Unlock the potential of your onboarding process: banks, you never get a second chance to make a first impression, so you’d better do it right!

Banks are investing heavily in technology to stay ahead when it comes to interacting with customers. Opening an account is one of the first interactions a new customer will have with an organisation. And it is a true cliché that ‘you never get a second chance to make a first impression’. So, you’d better do it right, right?

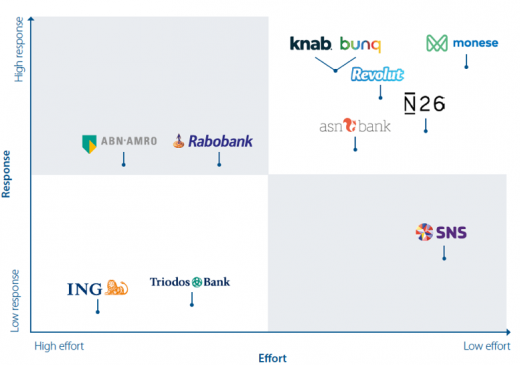

Our Digital Customer Onboarding Benchmark is revealing that newer, smaller banks are doing it much better than their large, more established competitors.

With evolving consumer demands and FinTechs challenging incumbent players, the fast-changing market for digital customer onboarding is becoming increasingly important. Organisations that can deliver quick, relevant and digital processes are gaining a competitive advantage. As a strong advocate of digital customer onboarding, we want to answer an important question: ‘What is the current status of digital customer onboarding in Retail Banking’? Our goal is to provide banks with essential insights into how to make a good first impression, based on lessons learned from those doing it right.

The INNOPAY Digital Customer Onboarding Benchmark

INNOPAY has developed a Benchmark that enables our clients to improve their digital customer onboarding processes in the Dutch market.

The Benchmark compares the account opening processes of retail banks for Dutch citizens. The onboarding process starts from the moment a customer indicates that they want to open a payment account up to the point the account is ready to use. The Benchmark focuses on the customer’s perspective and is based on two variables:

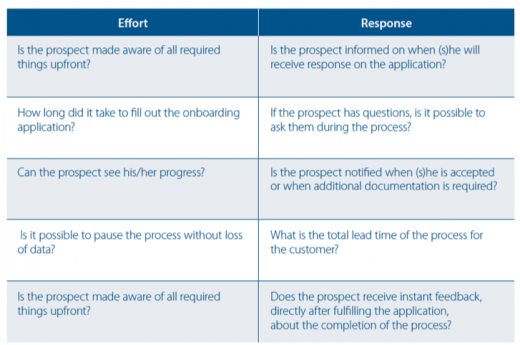

1. The Effort it takes for the prospect to complete the onboarding process;

2. The Response of the organisation to the prospect during the onboarding process.

An organisation’s performance on these axes is determined by a number of questions, some of which are shown in Figure 1. The questions are deliberately objective in nature; elements such as ‘fun’ or ‘cool design’ have not been taken into account because they would lead to subjective results.

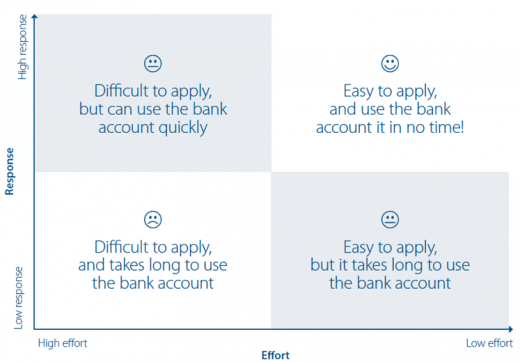

The two axes result in four quadrants:

Outcome of the Benchmark: challenger banks are ahead

It immediately becomes clear that challenger – newer and smaller – banks, such as N26 and Monese are outperforming incumbent banks in the way they onboard new customers.

The banks on the left side of the matrix either require physical identification or involve multiple paper and/or postal processes, increasing lead times. For examples, customers receive hardware tokens for authentication purposes, which limit instant access to and use of the account. Triodos, ABN AMRO and SNS only support processes via the web, whereas some banks also offer native app processes. ING does not offer an online process.

On the right side of the matrix, European challengers such as N26, Bunq, Revolut and Monese offer full in-app processes, which make account opening almost instantaneous. They have embraced new technologies for online identification purposes, such as video-identification or photographing ID documents, accompanied by a verification payment. ASN Bank and Knab do not require an ID document and only ask for the document number. This results in a convenient process for the customer, but it can be questioned how sustainable this is from a risk and compliance perspective[1]. The same goes for SNS, who relies on a verification payment via iDEAL, with no need for an ID document. As more and more (digital) banks make use of this form of derived identification, it becomes less valuable (it becomes the ‘derived of the derived’ identification).

Revolut uses the room that is provided by legislation to allow customers to open restricted accounts without the need for identification[2], limiting transactions to a total of € 250,-. To increase the amount, additional identification is required. This can be seen as phased onboarding, which could increase conversion.

Additionally, we see the following ‘quick wins’ at several of the retail banks for improving the onboarding process;

- Manage the prospect’s expectations by explaining the steps and showing a progress bar;

- Explain for what purposes data is going to be used; especially considering the imminent GDPR;

- Ensure data fields are not cleared once a screen is closed;

- Minimise the details the customer has to fill in by looking at what is really required, and by using automatic filling of these required data fields (e.g., OCR or NFC);

- Although not taken into consideration when determining the score; have a real good design that supports the first impression you want to make.

Our views - Allow customer onboarding to be customer-centric

It is not surprising that more incumbent banks are on the left side of the matrix. They maintain a different risk profile to the challenger banks due to their higher volume of customers and the bank’s impact on the financial market. Incumbent banks are in generally more hesitant towards the use of online identification techniques. Also, their target group is more diverse than the early adopting smartphone users, meaning that a web-based onboarding process is more appropriate for some of their customers. For web-based processes, fewer techniques are available that allow for the same seamless and secure experiences provided by native apps. Combine this with legacy systems and it becomes difficult to move as fast as the challenger banks do.

As said, customers however seek convenience and as such will be attracted by the easiest or fastest way to open an account. Onboarding is a business differentiating process for customers and it should therefore be approached from this perspective, and not just from a compliance and/or risk point of view. The new AML4 Directive also allows for a more risk based approach[3]. We encourage you to test and embrace new techniques. The quest for the right technology to enhance the customer interaction, is an important one. Start with a proper strategic alignment before jumping into the arms of solution providers, as explained in our previous blog.

Recommendations:

- Enhance customer interaction by ensuring the first interaction with the customer is rock-solid;

- Approach customer onboarding from a business perspective, not from a compliance or risk angle only;

- Keep track of other players in the market, learn and benefit from their onboarding processes;

- Test and embrace new technology to fulfil KYC requirements, and improve customer experience;

- Place the onboarding process in the strategic context and choose specific vendors based upon strategic fit.

Opportunities: it starts with knowledge

INNOPAY has developed the Benchmark to provide our clients with insights into digital customer onboarding in Retail Banking and how new techniques are being leveraged to ensure that the first point of contact is a market leading experience for the customer. As the market is evolving rapidly, we will renew the onboarding Benchmark every quarter.

For retail banks, the Benchmark can serve as a starting point when your aim is to optimise the first point of contact and make a great first impression. We encourage you to be inspired by each other, and to create a digital customer onboarding process that fits both the customer and your company profile.

If you are considering how to improve your customer onboarding process, feel free to contact us. We are more than happy to think with you and determine how we can help.

In our next blog, we will elaborate more on what techniques are and can be used to create a solid first interaction with your customer.

---

[1] AMLD3 article 8.1, AMLD4 article 13.1, states that "Customer due diligence measures shall comprise: (a) identifying the customer and verifying the customer's identity on the basis of documents, data or information obtained from a reliable and independent source"; Note that AMLD4 still needs to be transposed into National Legislation in the Netherlands

[2] AMLD4, article 12.1

[3] Customer not physically present (remote onboarding) is not seen as a high-risk on its own, where enhanced due diligence is required, as it was noted in AMLD3, art. 13.2