Open banking is the start of something much bigger: an Open Data economy

Innovations are happening faster than ever in the world of payments and data, driven by a major trend towards providing consumers increasing control of their data. According to Vincent Jansen, Partner at INNOPAY, and his colleague Mounaim Cortet, head of Open Banking, Open Banking is actually the start of something much bigger: an Open Data economy.

Open Data economy as a basis for data sharing

To move from Open Banking to an Open Data economy, we first need to understand that an Open Data economy gives consumers full control of their personal data. They own it and have the tools to specify with whom they are willing to share particular data, what those parties are allowed to do with it and for how long. Jansen and Cortet believe that it should be a human right to control and grant others access to your own data. That would support a shift towards a more equal ‘data benefit balance’ as described in the Dutch management book of the year, ‘Alles Transactie’ or ‘Everything Transaction’. Then, not only major companies but also consumers would be able to exploit the benefits generated from their data.

More control of your own payment data

Cortet sees Open Banking as the first step towards the Open Data economy. Open Banking describes an ecosystem in which banks increasingly open up their systems. Whereas payment data used to be controlled exclusively by the banks, that control is increasingly shifting to the consumer. PSD2, the new European payments directive, is being implemented to accelerate this process. It gives consumers the right to authorise third parties to access their payment data. They can also give these parties consent to initiate payments on their behalf. The empowerment of consumers to control their data is therefore no longer a theoretical concept but is actually being implemented in practice.

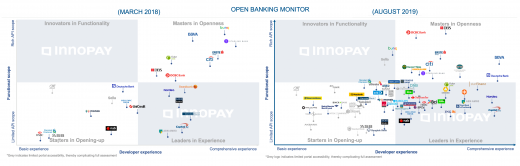

INNOPAY’s Open Banking Monitor shows that banks are gradually opening up. It describes a trend whereby banks are increasingly developing from ‘starters in opening up’ to ‘masters in openness’ (see Figure 1). It looks first at the extent to which banks are opening up and making data and functionality available to third parties, naturally with the consent of the customer concerned. It also assesses the quality and scope of the resources that banks are providing so other parties can integrate more easily and develop innovative applications for their customers.

Banks have an important role to play

The evolution of banks in the Open Banking ecosystem shows that the ideal of the Open Data economy is not just a hollow phrase but could actually become a reality. Banks not only have an exemplary role but are also very proficient at determining consumers’ digital identities due to their Know Your Customer (KYC) obligations. Jansen claims that thanks to these digital identities and strong customer authentication (SCA) mechanisms, banks can already play a key role in giving consumers control of personal data in other sectors. After all, consumers must be identified with sufficient reliability if they are to irrefutably authorise other parties to use particular data.

The mandatory opening up of banks has also enabled them to gain experience in obtaining and managing authorizations from consumers. Each authorization must be recorded securely and reliably, so the consumer always has an up-to-date overview of the parties which have been given access and, if desired, can also withdraw that access. This experience, combined with the experience in digital identity, provides an important resource that can be deployed beyond the confines of banking. By turning this experience into services, banks can take a significant step towards facilitating the Open Data economy in other sectors.

National trust infrastructure

Needless to say, managing and sharing data from a large number of sources requires more than just a digital identity and the management of authorizations. Cortet believes that a national trust infrastructure needs to be created to exchange data. This requires the development of a scheme for data sharing, digital identities and authorizations. Such a scheme is not very different from those used in payments (e.g. Mastercard, VISA). It records the functional, technical, operational, business and legal agreements that are necessary to give consumers control of their data. Such a scheme requires collaboration, initially with banks in the pioneering role thanks to their experience followed by the subsequent involvement of other public and private-sector operators.

Cortet believes that proactive investment in a national trust infrastructure will make legislative intervention unnecessary. The PSD2 provides for the opening up of banks but omits or inadequately addresses a number of key issues, making the rollout difficult in practice. Jansen hopes to see a more market-driven initiative for the national trust infrastructure across various sectors, giving rise to a kind of consumer-branded service for data sharing: a service that all consumers know, trust and use almost daily, to share – and finally reap the benefits of – their own data.

Reach out to Mounaim Cortet or Vincent Jansen to discuss the opportunities if you are starting your Open Banking and Open Data transformation, or when you are seeking to take the next step in your Open Data journey. Stay tuned for more updates on the Open Data economy!