Turning the Anti-Money Laundering Directive into a competitive advantage

Financial service providers are challenged by Bigtechs to build international scale for their innovative products. Cross-border introduction of innovative digital payment and loan products is a difficult game however, as local implementations of the Anti-Money Laundering Directive (AMLD) and other regulatory requirements differ markedly between countries. INNOPAY’s phased approach to cross border compliant expansion will help banks and financial service providers to turn AMLD (and other regulations) into a competitive advantage and offer compliant products in line with consumer expectations.

Scale necessity for European banks – AMLD a blocking issue?

With Bigtech companies pounding at the gates, traditional banks and other financial service providers are challenged to slash costs through digitisation and innovation while improving quality of service. Banks currently offer a broad scope of services but their digital products often lack the international footprint needed to realise optimal scale economies to compete with Bigtech companies. Successful digital products such as Tikkie by ABN AMRO in the Netherlands, the ING-Kabbage partnership in Spain, or Qliro in the Nordics are often only offered in local markets.

In the fragmented European marketplace, it is imperative for banks to build scale by increasingly offering their products and services across borders. When doing so, however, they face significant regulatory obstacles.

Take the recently updated European Anti-Money Laundering Directive (‘AMLD’). EU Member States have had wide discretion in implementing both the previous (AMLD3) and the current (AMLD4) incarnation of this directive. Member State government or local industry organisations take these decisions, which has led to a blanket of widely different interpretations across countries.

These differences have deep implications for products and operations, as Member State discretion includes key issues such as information and documents required for Customer Due Diligence (CDD) and which products and services are in scope for AMLD in the first place [1]. Differing local consumer expectations for identification and verification of new users, and authentication and signing for making transactions further complicate things, as services also need to be tailored to local tastes.

But besides complicating matters for banks, these requirements also contain a hidden competitive advantage. Not only banks have to comply with AMLD4, but so do potential newcomers. For banks this is a known quantity, as they have deep experience offering compliant products and services. For tech giants, this is a new game altogether. Key question for banks and other incumbents is how to turn this potential roadblock into an advantage: how to realise European product roll-outs that are (a) compliant and (b) in line with local customer expectations?

The INNOPAY approach to geographic expansion with AMLD compliant products

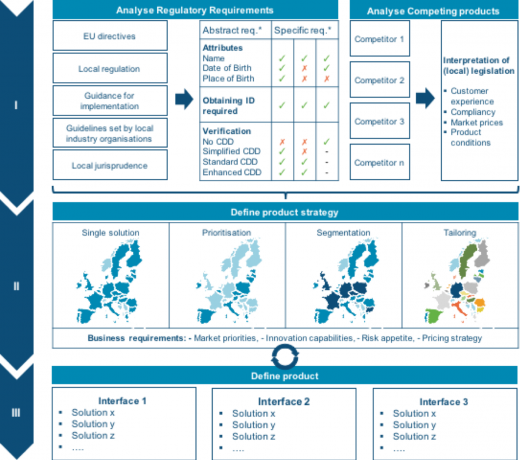

In solving this complex problem, INNOPAY has developed an approach in four phases (Figure 1):

- Determine strategy;

- Analyse regulatory requirements;

- Analyse competing products; and

- Determine product design.

1. Determine strategy

Product vision and strategy are key starting point for strategic decisions on product design. Decisions on strategy have to be made in developing and implementing a simple and seamless customer journey. Here, an inherent trade-off exists between offering a uniform product across geographies and tailoring a product to local requirements in each country. The latter allows for designing an optimal product for each geography given regulatory requirements and customer expectations, but may increase cost and complexity. A second trade-off exists between being market lead or following competitors in specific countries on specific product characteristics and product prices.

2. Analyse regulatory requirements

The first step towards realising compliant products across the footprint is assessing compliance requirements in relevant countries. This results in an overview of regulatory requirements per country. Sources for compliance requirements include EU directives, local regulation, guidance for the implementation in local regulation, guidelines set by local regulators, and local jurisprudence.

Consumer credit case example

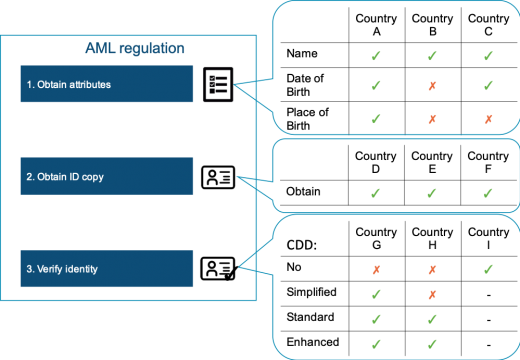

AML requirements apply for most financial service providers falling within the scope of AMLD. Which AML requirements apply depends on a combination of the services offered, the type of customer, current status of AMLD implementation, and other relevant local regulation. Different regimes can be mapped by distinguishing abstract regulatory requirements. Figure 2 shows differences between countries on requirements for onboarding a new customer. Different requirements exist for obtaining which attributes. In all countries, an ID copy should be obtained. Customer Due Diligence (CDD) is required when onboarding a new customer. With simplified CDD, customer attributes and a copy of the ID document should be obtained. Standard CDD requires the obliged entity to obtain customer attributes, the ID copy and the verification of identity. Enhanced CDD, to be applied in case of a specific customer involves a higher risk, requires additional checks.

3. Analyse competing products

Analysing competing products in different countries helps in realising compliant products and gives insights in customer expectations. Market players are usually bound to offer products that align with market practices or improve on them to create market traction. Market practices for the customer journey differ highly across countries and regulatory requirements and existing market solutions dictate the possibilities for design.

Another reason for analysing competitors’ products is that interpretation of local regulation may result in different requirements than expected. Interpretation of regulation can best be assessed in practice.

4. Determine product design

In product design, the best way to meet different regulatory regimes should be defined. However, different solution designs can all meet the same regulatory requirements. Selecting the right design should be an iterative process between product vision and strategy, customer expectations, and regulatory requirements.

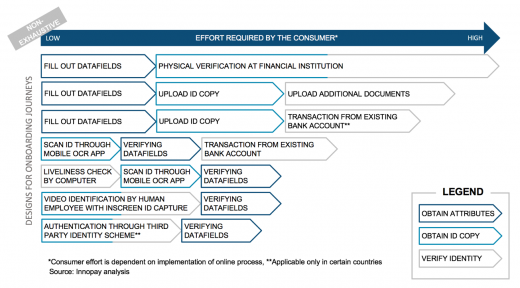

Standard CDD requires the obliged entity to obtain customer attributes, the ID copy and identity verification. As showed in figure 3 below multiple solutions exist for the different requirements, but not all solutions are appropriate in all cases. For a uniform product across countries, authentication through a third party identity scheme is insufficient as third party schemes are only available in some countries. The most basic customer journey of filling in datafields and physical verification are not sufficient when a decision was made on being market lead in a specific country.

This shows that choosing the right solutions has dependencies with the chosen strategy and is an iterative process between strategy development and product design an organisation and customer experience specific optimum should be found.

Towards cross-border compliant products

With a focus on the front-end design of financial products, geographical expansion with compliant products should be done by performing an analysis on regulatory requirements for AMLD in EU countries. Analysing competing products helps in creating a competitive product in each country, but also for interpreting regulations across countries. By expanding across geographies, traditional financial services companies will make an important step in remaining competitive in the face of increasing competition from digital newcomers.

Is your organisation ready to answer the challenge of Bigtechs? Do you want to let AML work for you when driving your geographical expansion? Please feel free to contact us for more information on how to develop and deliver compliant financial service products as part of your geographical expansion strategy.

[1] This is jointly determined by licensing and AML requirements (or, more accurately, AML requirements are often subject to licensing requirements in local law)