Insurance and the Open Banking wave: seven use cases

Every single day, more than a billion active users share their thoughts, photos, news, videos, memes, and more with friends and connections on Facebook. With data from current accounts, bankers know what their customers eat, where they buy their clothes and what they get up to online. In today and tomorrow’s world (personal) data is becoming increasingly available and easily shared due to the digitalization of our day to day interactions. New connectivity technology (e.g. APIs) enables consumers and businesses to share more and more data with different parties who again monetize on this data. This frequent and relevant interaction from businesses with their customers forms the basis of new business models in new ecosystems.

To respond to this trend, banks are opening up and create new opportunities for other parties. These new transactional ecosystems focus on gathering data and offer new products and services around these transactions. The payment (functionality) as such becomes less relevant. Insurance companies can capture the new value when they become key actors in this new ecosystem. It is a great opportunity to reshape the current often incidental customer interactions to a more interactive and thus more relevant relationship.

So far, there is no indication that insurance companies are seriously working on the concept of openness. They are at best in an exploratory phase on a new wave of Open Banking data and functionalities. As a consequence, they are falling behind.

The time is now for insurance companies to move on PSD2 and Open Banking

With the new and much talked about revised European Payment Services Directive (PSD2), regulators aim to boost competition, protect customers and encourage innovation in the digital transactions space. PSD2 is currently in the process of becoming official regulation in member states and introduces various changes. Third party ‘access to account’ (XS2A) is anticipated most by third party providers (TPP). And even though the anticipated ecosystem revolution promised by PSD2 evangelists is not in sight yet [1], PSD2 has sparked thinking and implementation on ‘Open Banking’ to better serve evolving needs of distinct customer segments beyond the regulatory scope.

The first serious steps are taken, and the spark of Open Banking has definitely ignited given the fact that almost all banks are working on exposing additional functionality through their API developer portals [2]. Also, inspired parties are acting on their own and create new interaction modes where customers have access to their account information through a 3rd party app. A good example is the recent announcement by ASN bank, Regiobank and SNS bank where customers can see their account information of all banks through either one of the bank’s apps [3].

Given the current state of the move to openness by banks, this is the moment for insurance companies to start seizing the opportunities of openness. They should not wait until regulation has crystallized around the current challenges and risk being outcompeted by players who do act.

How could it look like: use cases for insurance companies

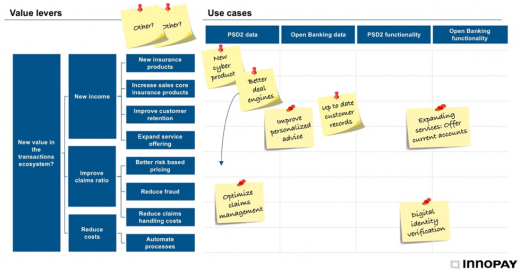

INNOPAY has defined a first set of use cases for insurance companies. The use cases have been mapped on the most important value levers for insurance to capture relevancy and see where exactly the use cases drive value. The mapping is presented in figure 1 and a first description of the cases is given below.

- New (cyber)insurance product for a new client segment: insure TPPs in PSD2 landscape: data sharing through third parties implies new (cyber) risks and thus accountability in case of data breaches. For PSD2 specifically, to be authorized or registered under PSD2, PISPs and AISPs (TPPs) respectively need a professional indemnity insurance or a comparable guarantee. This is mainly needed to cover liability to account servicing payment service providers (e.g. banks). [4] The first specialists are already entering this market space, like Protean Risk which is underwritten by Lloyd’s of London. [5]

- Better deal engines: PSD2 provides third parties access to payment account information data (AIS). This data can be mined and relevant insights on customer behaviour can be extracted. This behaviour can then be for example spending on insurance to see if a better offer can be made to the customer or looking for patterns which can imply a better risk profile and thus better pricing on insurance products for the customer.

- Improve personalised advice: next to mining, the data can be used to improve personalized advice. Although TPPs are by law only allowed to present the account information of customers, insurance companies can use that information to give advice about their financial situation.

- Optimise claims management: together with other data sources, account information that is shared by customers’ banks can be used to create new data sets that could be used to improve reconciliation and reimburse the right amount to customers and gain better insights on possible fraud (by looking at for example customer spending patterns).

- Up to date customer records: although there is no Open Banking standard yet and all banks are developing their own view and strategy on opening up data beyond PSD2 compliance, there are already good examples insurance companies can build upon. For example, banks often have accurate verified address information of their customers. When insurance companies have access to this data, the quality of their customer data records will increase. This will improve conversion ratios when reaching out to customers while at the same time provide a better customer experience.

- Expanding service proposition to providing accounts: with the possibility to execute a transaction (PIS) on behalf of the customer or to check available funds (CAF) the functional scope of PSD2 is limited. But in combination with Open Banking functionality insurance companies can look for ways to expand their own services by providing account services. Focusing on specific customer needs, customer engagement will increase. For example, insurance companies offering wealth management services can integrate dedicated payment accounts into their products for studying children or elderly care.

- Digital identity verification: banks can help in identifying a person during a digital onboarding or digital identity verification process. This functionality is for example already operated by the banks in The Netherlands under the iDIN scheme.

Before insurance companies move forward and invest in potential use cases they have to ask themselves five strategic questions. Providing clear answers will help them navigating the challenges ahead and make sure their investments are worthwhile.

- How does openness increase relevance to our customers?

- Which capabilities do we need to leverage in PSD2 and open banking?

- How can we partner with the InsurTech scene, which is already developing services around PSD2 and Open Banking, to accelerate?

- What can we learn from banks and other parties connecting to their ecosystems?

- How can we attract the right talent to deliver on these new opportunities?

In our next blogs, INNOPAY will further explore the presented innovation opportunities of PSD2 and Open Banking and address how insurance companies can tackle their main questions in this space. In the meantime, please do not hesitate to reach out if you want to join the discussion or learn more about how we can help your organisation.

---

[1]https://www.innopay.com/blog/banks-should-open-up-beyond-psd2-to-deliver-on-the-innovation-promise/

[2]https://www.innopay.com/blog/innopay-open-banking-monitor-who-are-the-masters-in-openness/

[3]https://www.nu.nl/apps/5154248/asn-bank-regiobank-en-sns-laten-klanten-rekeningen-samenvoegen-in-app.html

[4]https://www.vandoorne.com/globalassets/bijlagen-nieuwsberichten/2016/fintech_changing_psd2_regulation.pdf

[5]https://www.proteanrisk.com/what-we-do/business-insurance-2/psd2-insurance/