EU presents legislative proposals to modernise AML regime

Over the past three decades, the European Union has steadily improved its framework to fight money laundering and terrorist financing (AML/CFT). The EU’s action has focused on the prevention, investigation and prosecution of these harmful practices.

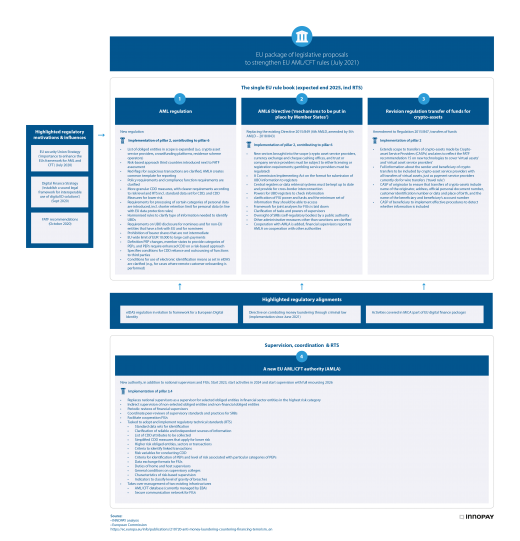

In July 2021 the European Commission (EC) presented a package of legislative proposals that constitute an ambitious set of measures to modernise the AML/CFT regime in the coming years. The key focal points will be a proposal to move parts of the existing AML Directive into a regulation, making it directly applicable in the Member States, and to implement EU-level supervision with an EU-wide AML authority, which will develop regulatory technical standards to improve harmonisation.

The poster below summarises the key components of the legislative proposals and the context surrounding it. Click here to download the poster.

Context

The package of legislative proposals is a follow-up to the EU action plan for a comprehensive policy. The action plan consists of six pillars. While pillars 1, 5 and 6 are currently being implemented, pillars 2, 3 and 4 required legislative action. The creation of the package is in line with the following (among others):

- the EU Security Union Strategy of July 2020 (‘importance of enhancing the EU’s framework for AML/CFT’);

- Digital Finance Strategy of September 2020 (‘establish a sound legal framework for interoperable use of digital ID solutions’);

- FATF recommendations of October 2020.

Key changes

Pillar 2, establishing a single EU rulebook on AML/CFT, is reflected in legislative proposals 1, 2 and 3, also referred to as ‘the single EU rulebook’. A key change in the EU single rulebook is that an AML Regulation is introduced, whereas before there was only a Directive. This means there is now a harmonised set of rules that apply to all private parties in all EU member states, whereas the Directive contains provisions (for example on national supervisors and FIUs) that need to be transposed into national law. This change fits within the overall trend of harmonising rules to establish an EU digital single market and to minimise fragmentation that hinders an effective fight against ML/TF. It is no surprise, therefore, that its content is aligned with the eIDAS Regulation and with the Directive on combatting money laundering through criminal law (implemented since June 2021).

Additionally, the Regulation on Transfer of Funds has been revised to include crypto-assets and crypto-asset service providers (CASPs). This is in line with the activities covered in the proposed regulation on Markets in Crypto Assets (MiCa).

Pillar 3 (bringing about EU-level AML/CFT supervision) and pillar 4 (establishing a support and cooperation mechanism for FIUs) is embodied in the new EU AML/CFT authority called AMLA. This new authority will be fully effective in 2026 and will:

- Harmonise and ease implementation of the regulation by developing regulatory technical standards (RTS) that provide among other things for standard data sets required for identification, simplified CDD measures and criteria for suspicious transactions and PEPs;

- supervise selected high-risk entities directly, replacing national supervisors;

- enhance cooperation of FIUs.

The full rulebook, including the technical standards developed by AMLA, is expected to be in place and apply by the end of 2025.

Stay tuned or get in touch for more information and implications for your business.