Book and Claim — Building Low-Carbon Markets Before Mandates

Most companies want to decarbonize their product lines and operations, whether because of smart risk management, shareholder pressure, or regulatory mandates. But decarbonizing is often expensive, with slower returns on investment, in part because of regulatory volatility. This has prompted many enterprises to struggle to find the “right” timing for decarbonization investments. Early movers risk becoming less competitive because of higher costs, while laggards can face supply chain disruptions and higher costs from waiting too long.

This is where book and claim can play a critical role, helping companies manage and potentially cut the cost of decarbonizing, making an investment in sustainability more likely to succeed. It achieves this by creating a new revenue stream from the sale of tradable, verifiable sustainability claims that come from the unbundling of sustainability attributes from the physical product without requiring costly supply chain segregation. Ultimately, book and claim can help producers monetize decarbonization investments early, accelerate the scaling of low-carbon products by subsidizing their premiums, and enable flexible participation for downstream buyers.

While lots of companies are considering book and claim, many are uncertain where to start — with some even considering waiting for regulation to force them to adopt it. But there are benefits for industries from developing voluntary markets now. Among the biggest: providing regulators with the kind of information that will help them create better rules and ease future regulatory implementation.

In a nascent market, voluntary book and claim mechanisms also channel capital toward low-carbon products and develop market infrastructure that will eventually be necessary with mandates. Longer-term benefits include building registries, data standards, and measurement protocols that regulators may eventually adopt. All this helps ensure a smooth transition with minimal market disruption.

Diesel shows the problems when regulation leads market development

To illustrate the potential risks if industry allows regulation to lead market development instead of moving ahead with voluntary markets such as book and claim, consider the experience of the US diesel market. In the early 2000s, the Environmental Protection Agency introduced mandates to use ultra-low-sulfur diesel, with sulfur content of 15 parts per million rather than the more conventional 500. Refinery supply and logistics weren’t prepared for such a dramatic cut, and diesel prices spiked with speculators and traders capitalizing on the arbitrage created.

We also saw this kind of disruption in renewable fuels, when step changes in regulation caused spikes in the price of biofuels or associated credits. In the late 2010s, for instance, increasing targets in California’s Low-Carbon Fuel Standard sent prices of credits above $200 per ton of carbon dioxide equivalent when historically they typically priced under $100. Developing voluntary systems for book and claim could provide platforms for market forces to align supply and demand before regulators step in and reduce the volatility of regulatory implementation.

Developing voluntary systems for book and claim could provide platforms for market forces to align supply and demand before regulators step in and reduce the volatility of regulatory implementation.

The beginnings of book and claim in sustainable aviation fuel

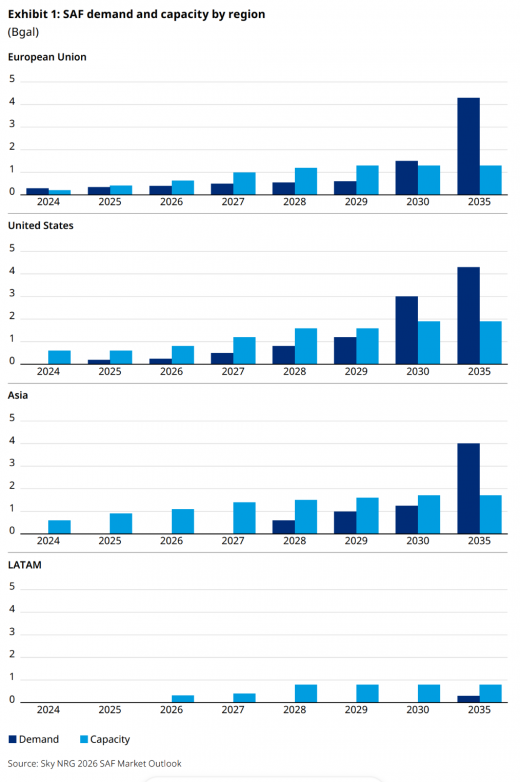

Take sustainable aviation fuel (SAF). In 2023, the European Union passed regulations mandating that aviation fuel suppliers provide European airports with a fuel blend including a minimum of 2% SAF by 2025. Historically, such a quick turnaround on a mandate might cause market prices for SAF to spike, with producers waiting for the rule to take effect before bringing capacity to market.

Instead, sufficient SAF capacity had already come to market by 2025, in part because of the voluntary book and claim market that developed, which has enabled a much smoother start to the SAF mandate. The minimum ramps up to 6% in 2030, and the voluntary book and claim market will have to expand with it to ensure supply-demand balance.

Maritime shipping is also beginning to embrace book and claim

In maritime, FuelEU — the EU's regulation designed to reduce greenhouse gas (GHG) emissions from the maritime sector — has prompted shippers to explore the use of book and claim for low-emission maritime shipping fuels. FuelEU would place the responsibility on shipping companies for the carbon intensity of the fuel used in the ships that land in EU ports — not just what’s bunkered at each port. This marks an important step forward for international transportation

FuelEU creates another natural fit for book and claim to integrate with regulation: Carriers can use sustainable marine fuels where infrastructure allows, rather than having to build out new infrastructure across the world to comply with EU regulations. While this will not fully address a possible supply shortage of sustainable marine fuels, as maritime shipping competes for biofuel feedstock with other industries, such as trucking and aviation, it could be expected to reduce the cost of compliance.

First movers within the maritime industry have already started to develop book and claim infrastructure to ensure compliance with upcoming regulations. For instance, Maersk, one of the largest shipping operations in the world, is building its own internal book and claim system to measure and manage the impact of the company’s fleet.

Budding traction for book and claim in low-carbon agriculture

Another vivid example of this is unfolding in agriculture in the United States, but it’s still a shallow market. Farmers participating in climate-smart agriculture programs can generate agricultural carbon certificates — verified emissions savings from low-till practices, cover cropping, or optimized nitrogen use. Ethanol producers can purchase these credits and pass on unbundled carbon reduction claims to end users, including food and beverage companies or mobility fleets.

The Renewable Fuels Association and several pilot initiatives are pushing for the US Department of Agriculture to accept book and claim methodologies in ethanol supply chains. These certificates represent real emissions reductions within the feedstock supply, supporting Scope 3 upstream and downstream emissions reporting for ethanol buyers and enabling demand-side players to inset climate benefits upstream.

This model reinforces how book and claim can fund systemic decarbonization — inside rather than outside the value chain — and gives buyers access to verified sustainability impact long before physical segregation or regulation arrives.

Public-private collaboration is essential to accelerate book and claim adoption

To scale effectively and responsibly, book and claim markets need collaboration across government, industry, and non-governmental organizations. This would include:

- Transparency standards to reinforce legitimacy, such as carbon equivalence and retirement protocols

- Efforts to educate buyers that book and claim is credible, measurable climate actions

- Collaboration on aligning registry standards and avoiding fragmentation and double counting

- Acknowledgment of voluntary schemes by regulators in their rulemaking to encourage a scaling up of the marketplace

In several industries, voluntary book and claim approaches are already proving how essential they are to achieve scaled decarbonization. They do this by financing tangible carbon reductions within the value chain, often before compliance mechanisms come into place.

Companies that invest in book and claim today are likely to contribute to lower emissions sooner and shape how future low-carbon markets will function over the next decade. In a world of rising scrutiny and fragmented regulation, this kind of early spade work will help establish the rules of the road, manage costs, and provide some needed predictability.