Topics

Services

- 0 results found

Publication

|

Blog

PSD2 is the revised European directive for payment services, with the supporting...

Lesen Sie mehr

Publication

|

Blog

The role of the corporate treasurer will change significantly with the transition towards an open, digital and data driven economy. Partially motivated by regulatory push (eg PSD2, GDPR), organisations are increasingly adopting new business models in which data is shared 24/7 to better respond to instant customer demand. This requires tre...

Lesen Sie mehr

Publication

|

Blog

With the rise of the Internet of Things (IoT) and artificial intelligence (AI), transactions initiated by smart devices and platforms will increase exponentially over the next years. An appealing example is Smart Home, which connects customers digitally through smart devices and allows them to share data and transact from home 24/7.

As r...

Lesen Sie mehr

Publication

|

Blog

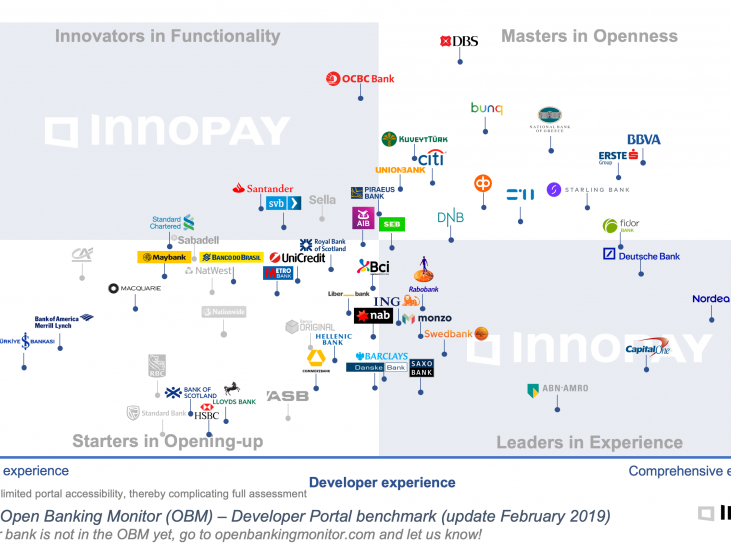

Looking back on a much eventful year in Open Banking; various banks have updated their Developer Portal in the last quarter of 2018, either by expanding the Functional Scope, by offering more APIs, or by introducing tools and features improving the Developer Experience. Predominantly with the shared goal of attracting more end-customers, ...

Lesen Sie mehr

Publication

|

Blog

Towards the first pan-European Open Banking based scheme

Imagine you’re taking an Uber at the airport, get to your destination and while you’re getting out of the Prius … ping… you receive a push notification from your bank that says € 32,78 was debited from your payment account. The full Uber experience, but no cards or wallets needed.&...

Lesen Sie mehr

Publication

|

Blog

This article was first published by the Paypers in the Open Banking Report 2018.

Lesen Sie mehr

Publication

|

Blog

PSD2 has been an important catalyst for banks to open up. While many banks in Europe are still focused on making the PSD2 deadline of September 2019, we see some leading banks move beyond compliance and shift towards Open API Banking. In this emerging Open Banking play, banks start to understand that enabling secure access to custome...

Lesen Sie mehr

Publication

|

Blog

This article was published in collaboration with Deutsche Bank.

Market disruption, client evolution and regulatory change mean that the banking and corporate world is preparing for an API and Open Banking revolution. Making a success of it will require both collaboration and standardisation.

Lesen Sie mehr

Publication

|

Blog

As Instant Payments is expected to become the new normal in payments in many countries, it is imperative for financial service providers to offer Instant Payments capabilities to remain relevant in the future. The significant investments required to update current payment infrastructures motivates financial service providers to look for r...

Lesen Sie mehr

Publication

|

Blog

Senior bank executives are starting to understand that Open Banking will have ke...

Lesen Sie mehr

Publication

|

Blog

Jeden Tag teilen mehr als eine Milliarde aktive Nutzer ihre Gedanken, Fotos, Nachrichten, Videos, Memes und mehr mit Freunden und Verbindungen auf Facebook. Mit Daten aus Girokonten wissen Banker, was ihre Kunden essen, wo sie ihre Kleidung kaufen und was sie online treiben. In der Welt von heute und morgen werden (persönliche) Daten durc...

Lesen Sie mehr

Publication

|

Blog

Developing state-of-the art developer portal capabilities will drive and accelerate your Open Banking strategy

Lesen Sie mehr