Bancassurance 4.0: Open Banking APIs as a new growth engine

Customer interaction and product distribution is increasingly taking place at new forefronts: at the point of interaction of digital journeys in third-party channels. The rapid rate of digitalisation is also driving the next phase of bancassurance. Banks need to start preparing for this right now – not only to protect their market share, but also to ensure they don’t miss out on the emerging blue ocean opportunities. In this article, we explain why and how Open Banking capabilities can be leveraged for new personalised Open API bancassurance propositions in order to increase customer relevance.

The era of low – and even negative – interest rates does not seem likely to end any time soon. Banks across the globe are responding by looking for new fee-based growth pockets to partially offset the declining margins on their balance sheets. The current European insurance market accounts for roughly EUR 1,300 billion, including an estimated EUR 250 billion involving bancassurance. Growing their bancassurance business can thus generate substantial fee-based or commission-based income for banks. In a world with soaring customer expectations and exponential growth of new digital ecosystems, innovation is imperative to secure a foothold in this market.

Open APIs provide new opportunities for insurance and usher in the next phase of bancassurance

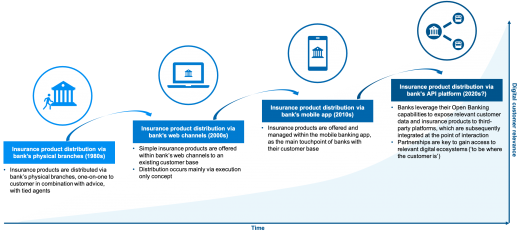

Banks have long relied on their own physical and digital channels as the main distribution point for insurance products and as the key touchpoint for engaging with their clients. Nowadays, however, insurance product offerings and insights can increasingly be found at the point of interaction within third-party channels. Digital channels have gained further importance since the outbreak of COVID-19 and this trend is expected to accelerate. Two thirds of bank executives across the globe believe that the bank branch model will be dead within five years as a result of digitalisation. Therefore, the next logical step for bancassurance is to play a role within new digital ecosystems based on open APIs, thereby ushering in the next phase of the bancassurance distribution model (see Figure 1). By pursuing an Open API strategy, banks can create new customer relevance, leverage their presence in new digital ecosystems, drive innovation and create new revenue streams.

Banks are ideally positioned to to capitalise on this blue ocean opportunity

As part of their strategic Open Banking initiatives, banks already provide third-party platforms with access to banking products and data. Numerous banks have recognised the potential of API-enabled distribution. Some banks expose lending products via APIs to accounting platforms, for instance, enabling their users to apply for a new loan directly from within the accounting platform.

The Open Banking journey has put banks in the hot seat for insurance product distribution due to a strong set of capabilities they have acquired along the way:

- Banks have a large client base, relevant data assets and frequent digital client interaction. Banks have built a large customer base with frequent digital interaction and have consequently developed trusted relationships. As a result, banks possess a wide range of financial and non-financial customer data (e.g. payments data, investments, insurance policies, etc.). Banking clients are comfortable with managing their finances online, making banks a logical and trusted party to be involved in their digital journeys and transactions on third-party platforms. This large client base also makes banks an attractive partner for third parties.

- Banks have a licensed, secure and regulated infrastructure. Due to their PSD2 compliance and Open Banking efforts, banks can offer licensed third-party platforms safe access to their API environment (including developer portal). This enables trusted and shared use of the bank’s products, services and data, and easy, scalable and secure integration with third-party platforms. Banks therefore have a significant head start on other parties (e.g. insurers) who are still several years away from developing this crucial capability.

- Banks have well-established digital identities of their customers and authentication/authorisation capabilities in place. Having established digital identity of customers is key for personalised API-driven insurance. Strong customer authentication and authorisation capabilities are required to participate in open digital ecosystems to interact with others, provide access to account data and digitally engage in legal agreements such as insurance policies. Banks already have these capabilities due to their thorough KYC processes in combination with authentication and authorisation mechanisms derived from Open Banking. This gives banks a clear competitive edge over insurance companies, InsurTechs and BigTechs.

How could it look for the customer?

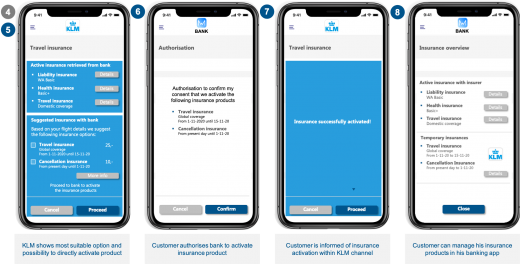

So banks have a unique opportunity to develop new Open API propositions. But how can this create new value for customers? At INNOPAY, we regularly explain this to our clients using a bancassurance case from the travel sector (as illustrated in Figures 2 and 3). In this example from airline KLM, when booking a flight passengers can check their existing insurance coverage in real time. Based on that personalised insight, they can then decide to buy extra coverage for that trip. Once the personalised coverage is activated, clients can see and manage their coverage in the banking app. Customers thus gain an integrated and personalised digital experience tailored to their specific needs with all the necessary information in one place.

Tapping into this opportunity calls for the right strategy, partnerships and operating model

According to the market insights from our Open Insurance Monitor and interviews with key industry players (banks, insurers, InsurTechs), some front-running banks are already moving into this space in a bid to stay ahead of their competition. Banks that limit themselves to distribution via their current channels will see their share of wallet decline as their competitors are taking part in new digital ecosystems. Most importantly, they will miss out on the opportunity to increase the resilience of their business model and to become more relevant for their clients.

Three must-do actions for banks that want to seize this emerging opportunity within bancassurance:

- Define the right strategy and business model. Banks need to define their Open API strategy, business model and use cases for distributing insurance products

- Engage in digital ecosystem partnerships. Banks need to engage in new partnerships to gain access to the ecosystems they want to be part of in order to meet new customers’ needs

- Prepare the operating model. Banks need to review their current operating model and define how they can integrate key Open API insurance distribution initiatives into the daily operations

Prepare for the next phase of bancassurance

Digitalisation is shifting insurance product distribution from the organisation’s own channels to the point of interaction within open digital ecosystems. Banks that fail to position themselves at the forefront will not only see their share of wallet decrease, but will also miss out on the opportunity to increase their relevance and build a more resilient business model during these uncertain times. If you would like to explore how to prepare for the next phase of bancassurance, do not hesitate to contact Maarten Bakker or Mounaim Cortet.