanded their API catalogue, with US Bank now being among the frontrunners in Functional Scope. Other noteworthy mentions are Cross-River Bank as well as Capital One, with their above-average performance on Functional Scope and Developer Experience, respectively. Lastly, banking giants such as Goldman Sachs, JPMorgan and Chase (separate portals despite being one entity) are slowly revealing their Open Banking offerings. However, they remain limited in accessibility, which makes it difficult to fully assess some US banks.

One key differentiator for US banks is the extensive offering of Investment and Foreign Exchange APIs. These APIs allow end-users to directly access relevant data and insights into different investment vehicles such as stocks, bonds, exchange rates and currency pairs offered by the banks. Additionally, some of these APIs also enable the trading of such assets at the current time or at a predetermined later date. Considering that US Open Banking developments are industry-driven rather than regulatory-driven, US financial institutions are exploring proactive, offensive Open Banking strategies to offer APIs that can unlock new value streams.

INNOPAY’s portfolio of services and experience can help financial institutions to design, launch and scale up their Open Banking initiatives. If you want to know more, reach out to discuss the opportunities for your organisation.