Poor strategy execution: it is time for a new perspective

Since 2000, 52% of companies in the US Fortune 500 including many financial organizations have either gone bankrupt, been acquired or ceased to exist. [1] In our recent blog on customer centricity, we argued that banks but also other large financial organizations struggle to successfully execute their strategy in today’s turbulent environment that is severely impacted by new regulations (e.g. PSD2, GDPR) and rapid global digitalization. It is therefore likely that several of the incumbent financial organizations will not successfully execute their strategic initiatives in the coming years, will lose market share and/or miss out on new market opportunities and subsequently risk being marginalized.

At INNOPAY, like many others, we agree that financial organizations must be customer centric to become and remain successful within this dynamic business environment. However, we do not support today’s popular view that starting with defining customer journeys is by default the best approach to execute customer centric strategies for these kinds of organizations.

In this blog, INNOPAY explains why we endorse a different approach and how we help our clients to become successful in executing their strategy.

Banks and other large financial institutions have complex (and often ill-defined) operating models in place that must deliver the defined strategy. The relationship with customers, however important, constitutes only a part of their operating model.

It is our experience that a too dominant focus, via customer journeys, on the customer relationship causes friction within organizations since it creates the perception that certain teams/departments are more ‘customer oriented’ than others: reinforcing existing silos rather than tearing them down. The customer journey approach lacks the required holistic perspective on the operating model that large organizations need to successfully execute their strategy. For this reason, Innopay advocates that successful strategy execution for large financial organizations starts by defining an activity based view of their operating model to create this holistic perspective, including the much-needed customer orientation, and take it from that point forward.

Value of a well-functioning operating model

The overall conclusion from leading articles, reports and studies on managing companies ([2][3]), is that successful companies have one thing in common: successful companies possess the capability to execute their strategy within a changing business environment because they have deployed an operating model that establishes coherence between their strategy and daily operations.

Operating models of these successful companies have three things in common:

- Create an unambiguous view of the operational organization allowing stakeholders to collaborate efficient and effectively. Management is in the position to oversee and orchestrate the operations from a holistic point of view in line with the strategy and the organization operates within optimal conditions to perform assigned roles and responsibilities aimed at meeting/exceeding the agreed targets;

- Enable the organization to deploy its strategy successfully since there is, based upon the operating model, a consensus how the strategy will impact the organization and how this strategy, as a program, can be successfully deployed via the various (strategic) initiatives and the daily operations;

- Establish a pro-active organization that can cope with changes in its business environment since the operating model has embedded mechanisms to signal and channel important changes in the business environment to the right teams within the organization. Allowing the organization to adequately respond or take advantage of changes it witnesses within its business environment.

For the above listed reasons, Innopay regards it of utmost importance that large financial organizations take a close look at their existing operating model before they start with the execution of their (customer centric) strategy. If they fail to do so, the likelihood of success of the strategic initiatives will decrease with 30% or more, having a profound impact on the overall results of the organization in the years to come [2][3].

Getting the right operating model in place to support the execution of a strategy

Three steps are required to get the right operating model in place to support the execution of your strategy:

- Define the ‘setup’ of your operating model that will establish an unambiguous view of the operational organization and creates coherence between the strategy and the daily operations;

- Establish a realistic view of the current state of your operating model and determine which improvements are required to support the execution of your strategy;

- Subordinate the improvement of the operating model to the execution of the strategy through a coordinated program management effort. By doing so the organization will make optimal use of available resources within the organization to execute the strategy since all projects and activities, internal and external oriented, are now linked to the strategy.

Organizations often struggle, or even just neglect the need, to get the right ‘setup’ for their operating model in place and just start with the execution of their strategy. Therefore, the execution of the strategy will most likely fail since the operational organization can’t, or is not willing to, cope with the impact of strategy. When organizations have defined the right ‘setup’ for their operating model, the aforementioned steps 2 and 3 proof to be less of a challenge.

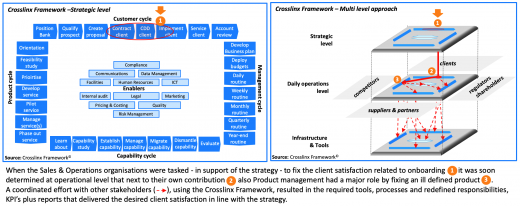

To help our clients getting the right ‘setup’ for their operating model in place Innopay prefers to apply the Crosslinx Framework© (see Figure 2). This model presents management with a new view at their organization; one that allows an organization to define their operating model in a holistic, coherent manner regardless of its current organizational structure, preferred way of working (e.g. agile versus functional management) and the tools, platforms and processes it has in place.

The set-up of the Crosslinx Framework, with four Cycles and the Enablers, creates a two-dimensional activity based view of an organization at both the strategic level and the daily operations level with a direct link to the supporting infrastructure and tools. The unique multi-layer Crosslinx representation of an organization enables seamless interworking between the strategy and the daily operations, creating coherence in the following way:

- Business objectives and the strategy can be mapped at the strategic level and subsequently be deployed, through the various initiatives, in a coherent manner within the daily operations of the organization;

- Management can oversee, orchestrate and actively manage the operational performance of the organization from a holistic perspective linking strategy to the daily operations and vice versa supported by a coherent cross-organizational set of metrics;

- Changes in the business environment with clients, suppliers, etc. will be detected in the daily operations and will be channelled to the right teams within the organization at operational or strategic level. When required, the strategy will be adjusted and subsequently deployed across the organization.

Once an organization has established this coherence between strategy and the daily operations, the likelihood of successful execution of its strategy and outperformance versus the competition will significantly increase.

|

‘nearly two-thirds of best executors of strategies say they are “well above average” at financial performance, compared with just 18% of other companies.’ Source: ‘Why good strategies fail’, A report of The Economist Intelligence Unit - April 2014 |

The Crosslinx approach can be applied to an entire organization but also to a business unit, a function or to fix a specific problem related to the execution of a strategy.

Crosslinx in practice

A Pan-European financial organization applied Crosslinx to overcome severe problems with the introduction of new services and features impacting the success of their strategy. After defining the Crosslinx Framework at strategic and daily operations level for the organization and following a root-cause analysis effort, it became clear to management that the problem resided predominantly within the operating model and less with the quality of product management. Within weeks an adjustment to the operating model was successfully defined. After a successful test, the changes were deployed and together with some personnel changes the entire product backlog was eliminated within one year and the IT development department could be downscaled with 20% due to improved efficiencies.

Please get in touch if you want to know how this new Crosslinx perspective on strategy execution can improve the performance of your organization.

---

[1] ‘Research Summary: Sneak Peeks From Constellation’s Futurist Framework And 2014 Outlook On Digital Disruption’, Constellation Research - February 2014

[2] ‘Why good strategies fail’, A report of The Economist Intelligence Unit - April 2014

[3] ‘Why Strategy execution unravels – and What to do about it’, D. Sull, R. Homkes, and C Sull. Harvard Business Review - March 2015