INNOPAY Open Banking Monitor: Banks moving beyond the PSD2 requirements

Open Banking has seen considerable activity in the last few months. Indeed, with the EU’s compliance deadline for PSD2 looming, Open Banking developer portals have emerged in great numbers, with 300-plus banks now in our monitor.

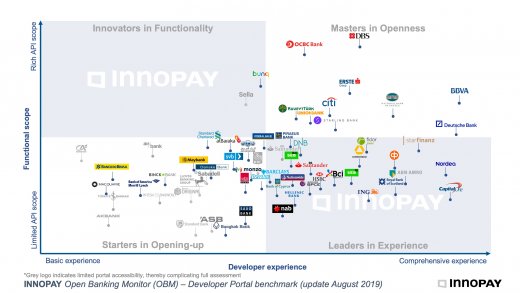

In the recent release of the INNOPAY Open Banking Monitor (OBM), updated in August 2019, we described the current state of play and sought to identify the new Masters in Openness. The full analysis of the updated OBM will be published in the Open Banking report of the Paypers to be released in late September.

In that new release, you can expect to read about some highlights regarding the ‘PSD2 baseline’, i.e. banks adhering solely to PSD2 requirements (~76% of the total) and the emerging API standards and platforms that they are using. Furthermore, we will share key observations on front-running banks that are moving beyond the requirements set by PSD2 and we will identify best practices that will help you to shape your API and Developer Portal roadmap.

The OBM visual in Figure 1 (below) includes players that have moved beyond the mandatory PSD2 API scope and front-running banks across the world, that have released new and previously unseen API functionalities. Banks adhering solely to the PSD2 requirements have not been visualised in the updated OBM. Stay tuned for more information on the Open Banking Monitor!