Topics

Services

- 20 results found

Publication

|

Blog

With the rise of the Internet of Things (IoT) and artificial intelligence (AI), transactions initiated by smart devices and platforms will increase exponentially over the next years. An appealing example is Smart Home, which connects customers digitally through smart devices and allows them to share data and transact from home 24/7.

As r...

read more

Publication

|

Blog

The European Union (EU) revised Payment Services Directive (PSD2) was adopted January 2016 as an update of PSD 1 (adopted in 2007) and introduces two types of new services under its licensing scope: payment initiation services and account information services. New players in the financial industry and incumbents (e.g. banks, electronic mo...

read more

Publication

|

Blog

As every interaction becomes a transaction, Open Insurance or API (B2B2C) insura...

read more

Publication

|

Blog

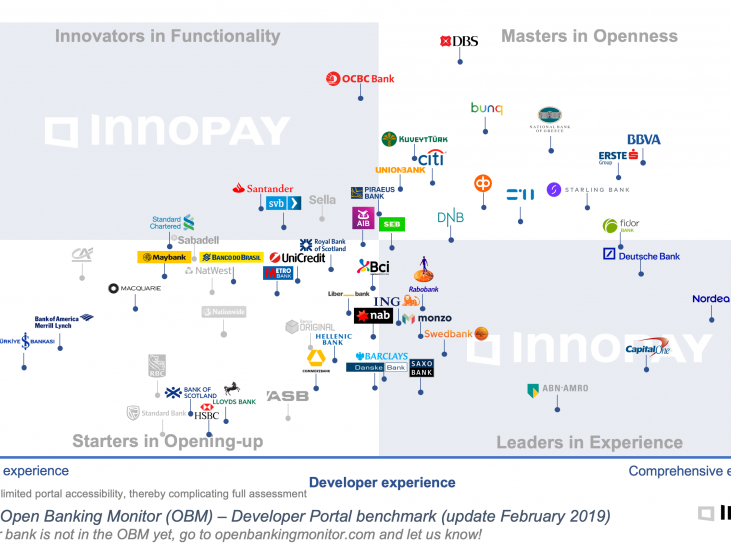

Looking back on a much eventful year in Open Banking; various banks have updated their Developer Portal in the last quarter of 2018, either by expanding the Functional Scope, by offering more APIs, or by introducing tools and features improving the Developer Experience. Predominantly with the shared goal of attracting more end-customers, ...

read more

Publication

|

Blog

Data and putting the customer in control over his or her data are crucial elements for any platform strategy, especially in an open ecosystem. For insurance companies it means they can extend and improve their service offering and to develop new revenue models. But if they fail to handle the data with sufficient care, they risk damaging t...

read more

Publication

|

Blog

This article was first published by the Paypers in the Open Banking Report 2018.

read more

Publication

|

Blog

Data sharing is extremely common among supply chain partners. Every company that uses SAP software is involved in some form of data sharing with customers, suppliers and/or service providers – but how can that be organized smartly and efficiently? Hewlett Packard Enterprise (HPE) recently organized a seminar on ‘Innovation for Digital Tra...

read more

Publication

|

Blog

This article was published in collaboration with Deutsche Bank.

Market disruption, client evolution and regulatory change mean that the banking and corporate world is preparing for an API and Open Banking revolution. Making a success of it will require both collaboration and standardisation.

read more

Publication

|

Blog

Shikko Nijland - Managing Partner INNOPAY

Douwe Lycklama - Founding Partner INNOPAY

GDPR mandates that organisations must provide consumers with increased levels of visibility and control over their personal data. But this data is already fragmented across the farthest reaches of the internet, and the long-term needs of neither...

read more

Publication

|

Blog

Senior bank executives are starting to understand that Open Banking will have ke...

read more

Publication

|

Blog

During the last EBA Day (12 June), the Euro Banking Association published their thought leadership paper “B2B data sharing: digital consent management as a driver of data opportunities”. This paper is a joint effort of INNOPAY and the EBA’s Open Banking Working Group. Below you will find the executive summary of the paper, you c...

read more

Publication

|

Blog

Interested in the Audio version of this article? See bottom of this page.

Exponential growth in the amount of digital transactions and customer data is causing organisations to fundamentally review how they will operate in future. As GDPR comes into force, companies need to accept that problems created by their use of customer data now r...

read more

Let's get in touch