How to optimise your customer onboarding journey: align your modular building blocks

Our Digital Customer Onboarding Benchmark reveales a large disparity in performance. Newer, smaller banks are onboarding much better than their larger, more established competitors. Why? By zooming in on four banks within the benchmark sample, we see that the higher performing banks are able to better position and align their different modular building blocks. Aligning these blocks results in a “low effort / high response” process that is customer-centric.

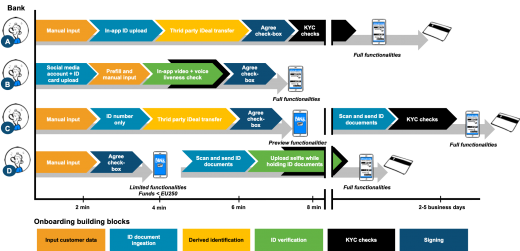

These improvements are best understood by breaking up the total customer journey into building blocks which represent different phases of the onboarding process. In one of our earlier articles, we introduced the onboarding building blocks and showed that these should be built modularly. They can be implemented or skipped depending on the country, the product or customer specific requirements.

Here we are focusing on the building blocks used by four banks from the benchmark sample. Analysing these building blocks helps in understanding how some banks are outperforming others when it comes to customer experience. Figure 1 shows the building blocks of the four banks, including their lead time. In total, there are six modular building blocks (each shown in a different colour). The blocks are implemented differently across the four banks. Some banks offer similar building blocks but use different techniques. The lead time per technique varies, resulting in smaller or larger blocks.

Bearing this in mind, let's now consider how the three main improvements can be realised.

1. Start with ID document ingestion and align manual and pre-filled input

Most banks start with a manual input of customer data (e.g. Bank A). Usability tests show that people tend to be more committed to finishing the process once they have manually entered data. However, this manual input is time-consuming and can include errors. In the benchmark sample there are some banks that perform better by aligning the ‘document ingestion’ and ‘manual input’ building blocks. Aligning these blocks means that customer data is extracted from the document, which decreases the amount of manual input required, and hence decreases the lead time.

Bank B performs well because it starts with the option to log in with a social media account. This enables the customer to skip the first manual data input. After the option to log in with a social media account, the document ingestion at the start of the process allows for reading and pre-filling additional data such as gender, date of birth, nationality and social security number (SSN). This significantly lowers the lead time, smoothens the process, and increases the accuracy of the data.

As a side note, many banks offer in-app ID uploading, but most of the techniques offered by solution providers are not yet sophisticated enough to provide accurate data. Often the data needs to be corrected manually by either the customer or the bank’s employees. In the end, this could result in the customer being rejected.

2. Consider phased onboarding as an option to provide a fast process while limiting risks

Customers are likely to be more satisfied when they are rewarded for their onboarding effort by gaining access to the service as soon as possible. If the onboarding process takes too long, this immediately leads to a loss in conversion. To achieve a fast onboarding process and reward the customer early in the process, we see banks in our sample offering "phased onboarding".

Bank C and Bank D are good examples. Bank C engages customers by immediately revealing all the online functionalities which will be available once the onboarding process is completed. This significantly increases the response from the bank’s side. Alternatively, Bank D makes available almost all the functionalities as soon as the customer has provided limited input. Once customers reach a certain account balance, they are required to undertake a second phase onboarding during which the bank asks them to upload an ID document and a selfie holding this document.

Phased onboarding helps to increase the conversion rate because the customer can use some services either directly after the first phase process or even immediately during the process. However, think carefully before introducing phased onboarding. It will be inconvenient for customers if they are subsequently rejected at a later stage in the process. And it may be annoying for some customers to be asked for additional information every time they want to use extra services. So your aim should be to ensure that the process is optimised throughout. When the entire onboarding process is as smooth as possible, you should be able to achieve optimal conversion.

3. Introduce real-time KYC processes to allow for full functionalities in less than 10 minutes

Banks perform all kinds of background checks before they accept and offer full services to their customers. Lower performing banks follow a static approach, whereas high-performing banks are able to align and overlap the KYC building block with other blocks, resulting in a lead time of less than 10 minutes (e.g. Bank B). Once the customer has been recognised, real-time KYC processes can get underway while the customer moves through the other building blocks. Choosing the right technology and cooperating with the right solution providers will definitely give you a competitive advantage here.

Taking the first steps to optimise your onboarding process

The INNOPAY Digital Customer Onboarding Benchmark shows large differences in the onboarding performance of retail banks. High-performing banks intelligently position and align their building blocks, resulting in a "low effort / high response" process. The market for online identification is evolving rapidly, with solution providers offering more and more sophisticated techniques which enable major process improvements. We advise you to keep track of these techniques and look at what your peers and competitors are offering. In the short-term, banks could consider taking two immediate steps. First, start by critically evaluating your current process because small UX improvements can significantly improve response rates (e.g. manage the prospect’s expectations by explaining the steps and showing a progress bar, or explain the purposes for which the data will be used). Second, consider phased onboarding to improve both effort and response.

Are you interested in optimising your process by learning more about dynamic and modular onboarding processes? Get in touch! INNOPAY can help you develop the right onboarding strategy, identify suitable technology and solution providers, and jointly redesign your process.