Topics

Services

- 3 results found

Publication

|

Blog

Customer interaction and product distribution is increasingly taking place at new forefronts: at the point of interaction of digital journeys in third-party channels. The rapid rate of digitalisation is also driving the next phase of bancassurance. Banks need to start preparing for this right now – not only to protect their market share, ...

read more

Publication

|

Blog

Open Insurance continues to be the next game changer in insurance. The second ed...

read more

Publication

|

Blog

To receive exclusive access to an extended Paper which expands on the ideas deve...

read more

Publication

|

News

Technological progress, the current COVID-19 pandemic and changes in customer be...

read more

Publication

|

Blog

Banks need to get their Open Banking strategy right. Our research indicates that...

read more

Publication

|

News

With the approval of the Dutch Senate, the law for registration of Ultimate Beneficiary Owners (UBOs) came into effect on 23 June 2020. Under the law, a UBO is defined as a person who controls at least a 25% stake in a company and whose registration is a requirement for financial service providers under the anti-money laundering directive...

read more

Publication

|

News

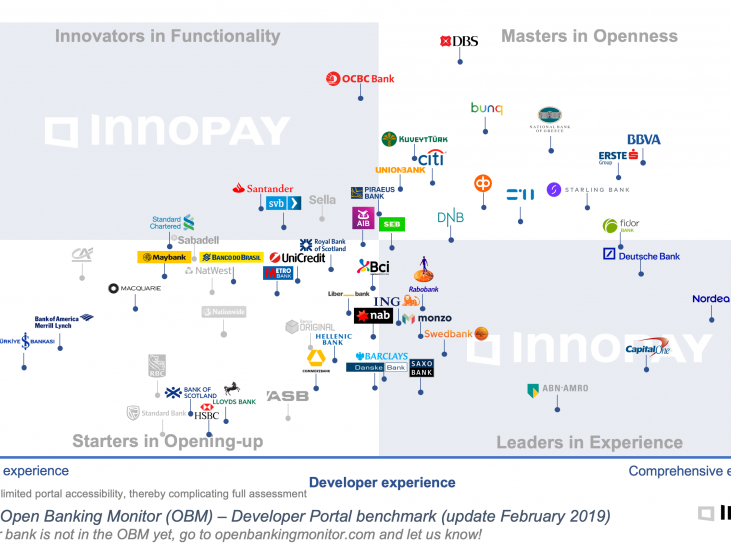

Open Banking has seen considerable activity in the last few months. Indeed, with the EU’s compliance deadline for PSD2 looming, Open Banking developer portals have emerged in great numbers, with 300-plus banks now in our monitor.

In the recent release of the INNOPAY Open Banking Monitor (OBM), updated in August 2019, we described the cur...

read more

Publication

|

Blog

As every interaction becomes a transaction, Open Insurance or API (B2B2C) insura...

read more

Publication

|

Blog

PSD2 has been an important catalyst for banks to open up. While many banks in Europe are still focused on making the PSD2 deadline of September 2019, we see some leading banks move beyond compliance and shift towards Open API Banking. In this emerging Open Banking play, banks start to understand that enabling secure access to custome...

read more

Publication

|

Blog

Senior bank executives are starting to understand that Open Banking will have ke...

read more

Publication

|

Blog

The Insurance sector evolves at a more leisurely pace than many industries, but according to Maarten Bakker, our INNOPAY Sector Lead Insurance, organisations which are slow to develop open strategies will soon find themselves marginalised.

read more

Publication

|

Blog

Every single day, more than a billion active users share their thoughts, photos, news, videos, memes, and more with friends and connections on Facebook. With data from current accounts, bankers know what their customers eat, where they buy their clothes and what they get up to online. In today and tomorrow’s world (personal) data is ...

read more