Topics

Services

- 14 results found

Publication

|

Blog

The European Union (EU) revised Payment Services Directive (PSD2) was adopted January 2016 as an update of PSD 1 (adopted in 2007) and introduces two types of new services under its licensing scope: payment initiation services and account information services. New players in the financial industry and incumbents (e.g. banks, electronic mo...

read more

Publication

|

Blog

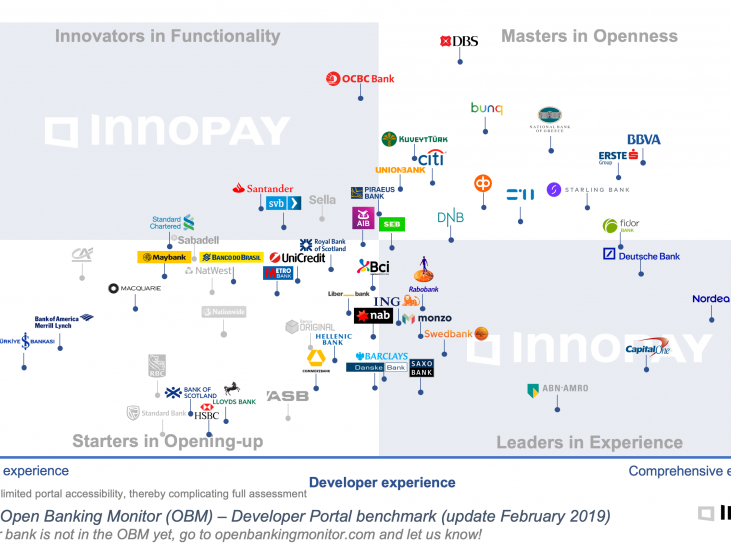

Looking back on a much eventful year in Open Banking; various banks have updated their Developer Portal in the last quarter of 2018, either by expanding the Functional Scope, by offering more APIs, or by introducing tools and features improving the Developer Experience. Predominantly with the shared goal of attracting more end-customers, ...

read more

Publication

|

Blog

Towards the first pan-European Open Banking based scheme

Imagine you’re taking an Uber at the airport, get to your destination and while you’re getting out of the Prius … ping… you receive a push notification from your bank that says € 32,78 was debited from your payment account. The full Uber experience, but no cards or wallets needed.

read more

Publication

|

Blog

This article was first published by the Paypers in the Open Banking Report 2018.

read more

Publication

|

Blog

PSD2 has been an important catalyst for banks to open up. While many banks in Europe are still focused on making the PSD2 deadline of September 2019, we see some leading banks move beyond compliance and shift towards Open API Banking. In this emerging Open Banking play, banks start to understand that enabling secure access to customer dat...

read more

Publication

|

Blog

This article was published in collaboration with Deutsche Bank.

Market disruption, client evolution and regulatory change mean that the banking and corporate world is preparing for an API and Open Banking revolution. Making a success of it will require both collaboration and standardisation.

read more

Publication

|

Blog

Senior bank executives are starting to understand that Open Banking will have ke...

read more

Publication

|

Blog

Every single day, more than a billion active users share their thoughts, photos, news, videos, memes, and more with friends and connections on Facebook. With data from current accounts, bankers know what their customers eat, where they buy their clothes and what they get up to online. In today and tomorrow’s world (personal) data is becom...

read more

Publication

|

Blog

Developing state-of-the art developer portal capabilities will drive and accelerate your Open Banking strategy

read more

Publication

|

Blog

We all know by now that “XS2A” - access to payment accounts by third party providers (TPPs) - is going to happen in some shape or form under PSD2, but there is still considerable uncertainty. The transposition of PSD2 into national law is being delayed in twenty member states[1] and while the Regulatory Technical Standards on Strong Custo...

read more

Publication

|

Blog

For many years, PSPs have had relatively easy pickings, charging significant markups to online merchants for handling their payment traffic. A large variety of players entered the market. In Germany, ±60 PSPs are active, and in the Netherlands 120 players either hold a license or are specifically exempted from license duty to act as PSP.

...

read more

Publication

|

Blog

PSD2 and Open Banking strategies should go hand in hand and aim at being compliant while creating (or at least not blocking) growth potential for your business. However, a suboptimal PSD2 compliance strategy and implementation can result in the opposite by causing structural damage to your Open Banking potential and propositions. You have...

read more

Let's get in touch