The battle is ON: incumbent banks accelerate onboarding innovations

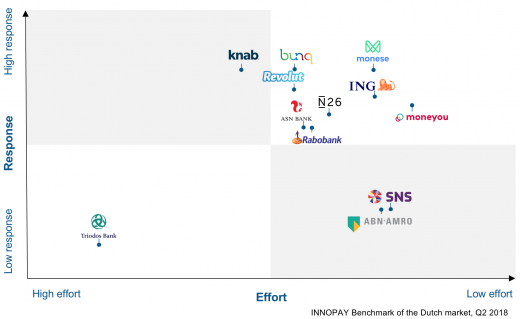

Where newer and smaller banks used to outclass the incumbent banks regarding the onboarding process, the recent INNOPAY benchmark shows a comeback of the established players. By now, there is no longer a need to visit the office to open an account. Now the question is: did the larger banks manage to compete with the challengers?

Our previous onboarding benchmark releases show that in a 6-month period of time hardly any improvements occurred in the onboarding processes of the larger banks. In the fast digitizing world where banks increasingly have to compete for the customer relation, it was surprising to see that so little changes were made in the first interaction with the customer by these players and that the need to visit an office remained.

One logical explanation for the larger banks to have been hesitant towards the use of online identification techniques is that they often find themselves in a split between balancing risk and convenience. They have a different risk profile and a bigger impact on the financial sector as the challenger banks do and as such compliance requirements dominate these discussions in most cases. But then the question becomes if banks will ever be able to offer the same seamless user experience and compete with the challenger banks. This blog intends to answer exactly that question.

Big banks on the move

With the Q1 benchmark publication it was already mentioned that Rabobank introduced their full online process for current customers turning 18. Now also ING and ABN AMRO Bank introduced their fully online processes, but for new customers.

The changes led to a dramatic shift of ING and ABN AMRO Bank from the left side of the matrix to the right. As the benchmark shows relative scores, all parties shifted in position. So, what was it that stood out?

Different approaches, different user experience?

With ING it is now possible to become a verified customer within approximately 15 to 20 minutes. For identification, ING uses a similar process as Rabobank does; an NFC scan of the passport and a selfie with flashing light technology to detect if a photo or screen image is being presented instead of a real face. The colour technique is considered to be an improvement in available techniques and is relatively new. That, combined with the fact that the NFC read is only available for Android could have been a reason it took ING a bit longer to release their online process.

ABN AMRO Bank took another approach. For identification they use similar techniques as the challenger banks do, and they are also the first Dutch bank to fully remove the iDEAL payment from their process. And it has to be admitted that they are right to do so. There’s no real value in the derived identification method with all banks using it. Pretty soon it becomes ‘the derived of the derived’. Before, iDEAL could also be seen as proof the person was living in the Netherlands (often a requirement when opening an account), but with for example Bunq allowing to open an account as a non-inhabitant, this is no longer the case. If banks would still like to use derived identification to mitigate their risks, they could better use iDIN[1] that provides for verified attributes.

With authentication ABN AMRO Bank remains on the safe side, with them providing hardware in the form of an e.dentifier. The customer needs this e.dentifier to activate the app and for authentication purposes this provides for ‘something you have’ and ‘something you know’. Opposed to an app, for authentication the chip of the debit card can be used and as such the use of the e.identifier and the debit card for authentication is by some considered to be more secure than the app combined with a PIN. Reasoning from a convenience perspective however, ING has an advantage that everything can be done in the app and no physical hardware is required. As hardware needs to be sent by postal mail this imposes waiting time. ABN AMRO could consider to reduce this friction, by activating the app during the online identification process and allow customer to make transactions right away. This would significantly increase the response score. After all, right after online identification, there is no need for further assurance during that session. Of course, in case of re-activating the app, the e.dentifier, debitcard and pincode can be used.

Something that is not included in the scoring, but is interesting to have a look at, is how the larger players approach the tone of voice and branding in their new processes. Larger banks have a tradeoff between servicing the current (broad) client portfolio or focusing on a specific target group. Balancing these interests is complex. Challenger banks such as Moneyou and Monese are mainly focused on millennials and their digital onboarding process have this distinct ‘millennial’ flavour to it. ING and ABN AMRO also seem to focus more on the ‘younger’ and tech-savvy audience, exemplified by employing more informal text, using slick interfaces and bright and flashy colours. Potential waiting time is made fun and is restricted to a bare minimum.

Balancing risk and convenience

As the benchmark only takes the customer facing process into account, it is hard to conclude how the banks are able to balance risk and convenience. What can be analysed are the means of identification or verification they use, and to what extent this differs between the larger and smaller players.

As the figure displays, both incumbent and challenger banks demand verification by 2 to 4 verification methods. The most frequently used combination is the scan of the ID document combined with the selfie and a payment. Within different methods, there are multiple technologies to use. The flashing colour selfie technique can be considered a more reliable solution to guard against spoofing attacks than for instance a selfie where the person has to blink the eyes. The same goes for scanning the document; with NFC it is actually proofed the person is in possession of the document, where with a photo this could still be a copy of the document. ASN Bank, Knab and Triodos only request a copy ID, which from a security perspective can’t be compared to the techniques used by other players.

Based on these results the impression arises that searching for the right balance between risk and convenience does not necessarily hamper the creation of a competitive onboarding process. As techniques evolve, processes can become more and more secure, while also providing an excellent customer experience. It’s time to realise that risk and convenience are no longer opposites and can be approached as two sides of the same coin.

Bridging the gap

Altogether, we have seen remarkable changes in the benchmark over the last three months, with finally the big banks making their move. They come close to bridging the gap with the challenger banks. As it seems that many onboarding features that were once considered as standing out now become more mainstream, new standards on what is competitive arise. We encourage this strive to perfection. To reflect these new tendencies our next benchmark will take into account new and more aspects on what makes an onboarding process outstanding. Stay tuned!

About the INNOPAY Onboarding Benchmark

INNOPAY is dedicated in helping clients to embrace the opportunities of the digital ecosystem. Onboarding is the first interaction of the organisation with the client and an important enabler to establish trust. Through our Onboarding Benchmark we provide organisations exceptional insight into how their onboarding processes compare to other organisations in the financial services sector, reasoning from a customer perspective. Every quarter we update the benchmark, allowing banks to learn from each other and to ensure that onboarding remains a topic on the agenda. For more information on the benchmark, we invite you to contact us, or to visit our website:

https://innopay.com/innopay-onboarding-benchmark/

---

[1] iDIN is a Dutch identification service developed by the Dutch banks. It works similar as iDEAL with the main difference that verified attributes are provided. For some banks iDEAL is still preferred in the onboarding process as it also provides the bank account number of the user.