Central Bank Digital Currencies: Today’s buzzword, or time to get ready?

A much-discussed (and much-hyped) topic among central banks is the issuing of currency in a digitalised form: a Central Bank Digital Currency (CBDC). It is claimed that CBDCs could have a significant impact on the payment infrastructure and ecosystem because they could change the rules of the game. However, the various existing CBDC implementations reveal numerous overlaps with the current payment infrastructure, and CBDCs can still develop in many directions. The potential future scenarios and practical implications for the positioning of payment industry players, whether they are payment-focused banks or other payment service providers (PSPs), are therefore unclear. So the question is, what CBDC-related action should payment players undertake today?

Three distinct implementations are being explored

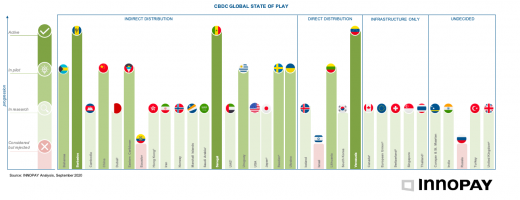

Central banks are considering CBDCs as a reaction to several developments in the payments landscape, such as declining cash use, the growing number of decentralised currencies and private initiatives such as Libra. Currently, only three countries have an active CBDC (see Figure 1), while 28 other countries are further exploring the topic and are in either a research phase or a pilot phase. A further three countries have explored CBDCs and have since decided not to pursue the topic.

There are currently three ways in which central banks can issue a digitalised currency:

- Indirect distribution: The central bank offers its digital currency to consumers through banks or other intermediaries. The dynamic of this approach is similar to how cash and scriptural money currently works. It implies a positioning of payment players that is similar to today’s positioning.

- Direct distribution: The central bank offers its digital currency directly to consumers. This approach is similar to current cryptocurrencies such as bitcoin with a decentralised storage of value, or to a payments account directly with the central bank. However, this option raises questions regarding consumer security, as additional security services (e.g. two-factor authentication) are expected to be required. These services are unlikely to be provided by central banks, but rather by other types of (licensed) service providers, effectively making it similar to an indirect distribution model. Given the security considerations, this model implies a positioning of payment players that is largely similar to today’s positioning. This conclusion is supported by the recent joint publication by seven central banks and the Bank of International Settlements (BIS).

- Infrastructure only: The central bank offers its digital currency to banks or other financial institutions only, for use in interbank payments and securities transactions. In practice, this would create a payment infrastructure specifically for banks that is an alternative to existing settlement systems rather than being a consumer-facing system. Infrastructure-only CBDCs seem mostly relevant and impactful for developing economies with a need for more efficient interbank systems.

Further maturing required to determine impact

Although the topic of CBDCs is gaining traction, especially in the media, the disruptive potential of CBDCs for payment players currently seems limited because the various CBDC models are either comparable with existing practices, unlikely to occur due to security considerations or too narrowly focused. However, since the topic of CBDCs is currently still in its infancy, there is uncertainty about its final shape. This uncertainty is reflected in the BIS publication, which raises questions about features and criteria for CBDCs. Matters such as the level of standardisation, interoperability, centralisation, required security, and whether CBDCs will be monetisable, consumer-facing and cross-border-enabled all need to be explored much further. These issues could increase the potential of CBDCs to disrupt the current positioning of payment players. However, since it will take some time for the topic of CBDCs to mature, it seems too early for payment players to incorporate CBDC initiatives into their short-term actionable strategies.

Three imperatives for payment leaders

Nevertheless, as all three CBDC models could have an impact on payment players, albeit to varying degrees and depending on the level of maturity of each model, we advise payment players to start taking action today. Whether they are keen to be among the leaders and innovators, want to engage as fast followers or prefer to wait until the market is more mature, it is important that payment players already spend time on understanding how emerging CBDC models will impact the payments landscape in general and their business in particular. To begin shaping their strategic perspective, payment players should initiate the following three actions:

- Closely monitor evolving design choices and results of existing CBDC initiatives (e.g. China’s DCEP and Sweden’s e-Krona)

- Define future scenarios and assess how each scenario can impact their current role across markets.

- Actively shape the future of CBDCs in their region together with their central bank by actively engaging with them on the topic and, optionally, start collaborating with other banks or PSPs to shape the future together.

INNOPAY is closely monitoring the evolution of CBDCs

Based on our rich experience and vision of the evolution of the payments market, INNOPAY can help you in preparing for the future impact of CBDCs. Reach out if you are interested in finding out how you can ready yourself for the future impact of CBDCs.