INNOPAY Embedded Finance Radar: How EmFi tackles the issue of financial inclusion

As part of INNOPAY’s continued focus on monitoring the Embedded Finance (EmFi) landscape, the company published the lasted edition of the INNOPAY Embedded Finance Radar in late 2023. The ‘spotlight topic’ in this edition is financial inclusion. Here, we take a deeper dive into the most recent findings, including why and how EmFi can be particularly transformative for the ‘unbanked’ and ‘underbanked’, and how it will continue to drive financial inclusion globally.

EmFi provides financial services at the point of need

Embedded Finance (EmFi) is about integrating financial services in customer journeys within digital platforms or applications. It allows end users to utilise personalised financial solutions in their preferred application at the moment when it matters. These solutions are typically enabled by means of application programming interfaces (APIs), which connect the various actors required to offer an embedded financial solution. In previous publications, we’ve elaborated on how APIs serve as a driver of EmFi, as well as how the different actors collaborate within the EmFi value chain.

INNOPAY’s Embedded Finance Radar tracks EmFi trends and developments

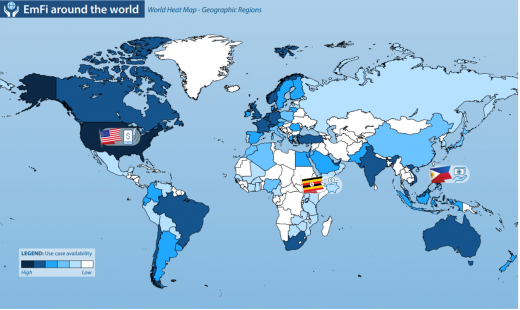

Since organisations are increasingly offering EmFi products and services, INNOPAY is closely monitoring the landscape systematically. The latest findings were published in the INNOPAY Embedded Finance Radar in Q4/2023. The radar tracks evolving use cases and the organisations involved throughout the value chain and around the globe, across six product categories (e.g. payments, lending) and six major industries (e.g. retail & ecommerce). Additionally, the radar visualises the maturity of various geographic regions in terms of the availability of use cases (see Figure 1) and presents three concrete real-life use cases. These are always linked to the radar’s ‘spotlight topic’, which picks up on one specific trend within EmFi. The spotlight topic of the latest radar is ‘financial inclusion’.

EmFi progress enables financial inclusion for the unbanked and underbanked

Broadly speaking, financial inclusion in the context of EmFi means providing faster, easier and digitally seamless access to financial resources for those consumers and businesses who would typically not have it. EmFi’s approach is particularly transformative for those in underdeveloped countries with stunted economic growth, such as the Philippines where (according to data from 2021) a significant number of the population are classified as ‘unbanked’, i.e. without access to any form of traditional banking services. There can be various reasons for being unbanked, such as lacking the necessary identification documents, residing in areas without physical banking infrastructure or encountering prohibitive fees.

Furthermore, financial inclusion issues extend beyond the unbanked. They can permeate certain professions and industries where financial services have not been fully integrated (see Use Case 1), leaving a gap that EmFi is uniquely positioned to fill. While these ‘underbanked’ individuals have some access to financial services, they often find these services to be limited in scope, flexibility and affordability. Although the underbanked may have basic bank accounts, they often lack access to credit, savings mechanisms, insurance or investment products that suit their needs and income patterns. There can be numerous reasons for people being underbanked, such as a lack of credit history making banks reluctant to offer loans.

According to the World Bank’s 2022 report, an estimated 1.4 billion people are currently classed as unbanked. The underbanked segment is even more extensive and is made up of a diverse demographic, including gig economy workers and seasonal labourers. Embedding financial services into commonly used digital platforms can eliminate the need for physical banking infrastructure, thus helping to address the unique challenges faced by these groups. Moreover, thanks to the expansion of mobile connectivity and internet penetration in increasingly remote areas, EmFi has the potential to provide more unbanked people with access to digital wallets, peer-to-peer lending platforms or micro-insurance products, for example. Meanwhile, for the underbanked, EmFi can offer tailored, context-appropriate financial products, such as those catered to less regular income streams.

The INNOPAY Embedded Finance Radar highlights three real-life use cases to illustrate in more detail how EmFi can improve access to financial services for these two underserved target groups (see Use Cases 1-3). As these compelling use cases for financial inclusion show, EmFi definitely has transformative potential in this domain and merits further investigation in the future.

Use Case 1: Addressing the pay-out needs of Mexico’s underbanked flexible workers

In Mexico, payment systems for flexible workers, who tend to engage with multiple employers, are not as widely available as in many European countries, for instance. This lack of availability renders such flexible workers ‘underbanked’ and can impede their ability to collect their earnings efficiently. To address this challenge, Zolvers – a platform designed to support flexible workers – has partnered with BBVA, which acts as both a balance sheet provider (BSP) and a technology service provider (TSP). This collaboration streamlines the income collection process for these workers, creating a unified system that enables them to rapidly and efficiently access their earnings from various employers. Crucially, this solution bypasses the need for workers to establish individual bank accounts, thus removing a significant barrier to financial access and simplifying the path to financial compensation.

Use Case 2: Revolutionising the underbanked community’s access to investments in Africa

Chipper Cash, an organisation already tackling the issues of the African ‘unbanked’ by providing free bank accounts and money movement, is now revolutionising investment opportunities for African citizens by allowing them to purchase US stocks without the usual minimum investment barriers. This use case is specifically supporting ‘underbanked’ citizens in Africa by adding investments as an additional functionality on top of the original Chipper Cash offering. This democratisation of financial markets is made possible by a partnership in which PayrNet serves as the BSP and Drive Wealth takes on the role of the TSP. To push this movement further, regulatory bodies in Africa are catalysing the adoption of EmFi. One notable example is the Central Bank of Kenya, which underscored the significance of EmFi in bolstering innovation within the banking sector in its 2022 annual survey. This reflects a broader trend across the continent, where regulatory support is proving to be a crucial factor in the widespread adoption of EmFi solutions.

Use Case 3: Providing the Philippines’ unbanked with equal opportunities to access medical care

In the Philippines, Union Digital Bank and the health application mWell have formed a strategic partnership to offer emergency medical loans and flexible payment terms, thus addressing the needs of the sizable ‘unbanked’ share of the population. This collaboration seamlessly integrates the bank’s services within the mWell app, enabling patients to swiftly secure financial assistance for healthcare services in their time of need, without having to first open a bank account or sign a contract with an insurer. This initiative is a prime example of how EmFi can facilitate timely healthcare interventions by providing patients with immediate access to financial resources, thereby alleviating the stress related to medical expenses. This service also exemplifies the potential for EmFi to enhance the healthcare industry by bridging the gap between medical services and financial support.

The upswing of EmFi across the globe will be a continuous driver for financial inclusion

EmFi is revolutionising financial accessibility, propelled by innovative thinking, technological progress and cross-sector collaboration. This evolution transcends traditional barriers, offering financial empowerment to a section of the worldwide population that is still significantly underserved. For those without traditional access to any banking services (i.e. the unbanked), EmFi bypasses conventional barriers and supports digital alternatives such as mobile wallets on people’s smartphones. Those who lack access to more comprehensive financial services (i.e. the underbanked) find solace in EmFi’s flexible and personalised financial products. By creating harmonised financial services across all professions and industries, EmFi is shaping a more inclusive, user-focused financial ecosystem and laying the groundwork for a globally integrated economic future.

Why should your organisation engage with EmFi?

EmFi can be integrated into everyday platforms and apps that consumers and business already trust, in a straightforward way. Therefore, EmFi has the unique ability to ensure that financial services are no longer the exclusive preserve of traditional institutions. This paradigm shift fosters innovation, competition and a wide variety of new partnership opportunities in the field of financial services, opening up possibilities for new and extended business models to help organisations stay relevant. Thanks to EmFi, organisations can provide better and more integrated services to their existing customers, while also serving new customer segments by addressing the increasing market demands for broader financial inclusivity.

If you have any questions or comments about the topic of EmFi or the INNOPAY Embedded Finance Radar, please reach out to Patrick.deHaan@innopay.com or Mounaim.Cortet@innopay.com.