Virtual Bank Accounts: more than a reconciliation tool

Virtual Bank Accounts are hot. They offer corporates the same advantages as extensive physical bank account structures, while eliminating the costs of opening and managing accounts. And they can help corporates bring back their number of physical bank accounts, at least theoretically, to one, centralised account, thus taking away the need for (expensive) cash management products, such as notional pools. In this blog, we discuss two commonly offered Virtual Bank Account-solutions that are often mixed up: Virtual IBANs and Virtual Accounts. We also dive into the foremost opportunities that Virtual Bank Accounts offer to corporates and banks.

Corporates have been aiming to centralise their cash- and transaction management for years, both to optimise their working capital and to decrease their administrative burden. Recent developments have made such centralisation easier in both Europe (SEPA) and the rest of the world (other ISO 20022 formats, such as CGI-MP). As the most important incentive for holding decentralised, physical bank account structures has now become one of financial administration, the call for Virtual Bank Accounts increases. Banks have started to answer, with both Virtual IBAN- and Virtual Account-propositions.

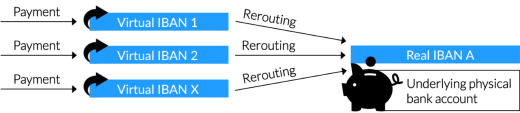

Virtual IBANs are bank-issued dummy International Bank Account Numbers that reroute payments to another, real IBAN – and into this IBAN’s underlying physical bank account (as depicted in Figure 1). From a client’s point of view, Virtual IBANs look and function exactly like real IBANs. Whenever he or she pays to a Virtual IBAN, however, his or her funds will end up in the corporate’s physical bank account to which the Virtual IBAN is associated. A corporate can hold numerous Virtual IBANs and reroute all payments made to them to the same physical bank account. Moreover, it can use Virtual IBANs to identify the purpose of the payment made. A corporate can in fact allocate a Virtual IBAN to each of its clients, so that client X is the only one paying to Virtual IBAN X. This facilitates straight-through reconciliation and greatly reduces administrative costs.

Most banks offer Virtual IBANs in parts of Central and Eastern Europe, where the largest straight-through reconciliation rate gains are to be made because of these regions’ limited tradition with Direct Debit products. Deutsche Bank and UniCredit are among those offering a Virtual IBAN reconciliation tool in Western Europe.

Virtual IBANs will help corporates increase their reconciliation rates, which improves the Days Sales Outstanding and increases the working capital available. It will also eliminate manual reconciliation effort needed, and allows companies to rationalise the number of accounts receivable bank accounts held. Virtual IBANs, therefore, are a serious step towards centralisation. But Virtual Accounts go much further.

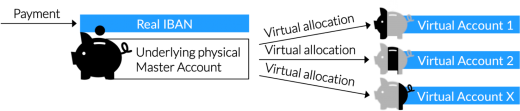

Virtual Accounts are administrative ‘subaccounts’ of one physical bank account, often called the ‘Master Account’ (as depicted in Figure 2). The Master Account is part of the bank’s ledger, and all of a corporate’s cash is in this account. Under the Master Account, corporates can open, close, and modify as many Virtual Accounts as they need, and organise account hierarchies to their liking. Cash can be earmarked as belonging to a Virtual Account, so that corporates can allocate funds without segregating them physically. A typical corporate could choose to open Virtual Accounts per business unit, per client, or for incoming and outgoing transactions – but also at different levels for all of these purposes. Virtual Accounts do not have or need IBANs: as it is the only physical bank account left, all transactions take place on the Master Account. Based on variables such as the counterparty bank account and remittance information, these transactions are also earmarked as payments or collections related to a certain purpose, and allocated to the corresponding Virtual Account. This facilitates straight through reconciliation.

Barclays and BNP Paribas are among those banks that offer Virtual Accounts to corporates. Both banks, interestingly, focus primarily on the receivables reconciliation benefits of Virtual Accounts, and only secondarily on benefits brought about by allocating funds without segregating them physically. One explanation could be that offering multi-entity Virtual Account hierarchies is still in its infancy.

While Virtual Accounts are potentially beneficial to any corporate that uses physical bank account structures for its financial administration, potential benefits of Virtual Accounts are greatest for corporate groups – and this is where opportunities lie. If a group or a holding of corporates can centralise its cash, liquidity otherwise trapped in complex bank account structures can be freed – improving available working capital substantially. Moreover, and because all transactions take place on the Master Account, multi-entity Virtual Account hierarchies will enable the Master Account-holding entity to Pay On Behalf Of (POBO) and Collect On Behalf Of (COBO) Virtual Account-holding entities – thus facilitating corporate groups to also centralise their transaction management. Add to that the ability to hold an intercompany loan administration, virtually, and to calculate internal interest, and one has a great in-house banking proposition – offered by the bank! Such proposition could even be an alternative for notional cash pooling, which will become a lot more expensive under the Basel III framework.

Several legal challenges will need to be faced before banks can offer their own Virtual Account-based in-house banking propositions. For example, under SR15 of the Financial Action Task Force Recommendations, which serve as an international standard for anti-money laundering and counter-terrorist financing measures, corporates are obliged to assess and mitigate the risks that may arise in relation to the use of new or developing technologies for both new and pre-existing products. Banks will need to decide whether a Customer Due Diligence procedure is required at a Virtual Account-holding entity level, and how rigorous this procedure is, as their Master Account-holding clients can now open accounts for entities that are not necessarily clients of the account-servicing bank. Before such issues are tackled, banks can start offering single-entity Virtual Accounts propositions. Or they can steer a middle course, combining reconciliation with corporate group centralisation through integration of Virtual IBANs with the in-house banking software that their most centralised clients do already own.

Doing nothing is no longer an option. Virtual Bank Accounts will be a guaranteed feature of the banking landscape of the future. And with banks opening up their systems under the pressures of both legislation (PSD2) and technology (API economy), non-bank players will undoubtedly offer this feature if banks do not. Innopay has been actively involved in developing Virtual Bank Account-propositions and is ready to help banks develop and implement their own. We also help corporates realise the full benefits of both Virtual IBANs and Virtual Accounts.