Topics

Services

- 0 results found

Publication

|

Blog

The European Union (EU) revised Payment Services Directive (PSD2) was adopted January 2016 as an update of PSD 1 (adopted in 2007) and introduces two types of new services under its licensing scope: payment initiation services and account information services. New players in the financial industry and incumbents (e.g. banks, electronic mo...

read more

Publication

|

Blog

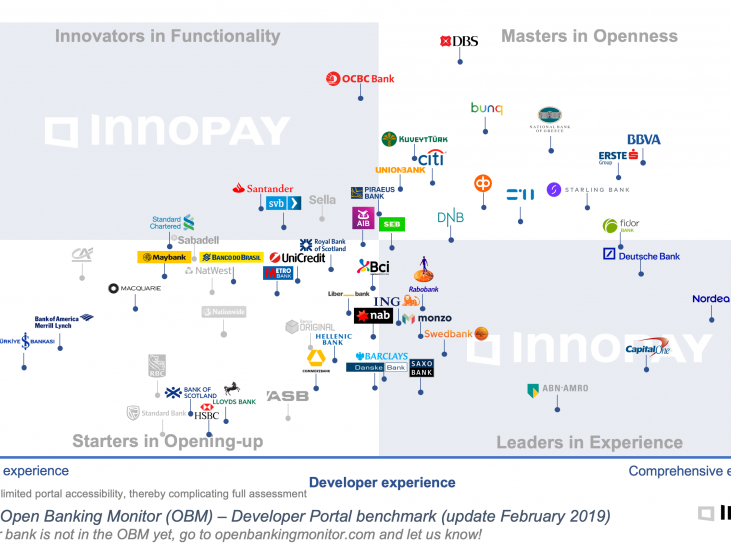

Looking back on a much eventful year in Open Banking; various banks have updated their Developer Portal in the last quarter of 2018, either by expanding the Functional Scope, by offering more APIs, or by introducing tools and features improving the Developer Experience. Predominantly with the shared goal of attracting more end-customers, ...

read more

Publication

|

Blog

This article was first published by the Paypers in the Open Banking Report 2018.

read more

Publication

|

Blog

Senior bank executives are starting to understand that Open Banking will have ke...

read more

Publication

|

Blog

Developing state-of-the art developer portal capabilities will drive and accelerate your Open Banking strategy

read more

Publication

|

Blog

We all know by now that “XS2A” - access to payment accounts by third party providers (TPPs) - is going to happen in some shape or form under PSD2, but there is still considerable uncertainty. The transposition of PSD2 into national law is being delayed in twenty member states[1] and while the Regulatory Technical Standards on Strong Custo...

read more

Publication

|

Blog

The European Banking Authority’s (EBA) has published its long-anticipated draft Regulatory Technical Standards (RTS) on ‘strong customer authentication and secure communication’ on 12 August. The RTS are considered key to achieve the PSD2 objectives of enhancing consumer protection, promoting innovation through competition and improving t...

read more

Publication

|

Blog

Virtual Bank Accounts are hot. They offer corporates the same advantages as extensive physical bank account structures, while eliminating the costs of opening and managing accounts. And they can help corporates bring back their number of physical bank accounts, at least theoretically, to one, centralised account, thus taking away the need...

read more

Let's get in touch