Topics

Services

- 420 results found

Publication

|

News

It probably won’t be long now until insurance companies – just like banks – with PSD2 are required to develop API portals to share customer data with third parties. Insurers have a choice: to wait it out and treat it as a compliance issue when the time comes, or to view it as an opportunity right now, according to Maarten Bakker, a partne...

read more

Publication

|

News

Insurers across the globe are looking for ways to apply the use of data, products and services to enhance value creation in digital ecosystems. Although several front-running insurers are already making inroads with this, most insurers are lagging behind banks. That is one of the key findings from the INNOPAY Open Insurance Monitor. This ...

read more

Publication

|

Blog

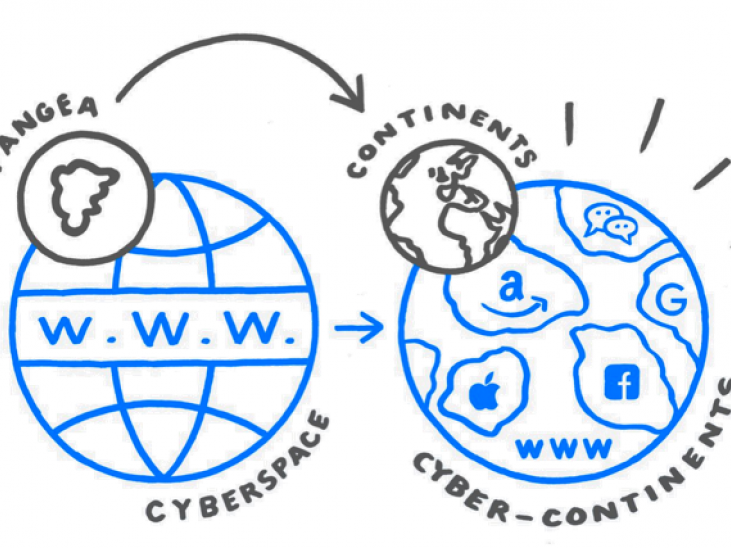

In the past decade, FinTech players have emerged that operate across borders wit...

read more

Publication

|

News

The EU’s fifth Anti Money Laundering Directive (AMLD5) comes into force in all Member States on 10 January 2020. This latest version of the directive broadens its regulatory scope by including two types of crypto service providers (CSP): virtual-fiat exchanges and custodian wallet providers. The main driver behind this regulatory update i...

read more

Publication

|

Blog

The EU’s fifth Anti Money Laundering Directive (AMLD5) comes into force in all Member States on 10 January 2020. This latest version of the directive broadens its regulatory scope by including two types of crypto service providers (CSP): virtual-fiat exchanges and custodian wallet providers. The main driver behind this regulatory update i...

read more

Publication

|

Blog

The European Union (EU) revised Payment Services Directive (PSD2) was adopted January 2016 as an update of PSD 1 (adopted in 2007) and introduces two types of new services under its licensing scope: payment initiation services and account information services. New players in the financial industry and incumbents (e.g. banks, electronic mo...

read more

Publication

|

Blog

As every interaction becomes a transaction, Open Insurance or API (B2B2C) insura...

read more

Publication

|

Blog

The Insurance sector evolves at a more leisurely pace than many industries, but according to Maarten Bakker, our INNOPAY Sector Lead Insurance, organisations which are slow to develop open strategies will soon find themselves marginalised.

read more

Publication

|

Blog

Every single day, more than a billion active users share their thoughts, photos, news, videos, memes, and more with friends and connections on Facebook. With data from current accounts, bankers know what their customers eat, where they buy their clothes and what they get up to online. In today and tomorrow’s world (personal) data is ...

read more

Let's get in touch