Digital consent management is key for data opportunities

During the last EBA Day (12 June), the Euro Banking Association published their thought leadership paper “B2B data sharing: digital consent management as a driver of data opportunities”. This paper is a joint effort of INNOPAY and the EBA’s Open Banking Working Group. Below you will find the executive summary of the paper, you can find the full paper here.

Data sharing can help to increase efficiencies, lower risks and contribute to service innovation. Over the past two decades, digitisation has not only increased the amount of existing data but also increased the sharing of data between individuals and businesses. However, multilateral (‘many-to-many’) relations in data sharing between businesses and their service providers, including banks, have not yet become widely established. Instead, a scattered landscape of business-to-business (B2B) exchange platforms, actors and bilateral projects has evolved.

The rise of B2B exchange platforms has led to business data accumulation by third parties, who use these data for analytics and value creation. For banks, the strategic implications include:

- Limited overview and insight into data about the end-to-end trade process, impacting the understanding of customer needs;

- Sharing of ‘added value’ with platform service providers that will leverage data capabilities to offer business customers new propositions;

- Risk of client disintermediation as platforms increasingly build seamless and comprehensive digital experiences, satisfying both financial and non-financial needs of corporate customers.

Meeting these challenges requires improvements in data accessibility, ensuring a free flow of data, enabling market actors including banks to access business data more easily, within businesses directly or indirectly via B2B exchange platforms.

‘Digital consent management’ lies at the heart of any possible solution for the challenges ahead. Digital consent is obtained from businesses, mandating banks (and/or other service providers) to obtain and use business data to innovate their services for the benefit of businesses. This concept is similar to the provisions of the revised Payment Services Directive (PSD2) and the General Data Protection Regulation (GDPR), which aim to improve customers’ control over their data through the right to provide (or withdraw) consent to allow authorised third parties to access their personal and business information in order to use their services.

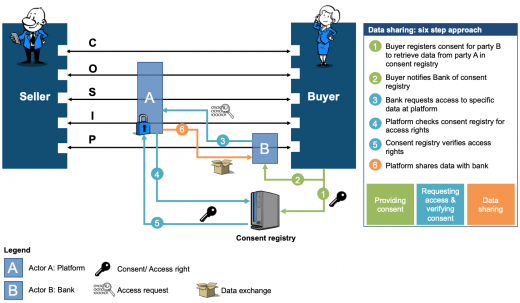

Banks traditionally play a role in the value exchange because of their trusted and regulated position. As data exchange is increasingly fraught with operational complexity and liabilities, banks can leverage this trust to play a crucial role in such consent transactions, thereby improving their access to business data (see figure 1).

Improved access to data allows banks to:

- Improve the efficiency of financing and risk processes contributing to the financial bottom line;

- Reduce cost to serve un- or under-addressed business segments, e.g. long tail of SMEs, opening up additional markets;

- Pursue data-driven propositions as part of an open banking strategy to strengthen the relationship with business clients.

For business clients, such improved access to data means a higher benefit of their data beyond the bespoke platform applications where the data is currently held. For B2B platforms, it means answering to customer demand to be in control of their data, potential regulatory pressure focused on ensuring free flow of B2B data, while also creating the opportunity to commercially leverage their position as the data holder.

To foster a wide adoption, data sharing needs to be standardised to enable businesses, B2B platforms and banks to seamlessly exchange data in a many-to-many relation. Standardisation of digital consent is also expected to reduce the transaction costs of data exchange. Figure 2 provides an overview of such consent relations and data sharing. In this example the buyer is the business providing consent to the bank, but this could also be the seller.

By actively pursuing improved B2B data accessibility, banks have an opportunity to revise their digital agenda for corporate and SMEs through:

- Creating awareness among business clients regarding the potential benefits and new value propositions emerging from improved access to data;

- Addressing potential changes to operating models (customer relationships, products and management) and business models enabling new value propositions;

- Considering options for industry collaboration to drive ubiquitous adoption of standardised consent management and data sharing.

The full paper ““B2B data sharing: digital consent management as a driver of data opportunities” can be found at: https://www.abe-eba.eu/media/azure/production/1815/eba_2018_obwg_b2b_data_sharing.pdf