Virtual Bank Accounts: not living up to their potential... yet

In INNOPAY's June 2015 blog, we introduced Virtual Bank Accounts as more than a reconciliation tool. We explained the difference between Virtual IBANs and Virtual Accounts, and showed how both could help SME- and corporate clients increase control over their cash- and transaction management. This blog sheds light on today’s Virtual Bank Accounts market. Some of the largest banks have answered to Virtual Bank Accounts’ promise, and while reconciliation is still one use case, more innovative banks are truly virtualising their clients’ cash management structures.

While this progress is encouraging, the number of banks offering mature Virtual Bank Accounts propositions does not quite live up to the hype surrounding the concept (yet). This blog therefore also explains why banks are struggling to unleash Virtual Bank Accounts’ full potential (or choose not to enter the market at all), and what changes are necessary to enable them to do so.

To refresh your memory…

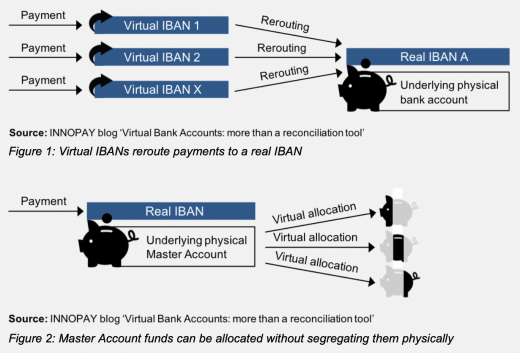

Remember that INNOPAY described Virtual IBANs as bank-issued dummy International Bank Account Numbers that reroute payments to another, real IBAN – and into this IBAN’s underlying physical bank account (as depicted in Figure 1). Virtual Accounts, on the other hand, are administrative ‘subaccounts’ of one physical bank account, often called the ‘Master Account’ (Figure 2). The Master Account is part of the bank’s ledger and all of a company’s funds are in this account.

Both the title and the content of INNOPAY’s earlier blog suggested that banks would soon utilise Virtual Bank Accounts, and especially Virtual Accounts, in new ways to move beyond reconciliation and into cash management. Two and a half years later, it’s time to find out who did…

Please note that while INNOPAY has been actively involved in developing Virtual Bank Accounts propositions, this overview was set up by analysing information publicly available at the time of this blog’s publication. If important information is missing, please let us know!

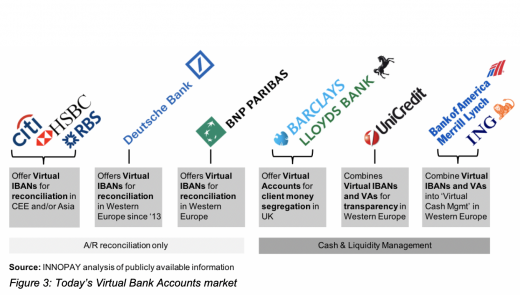

Figure 3 shows that of a total of 12 major banks in Virtual Bank Accounts, 6 are offering Virtual Accounts propositions today. Those banks newest to the Virtual Bank Accounts game – i.e. Lloyds Bank, J.P. Morgan, and ING – all chose to offer Virtual Accounts. And all of these newcomers chose to focus on more than reconciliation alone.

Zooming in, ING offers what seems to be the most extensive Virtual Bank Accounts proposition available today. Their Virtual Cash Management offering combines Virtual Account hierarchies with Virtual IBANs. While one could argue that Virtual IBANs are unnecessary with the right Virtual Account tooling in place, ING offers cross-border Virtual IBANs to deal with imperfections in SEPA. Such imperfections include IBAN-discrimination, i.e. rather paying to an IBAN with your own country code than to one with a foreign country code. This might also be the reason for Bank of America Merrill Lynch’s choice to combine Virtual Accounts with Virtual IBANs.

Even though 12 major banks in Virtual Bank Accounts – and 6 in Virtual Accounts – is not insignificant, these numbers do not quite live up to the hype surrounding the concept yet. Moreover, INNOPAY understands that SME and corporate clients are not exactly running away with the Virtual Accounts solutions offered by most banks today.

Inability to incorporate virtual banking

Banks have found it challenging to develop intuitive and easy-to-use in-house banking solutions that put SMEs, who cannot afford the alternatives offered by large ERP-providers, in control. To corporates, banks do not offer the synergies between Virtual Accounts and other banking products that would make in-house banking solutions stand out from ERPs. Underlying these challenges is the well-documented problem of technical implementation; even the most innovative banks struggle to incorporate virtual banking into their, very real, legacy systems. Also fundamental to these challenges, and perhaps more strikingly so, is banks’ apparent inability to incorporate virtual banking into their operating models.

Banks are finding out that in-house banking is seriously different to ‘simple’ Cash & Liquidity Management. They are struggling to decide how much control to give to the client. Setting up a Virtual Accounts structure for the client requires in-depth knowledge – similar to that of treasury consultants – of the client’s organisational structure and payment streams. Leaving the client to it, by supplying him the tools to set up his own in-house bank, will come with a whole lot of client questions, which banks’ service organisations must be able to answer. And both sides of this struggle come with serious questions from banks’ legal- and compliance departments: is the bank responsible when it implements a suboptimal Virtual Accounts structure? Will the bank allow clients to open Virtual Accounts for different divisions or even entities? And if a bank chooses to pursue product synergies, will it allow clients to give out intercompany loans on their own? For some banks, uncertainty surrounding KYC-issues is enough to avoid Virtual Bank Accounts altogether.

So while some of the largest banks have answered to Virtual Bank Accounts’ promise, most of them are struggling to unleash the concept’s full potential. Some banks do not opt to consider Virtual Bank Accounts at all – often because they do not oversee the technical, operational and compliance impact or the potential profits. This is unfortunate. With the right operating model in place, one that is actively aimed at achieving client control and synergies between Virtual Bank Accounts and other banking products, banks can claim a place in the market that ERP providers will never be able to claim. They can offer the in-house bank that is not just the portal, but the place where all of a client’s (internal and external, and even money market) payments, receivables (reconciliation) and loans come together.

Unleashing the full potential

INNOPAY has worked with banks to pinpoint Virtual Bank Accounts’ impact on the entire banking organisation. It is well-positioned to help any bank take the decision of whether to go virtual or not. Moreover, INNOPAY is working with several banks to innovate their operating model to support the execution of a strategy that was already set.

For questions on how INNOPAY can help define or execute your Virtual Bank Accounts strategy, please contact INNOPAY directly.