Topics

Services

- 2 results found

Publication

|

Blog

PSD2 has been an important catalyst for banks to open up. While many banks in Europe are still focused on making the PSD2 deadline of September 2019, we see some leading banks move beyond compliance and shift towards Open API Banking. In this emerging Open Banking play, banks start to understand that enabling secure access to customer dat...

read more

Publication

|

Blog

This article was published in collaboration with Deutsche Bank.

Market disruption, client evolution and regulatory change mean that the banking and corporate world is preparing for an API and Open Banking revolution. Making a success of it will require both collaboration and standardisation.

read more

Publication

|

Blog

As Instant Payments is expected to become the new normal in payments in many countries, it is imperative for financial service providers to offer Instant Payments capabilities to remain relevant in the future. The significant investments required to update current payment infrastructures motivates financial service providers to look for r...

read more

Publication

|

Blog

Senior bank executives are starting to understand that Open Banking will have ke...

read more

Publication

|

Blog

Every single day, more than a billion active users share their thoughts, photos, news, videos, memes, and more with friends and connections on Facebook. With data from current accounts, bankers know what their customers eat, where they buy their clothes and what they get up to online. In today and tomorrow’s world (personal) data is becom...

read more

Publication

|

Blog

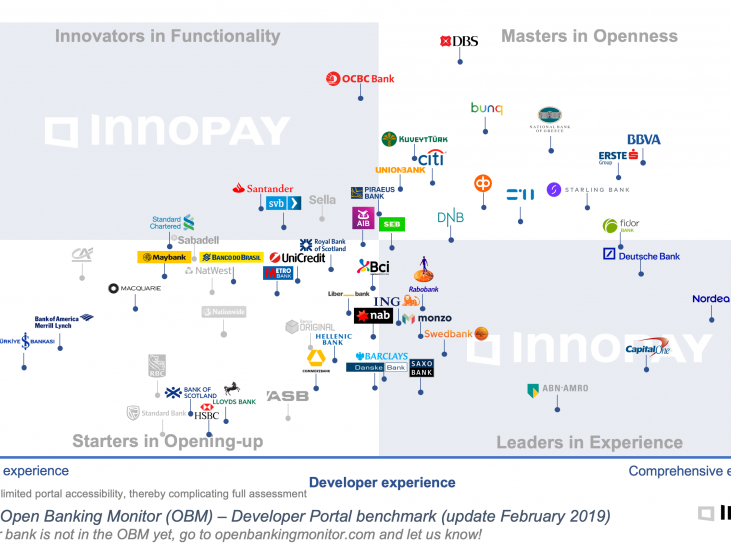

Developing state-of-the art developer portal capabilities will drive and accelerate your Open Banking strategy

read more

Publication

|

Blog

We all know by now that “XS2A” - access to payment accounts by third party providers (TPPs) - is going to happen in some shape or form under PSD2, but there is still considerable uncertainty. The transposition of PSD2 into national law is being delayed in twenty member states[1] and while the Regulatory Technical Standards on Strong Custo...

read more

Publication

|

Blog

For many years, PSPs have had relatively easy pickings, charging significant markups to online merchants for handling their payment traffic. A large variety of players entered the market. In Germany, ±60 PSPs are active, and in the Netherlands 120 players either hold a license or are specifically exempted from license duty to act as PSP.

...

read more

Publication

|

Blog

In INNOPAY's June 2015 blog, we introduced Virtual Bank Accounts as more than a reconciliation tool. We explained the difference between Virtual IBANs and Virtual Accounts, and showed how both could help SME- and corporate clients increase control over their cash- and transaction management. This blog sheds light on today’s Virtual Bank A...

read more

Publication

|

Blog

PSD2 and Open Banking strategies should go hand in hand and aim at being compliant while creating (or at least not blocking) growth potential for your business. However, a suboptimal PSD2 compliance strategy and implementation can result in the opposite by causing structural damage to your Open Banking potential and propositions. You have...

read more

Publication

|

Blog

Opportunities for existing and new market players to bridge the gaps

The ever-increasing regulatory burden is giving financial institutions a hard time these days. As part of their digital transformation, they strive to deliver customer friendly onboarding experiences. But they are also faced with increasing compliance costs, amongst oth...

read more

Publication

|

Blog

INNOPAY values clients as much as anyone else. Hence, we fully understand the urgency that is felt throughout the sector to become more customer centric. However, most existing operating models are so much intertwined with the DNA of corporate banks that it has proven to be almost impossible to fundamentally renew. Today’s conventional ap...

read more

Let's get in touch