Topics

Services

- 77 results found

Publication

|

Blog

In the last few months, Open Banking has seen considerable activity. Indeed, wit...

read more

Publication

|

Blog

Although almost imperceptibly, the number of data transactions is growing expone...

read more

Publication

|

News

Open Banking has seen considerable activity in the last few months. Indeed, with the EU’s compliance deadline for PSD2 looming, Open Banking developer portals have emerged in great numbers, with 300-plus banks now in our monitor.

In the recent release of the INNOPAY Open Banking Monitor (OBM), updated in August 2019, we described the cur...

read more

Publication

|

Blog

In an ideal world, data sharing is hassle-free and the transactional internet of...

read more

Publication

|

Blog

PSD2 is the revised European directive for payment services, with the supporting...

read more

Publication

|

Blog

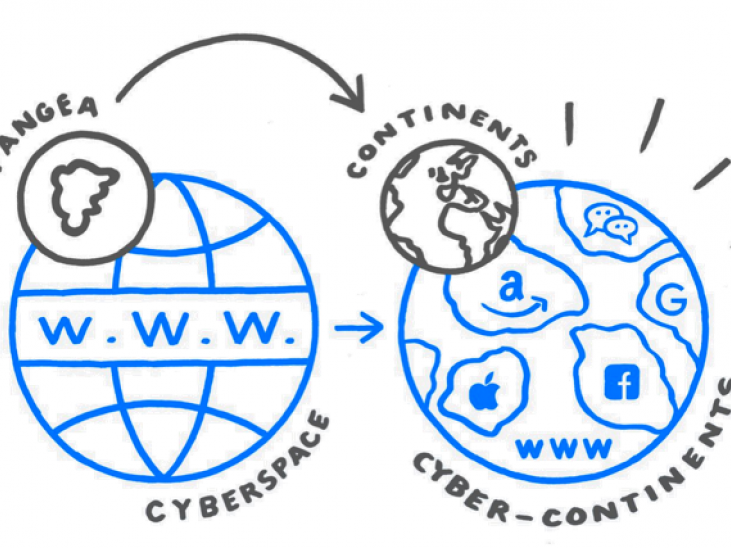

As the number of digital transactions is growing exponentially, companies who have relevant and frequent digital interactions with their customers compete to become future ecosystem orchestrators. This is also true for the banking sector, where customers are increasingly banking through their smartphone, making that the primary digit...

read more

Publication

|

Blog

Facebook’s new cryptocurrency Libra is not merely about transactions; it’s also ...

read more

Publication

|

Blog

The role of the corporate treasurer will change significantly with the transition towards an open, digital and data driven economy. Partially motivated by regulatory push (eg PSD2, GDPR), organisations are increasingly adopting new business models in which data is shared 24/7 to better respond to instant customer demand. This requires tre...

read more

Publication

|

Blog

With the rise of the Internet of Things (IoT) and artificial intelligence (AI), transactions initiated by smart devices and platforms will increase exponentially over the next years. An appealing example is Smart Home, which connects customers digitally through smart devices and allows them to share data and transact from home 24/7.

As r...

read more

Publication

|

Blog

As every interaction becomes a transaction, Open Insurance or API (B2B2C) insura...

read more

Publication

|

Blog

Looking back on a much eventful year in Open Banking; various banks have updated their Developer Portal in the last quarter of 2018, either by expanding the Functional Scope, by offering more APIs, or by introducing tools and features improving the Developer Experience. Predominantly with the shared goal of attracting more end-customers, ...

read more

Publication

|

Blog

Data and putting the customer in control over his or her data are crucial elements for any platform strategy, especially in an open ecosystem. For insurance companies it means they can extend and improve their service offering and to develop new revenue models. But if they fail to handle the data with sufficient care, they risk damaging t...

read more