Topics

Services

- Ergebnis gefunden

Publication

|

Blog

In der Welt des Zahlungsverkehrs und der Daten finden Innovationen, angetrieben von einem großen Trend, den Verbrauchern immer mehr Kontrolle über ihre Daten zu geben, schneller denn je statt. Laut Vincent Jansen, Partner bei INNOPAY, Mounaim Cortet, Leiter des Bereichs Open Banking und Karl Illing, Leiter INNOPAY Deutschland, ist Open Ba...

Lesen Sie mehr

Publication

|

Blog

In the last few months, Open Banking has seen considerable activity. Indeed, wit...

Lesen Sie mehr

Publication

|

Blog

PSD2 is the revised European directive for payment services, with the supporting...

Lesen Sie mehr

Publication

|

Blog

As the number of digital transactions is growing exponentially, companies who have relevant and frequent digital interactions with their customers compete to become future ecosystem orchestrators. This is also true for the banking sector, where customers are increasingly banking through their smartphone, making that the primary digital so...

Lesen Sie mehr

Publication

|

Blog

The role of the corporate treasurer will change significantly with the transition towards an open, digital and data driven economy. Partially motivated by regulatory push (eg PSD2, GDPR), organisations are increasingly adopting new business models in which data is shared 24/7 to better respond to instant customer demand. This requires tre...

Lesen Sie mehr

Publication

|

Blog

Die überarbeitete Zahlungsdiensterichtlinie der Europäischen Union (EU) (PSD2) wurde im Januar 2016 als Aktualisierung der PSD 1 (2007 verabschiedet) verabschiedet und führt zwei neue Lizensierungstypen ein: Zahlungsauslösedienste und Kontoinformationsdienste. Neue Akteure in der Finanzbranche und etablierte Unternehmen (z. B. Banken, E-G...

Lesen Sie mehr

Publication

|

Blog

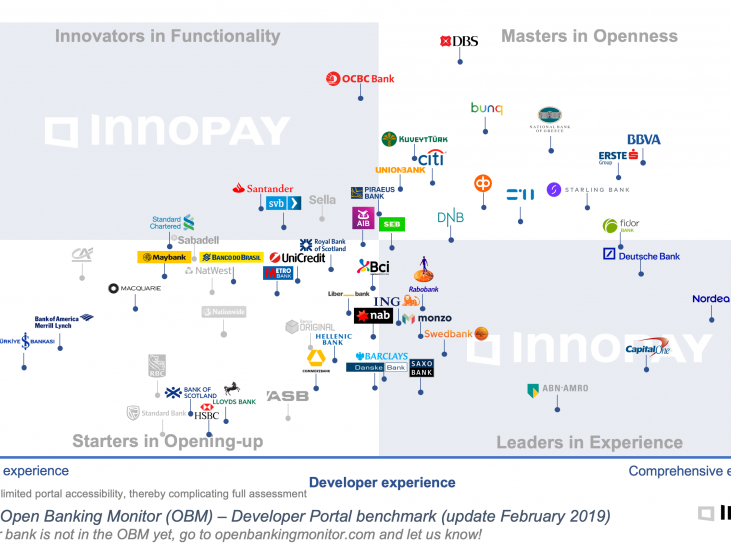

Looking back on a much eventful year in Open Banking; various banks have updated their Developer Portal in the last quarter of 2018, either by expanding the Functional Scope, by offering more APIs, or by introducing tools and features improving the Developer Experience. Predominantly with the shared goal of attracting more end-customers, ...

Lesen Sie mehr

Publication

|

Blog

This article was first published by the Paypers in the Open Banking Report 2018.

Lesen Sie mehr

Publication

|

Blog

Senior bank executives are starting to understand that Open Banking will have ke...

Lesen Sie mehr

Publication

|

Blog

Developing state-of-the art developer portal capabilities will drive and accelerate your Open Banking strategy

Lesen Sie mehr

Publication

|

Blog

We all know by now that “XS2A” - access to payment accounts by third party providers (TPPs) - is going to happen in some shape or form under PSD2, but there is still considerable uncertainty. The transposition of PSD2 into national law is being delayed in twenty member states[1] and while the Regulatory Technical Standards on Strong Custo...

Lesen Sie mehr

Publication

|

Blog

The European Banking Authority’s (EBA) has published its long-anticipated draft Regulatory Technical Standards (RTS) on ‘strong customer authentication and secure communication’ on 12 August. The RTS are considered key to achieve the PSD2 objectives of enhancing consumer protection, promoting innovation through competition and improving t...

Lesen Sie mehr

Nehmen Sie Kontakt auf